Answered step by step

Verified Expert Solution

Question

1 Approved Answer

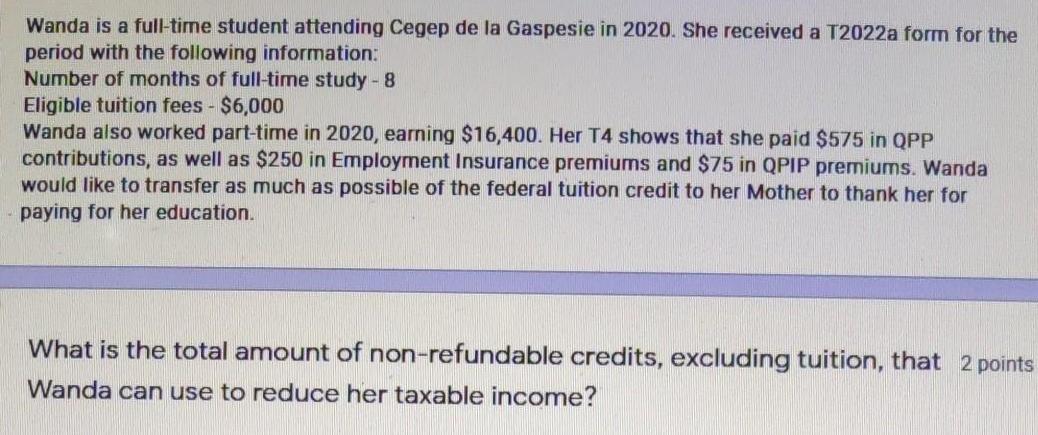

Wanda is a full-time student attending Cegep de la Gaspesie in 2020. She received a T2022a form for the period with the following information:

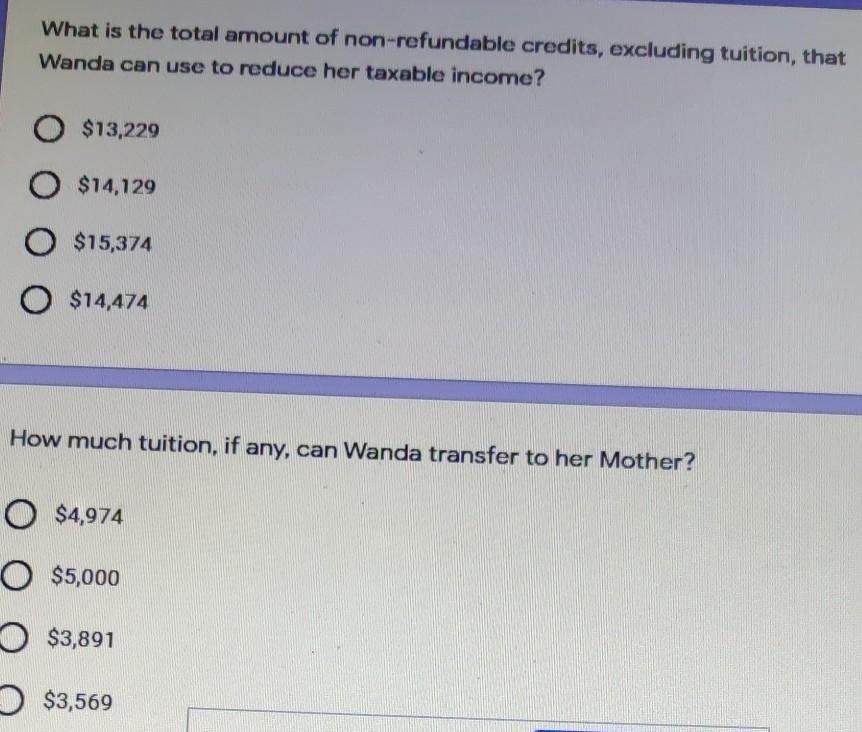

Wanda is a full-time student attending Cegep de la Gaspesie in 2020. She received a T2022a form for the period with the following information: Number of months of full-time study - 8 Eligible tuition fees - $6,000 Wanda also worked part-time in 2020, earning $16,400. Her T4 shows that she paid $575 in QPP contributions, as well as $250 in Employment Insurance premiums and $75 in QPIP premiums. Wanda would like to transfer as much as possible of the federal tuition credit to her Mother to thank her for paying for her education. What is the total amount of non-refundable credits, excluding tuition, that 2 points Wanda can use to reduce her taxable income? What is the total amount of non-refundable credits, excluding tuition, that Wanda can use to reduce her taxable income? O $13,229 O $14,129 O $15,374 O $14,474 How much tuition, if any, can Wanda transfer to her Mother? O $4,974 O $5,000 $3,891 $3,569

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Total amount of nonrefundable credits excluding tuition that Wanda ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started