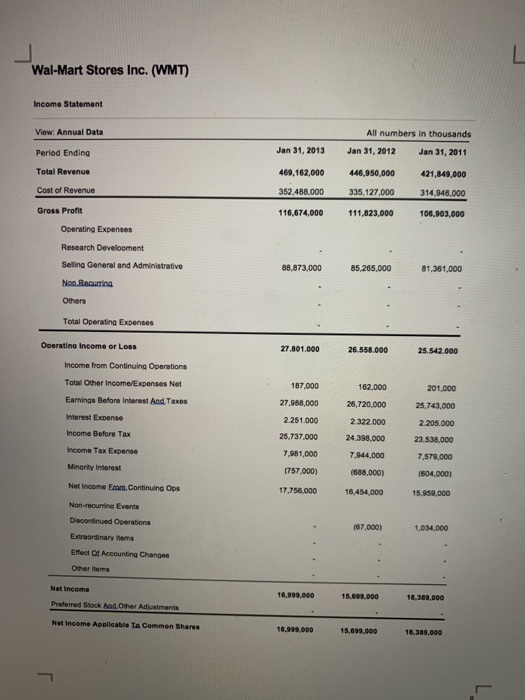

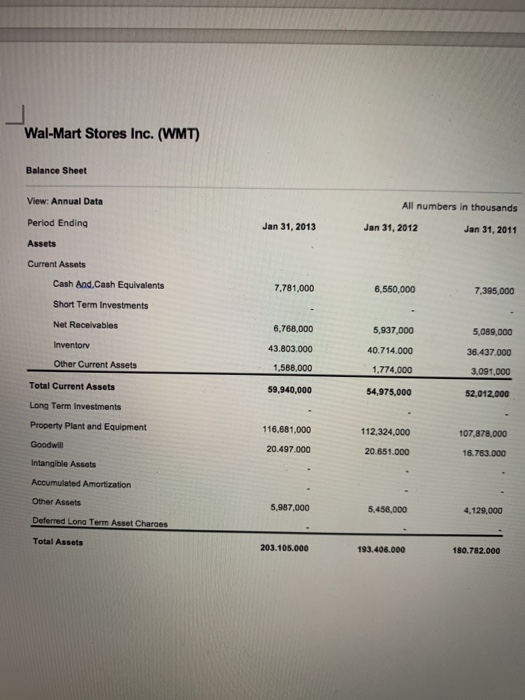

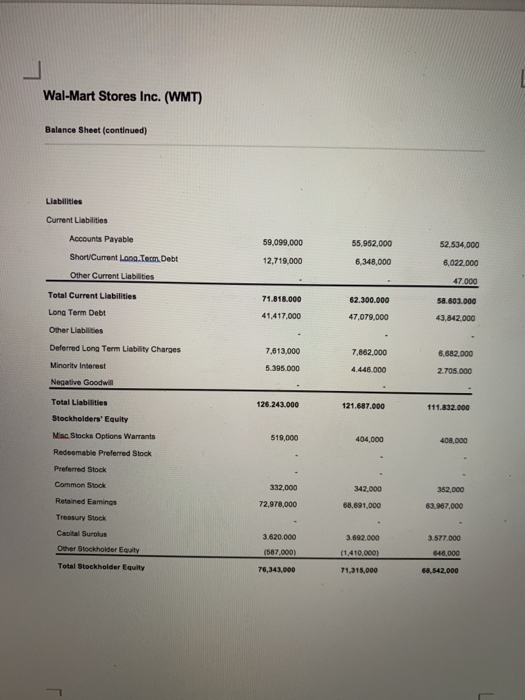

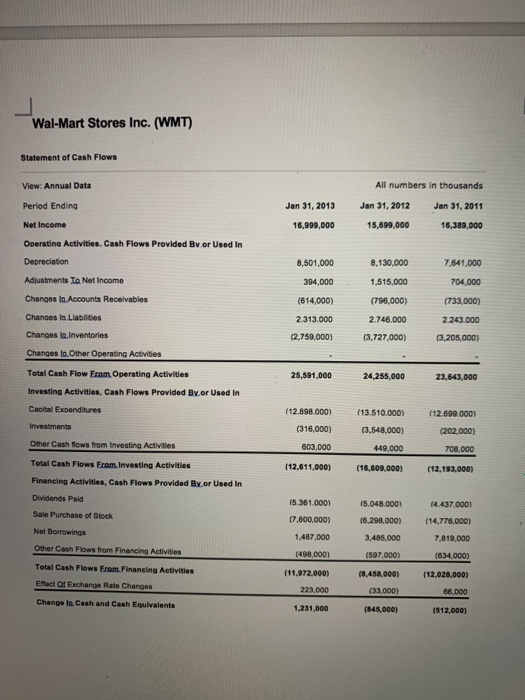

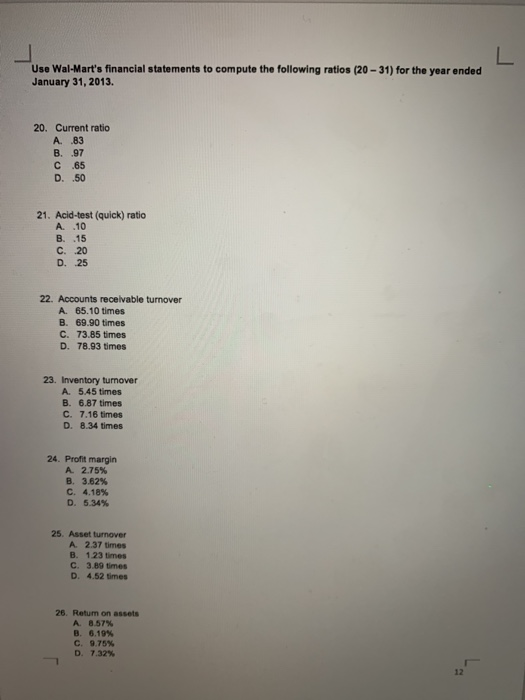

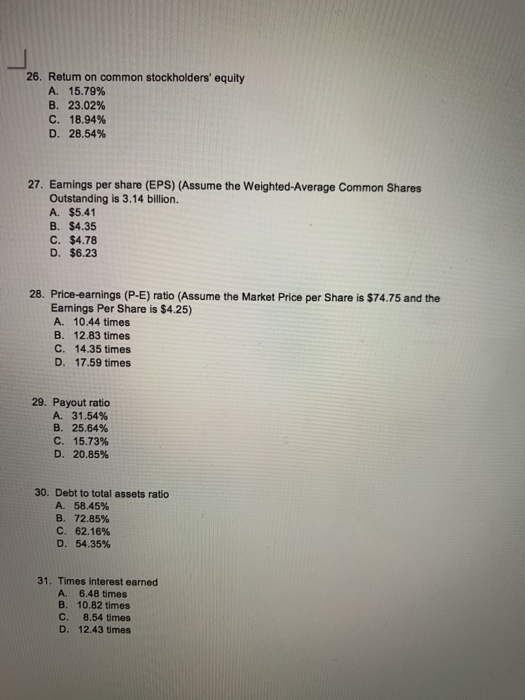

Wal-Mart Stores Inc. (WMT) Income Statement View. Annual Data All numbers in thousands Period Ending Jan 31, 2013 Jan 31, 2012 Jan 31, 2011 Total Revenue 469,162,000 446,950,000 335,127.000 Cost of Revenge 352.488,000 421,849,000 314.948.000 106.903.000 116,674,000 111,823,000 Gross Profit Operating Expenses Research Develoment Seling General and Administrative No. Recurrina Others 88,873,000 85,265,000 81,361,000 Total Operating Expenses Operating income or Loss 27.801.000 26.558.000 25.542.000 Income from Continuing Operations Total Other Income/Expenses Net Earnings Before Interest And Taxes Interest Expense Income Before Tax Income Tax Expense Minority interest 187,000 27.968,000 2.251.000 25,737.000 7,981,000 (757.000) 162.000 26,720,000 2.322.000 24.390.000 7,944,000 1688.000) 201,000 25,743,000 2.205.000 23,538.000 7.579.000 1804.0001 Net Income from. Continuing Ops 17,756,000 16,454,000 15.950.000 Non-coutine Event Decond Operations 187,000) 1,034.000 et Accounting Changes Ontem Net Income 16,999,000 15,699.000 16.300,000 Preferred Stock And Other Adjustments Net Income Applicable la Common Shares 16,999.000 15,699.000 16.300,000 Wal-Mart Stores Inc. (WMT) Balance Sheet View. Annual Data All numbers in thousands Period Ending Jan 31, 2013 Jan 31, 2012 Jan 31, 2011 Assets Current Assets Cash And Cash Equivalents 7.781,000 6,550,000 7,395,000 Short Term Investments Net Receivables 6,768,000 5,937,000 40.714.000 Inventory 43.803.000 5,089,000 36.437.000 3,091,000 Other Current Assets 1.588,000 1,774,000 Total Current Assets 59,940,000 54,975,000 52.012,000 Long Term Investments Property Plant and Equipment 116,681,000 20.497.000 112,324,000 20.651.000 107,878.000 16.763.000 Gooda Intangible Assets Accumulated Amortization Other Assets 5,987.000 5,458,000 4,129,000 Deferred Long Term Asset Charoos Total Assets 203.105.000 193.406.000 180.782.000 Wal-Mart Stores Inc. (WMT) Balance Sheet (continued) 59,099.000 12,719,000 55,952,000 6,348,000 52.534.000 6,022,000 47.000 Liabilities Current Liabilities Accounts Payable ShortCurrent Long Term.Debt Other Current Liabilities Total Current Liabilities Long Term Debt Other Liabilities Deferred Long Term Liability Charges Minority interest Negative Goodwill 71.818.000 41,417,000 62.300.000 47,079.000 58.603.000 43.842.000 7,613,000 5.395.000 7,862.000 4.446.000 6.662.000 2.705.000 Total Liabilities 126.243.000 121.687.000 111.832.000 Stockholders' Equity Nac Stocks Options Warrants 519,000 404,000 408.000 Redeemable Preferred Stock Preferred Stock Common Stock 332,000 72,978,000 342.000 68.601.000 362.000 63.967,000 Retained Earings Trey Stock Carolus 3.620.000 (587.000) 3.692.000 (1410.000 Other Stockholder Equity 3.877000 646,000 44.542.000 Total Stockholder Equity 76.341.000 71.315.000 Wal-Mart Stores Inc. (WMT) Statement of Cash Flows View. Annual Data Period Ending Jan 31, 2013 16,999,000 All numbers in thousands Jan 31, 2012 Jan 31, 2011 15,699.000 16,389,000 Net Income Operating Activities. Cash Flows Provided By or Used In Depreciation Adjustments To Net Income 8,501,000 394,000 (614,000) 2.313.000 (2,759,000) 8,130,000 1,515,000 (796,000) 2.746.000 (3.727,000) 7,641,000 704,000 (733,000) 2.243.000 (3,205,000) Changes to Accounts Receivables Changes to Liabilities Changes in Inventories Changes in Other Operating Activities Total Cash Flow From Operating Activities Investing Activities, Cash Flows Provided By.or Used In Capital Expenditures Investments 25,591,000 24,255,000 23,643,000 112.898.0001 (316,000) 603.000 113.510.000) (3,548,000) 449,000 112.699.0001 (202,000) 708.000 Other Cash flows from Investing Activities [12.611,000) (16.600.000) (12.193.000) Total Cash Flows From Investing Activities Financing Activities, Cash Flows Provided Bx or Used In Dividends Paid Sale Purchase of Stock 15.361.0001 67.600.000) 1,487,000 15.048.0001 18.290.0001 3,485.000 (597.000) 14.437.0001 (14,776,000) 7,819,000 Net Domingo Other Cash Flows from Financing Activities (498.000) (634.000) Total Cash Flows From Financing Activities EM O Exchange Rate Changes (11.972,000) 18.458,000) (12,028,000) 86.000 223,000 (33,000) Change in Cash and Cash Equivalente 1,231,000 (545,000) ($12,000) Use Wal-Mart's financial statements to compute the following ratios (20 - 31) for the year ended January 31, 2013. 20. Current ratio A .83 B. 97 C .65 D. 50 21. Acid-test (quick) ratio A..10 B..15 C. 20 D. 25 22. Accounts receivable turnover A 65.10 times B. 69.90 times C. 73.85 times D. 78.93 times 23. Inventory turnover A. 5.45 times B 6.87 times C 7.16 times D. 8.34 times 24. Profit margin A 2.75% B 3.62% C. 4.18% D. 5.34% 25 Asset turnover A 2.37 times B 123 times C 3.89 times D 4.52 times 26 Ratum on assets A 8.57% B. 6.19% C. 9.75% D. 732 26. Return on common stockholders' equity A. 15.79% B. 23.02% C. 18.94% D. 28.54% 27. Eamings per share (EPS) (Assume the weighted Average Common Shares Outstanding is 3.14 billion. A. $5.41 B. $4.35 C. $4.78 D. $6.23 28. Price-earnings (P-E) ratio (Assume the Market Price per Share is $74.75 and the Earnings Per Share is $4.25) A. 10.44 times B. 12.83 times C. 14.35 times D. 17.59 times 29. Payout ratio A. 31.54% B. 25.64% C. 15.73% D. 20.85% 30. Debt to total assets ratio A. 58.45% B. 72.85% C. 62.16% D. 54.35% 31. Times Interest earned A. 6.48 times B. 10.82 times C. 8.54 times D. 12.43 times