Question

Wanda takes out a 33-year mortgage for $152000 at an interest rate of j = 7.8%. After the 10th monthly mortgage payment, she decides

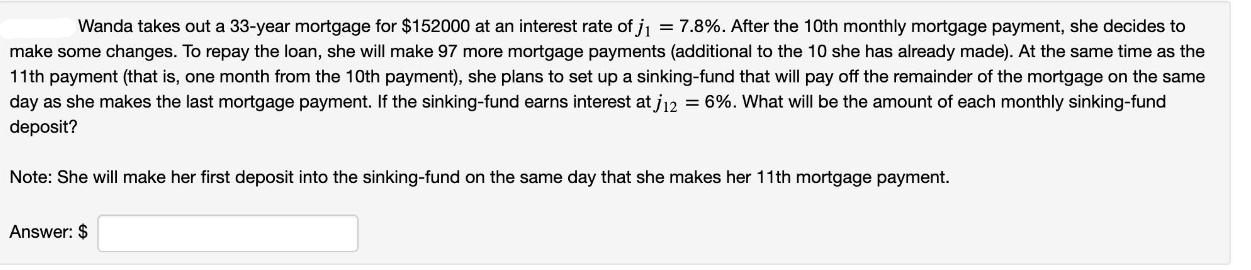

Wanda takes out a 33-year mortgage for $152000 at an interest rate of j = 7.8%. After the 10th monthly mortgage payment, she decides to make some changes. To repay the loan, she will make 97 more mortgage payments (additional to the 10 she has already made). At the same time as the 11th payment (that is, one month from the 10th payment), she plans to set up a sinking-fund that will pay off the remainder of the mortgage on the same day as she makes the last mortgage payment. If the sinking-fund earns interest at j12 = 6%. What will be the amount of each monthly sinking-fund deposit? Note: She will make her first deposit into the sinking-fund on the same day that she makes her 11th mortgage payment. Answer: $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Nicola M. Young, Irene M. Wiecek, Bruce J. McConomy

10th Canadian Edition Volume 2

1118300858, 978-1118300855

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App