Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wanda Instrumentation produces navigational equipment for ships, aircraft (both staffed and drones), and land vehicles. The parts are produced to specification by their customers.

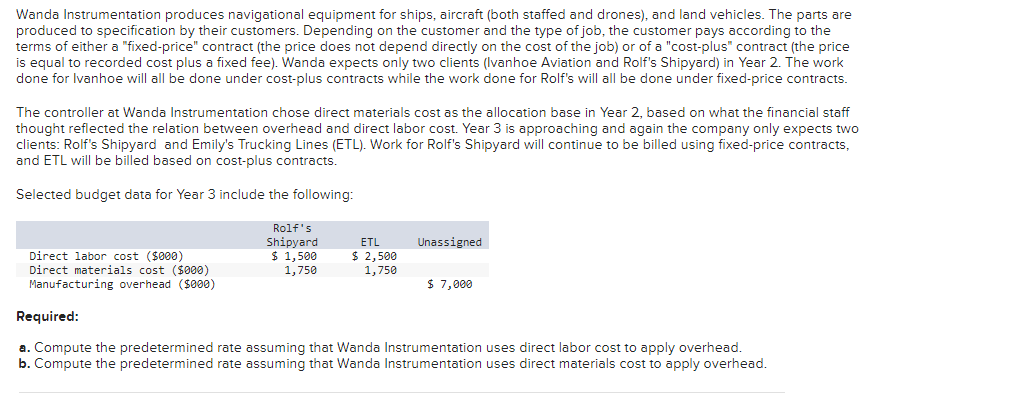

Wanda Instrumentation produces navigational equipment for ships, aircraft (both staffed and drones), and land vehicles. The parts are produced to specification by their customers. Depending on the customer and the type of job, the customer pays according to the terms of either a "fixed-price" contract (the price does not depend directly on the cost of the job) or of a "cost-plus" contract (the price is equal to recorded cost plus a fixed fee). Wanda expects only two clients (Ivanhoe Aviation and Rolf's Shipyard) in Year 2. The work done for Ivanhoe will all be done under cost-plus contracts while the work done for Rolf's will all be done under fixed-price contracts. The controller at Wanda Instrumentation chose direct materials cost as the allocation base in Year 2, based on what the financial staff thought reflected the relation between overhead and direct labor cost. Year 3 is approaching and again the company only expects two clients: Rolf's Shipyard and Emily's Trucking Lines (ETL). Work for Rolf's Shipyard will continue to be billed using fixed-price contracts, and ETL will be billed based on cost-plus contracts. Selected budget data for Year 3 include the following: Direct labor cost ($000) Direct materials cost ($000) Manufacturing overhead ($000) Required: Rolf's Shipyard $ 1,500 1,750 ETL $ 2,500 Unassigned 1,750 $ 7,000 a. Compute the predetermined rate assuming that Wanda Instrumentation uses direct labor cost to apply overhead. b. Compute the predetermined rate assuming that Wanda Instrumentation uses direct materials cost to apply overhead.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Predetermined Overhead Rates for Wanda Instrumentation We need to calculate the predetermined overhe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started