Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wal-Marts story- past, present, future. Include who they are (include current events and interesting facts), what do they do (products), when they began (how long),

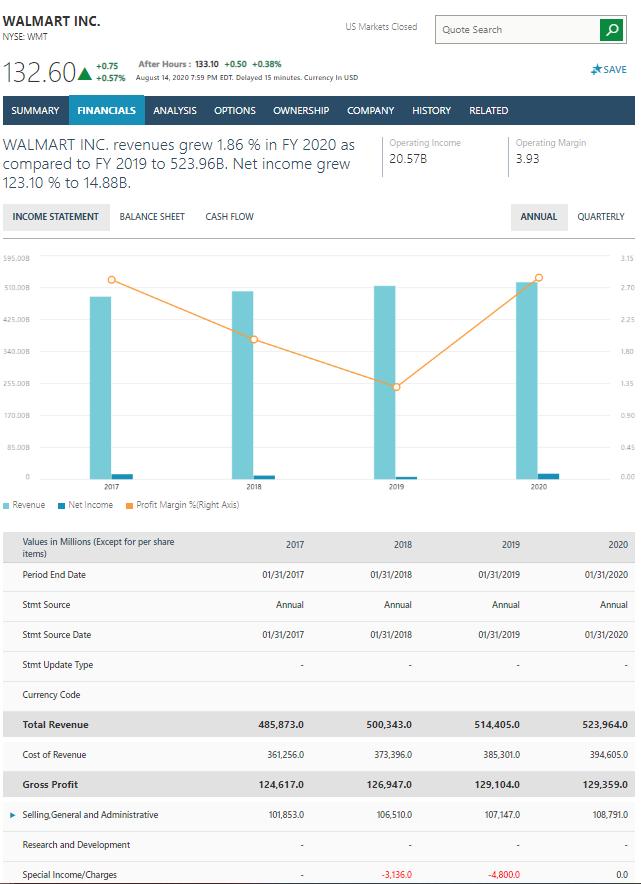

Wal-Marts story- past, present, future. Include who they are (include current events and interesting facts), what do they do (products), when they began (how long), and where they do business. Discuss the markets they operate in globally, the current market trends, and their competitors.

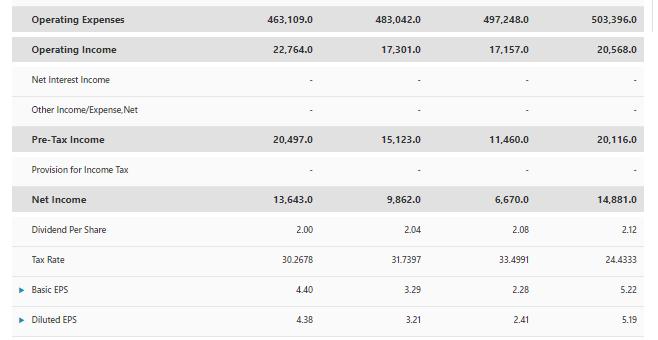

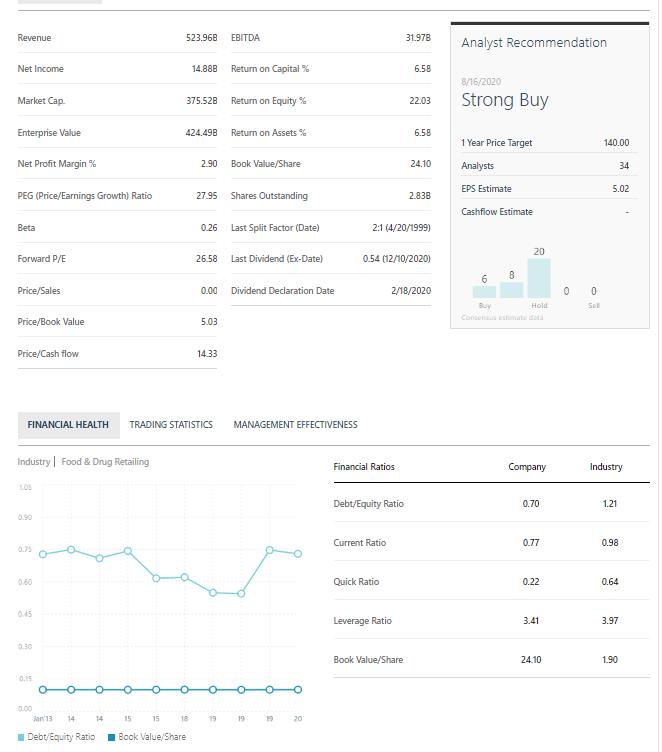

WALMART INC. NYSE: WMT 132.600.57% SUMMARY FINANCIALS ANALYSIS OPTIONS OWNERSHIP INCOME STATEMENT BALANCE SHEET CASH FLOW 595,008 WALMART INC. revenues grew 1.86 % in FY 2020 as compared to FY 2019 to 523.96B. Net income grew 123.10 % to 14.88B. 310.008 425.00 340.00 255.00B 170308 85.008 Revenue Stmt Source Net Income Profit Margin %(Right Axis) Values in Millions (Except for per share items) Period End Date Stmt Source Date Stmt Update Type After Hours: 133.10 +0.50 +0.38% +0.57% August 14, 2020 7:59 PM EDT. Delayed 15 minutes. Currency In USD Currency Code Total Revenue Cost of Revenue 2017 Gross Profit Selling, General and Administrative Research and Development Special Income/Charges M 2018 2017 01/31/2017 Annual 01/31/2017 485,873.0 US Markets Closed 361,256.0 124,617.0 COMPANY 101,853.0 2019 Operating Income 20.57B 2018 01/31/2018 Annual 01/31/2018 500,343.0 373,396.0 126,947.0 HISTORY RELATED 106,510.0 Quote Search -3,136.0 Operating Margin 3.93 2019 01/31/2019 Annual 01/31/2019 514,405.0 385,301.0 129,104.0 ANNUAL QUARTERLY 107,147.0 -4,800.0 Q 2020 #SAVE 3.15 2.70 225 1.80 135 10.90 0.45 0.00 2020 01/31/2020 Annual 01/31/2020 523,964.0 394,605.0 129,359.0 108,791.0 0.0 Operating Expenses Operating Income Net interest income Other Income/Expense, Net Pre-Tax Income Provision for Income Tax Net Income Dividend Per Share Tax Rate Basic EPS Diluted EPS 463,109.0 22,764.0 20,497.0 13,643.0 2.00 30.2678 4.40 4.38 483,042.0 17,301.0 15,123.0 9,862.0 2.04 31.7397 3.29 3.21 497,248.0 17,157.0 11,460.0 6,670.0 2.08 33.4991 2.28 2.41 503,396.0 20,568.0 20,116.0 14,881.0 2.12 24.4333 5.22 5.19 Revenue Net Income Market Cap. Enterprise Value Net Profit Margin% PEG (Price/Earnings Growth) Ratio Beta Forward P/E Price/Sales Price/Book Value Price/Cash flow FINANCIAL HEALTH Industry Food & Drug Retailing 1.05 0.60 0.45 0.30 0.15 0.00 Jan 13 Debt/Equity Ratio 14 14 523.968 EBITDA 15 375.528 14.888 424.498 15 Book Value/Share 18 2.90 0.26 26.58 0.00 27.95 Shares Outstanding 5.03 14.33 Return on Capital % Return on Equity % 19 Return on Assets % Book Value/Share TRADING STATISTICS MANAGEMENT EFFECTIVENESS Last Split Factor (Date) Last Dividend (Ex-Date) Dividend Declaration Date 19 19 20 Financial Ratios Debt/Equity Ratio Current Ratio Quick Ratio 31.97B 2:1 (4/20/1999) 6.58 0.54 (12/10/2020) Leverage Ratio Book Value/Share 8/16/2020 22.03 Strong Buy 6.58 24.10 2/18/2020 2.838 Analyst Recommendation 1 Year Price Target Analysts EPS Estimate Cashflow Estimate 6 8 20 Hold Buy Consensus estimata data Company 0.70 0.77 0.22 3.41 24.10 00 Sell 140.00 5.02 Industry 1.21 34 0.98 0.64 3.97 1.90

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Walmart is a world largest retailer which is doing the physical consumer retail business and they ar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started