Answered step by step

Verified Expert Solution

Question

1 Approved Answer

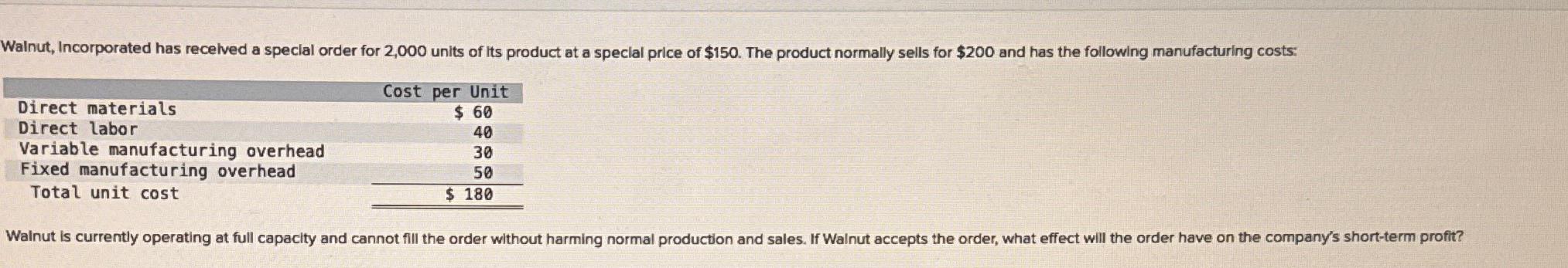

Walnut, Incorporated has received a special order for 2,000 units of its product at a special price of $150. The product normally sells for

Walnut, Incorporated has received a special order for 2,000 units of its product at a special price of $150. The product normally sells for $200 and has the following manufacturing costs: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total unit cost Cost per Unit $ 60 40 30 50 $ 180 Walnut is currently operating at full capacity and cannot fill the order without harming normal production and sales. If Walnut accepts the order, what effect will the order have on the company's short-term profit?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the effect of accepting the special order on Walnut Incorporateds shortterm profit we n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6643344e5a5e1_952012.pdf

180 KBs PDF File

6643344e5a5e1_952012.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started