Want post closing trial balance and related t accounts. Thanks

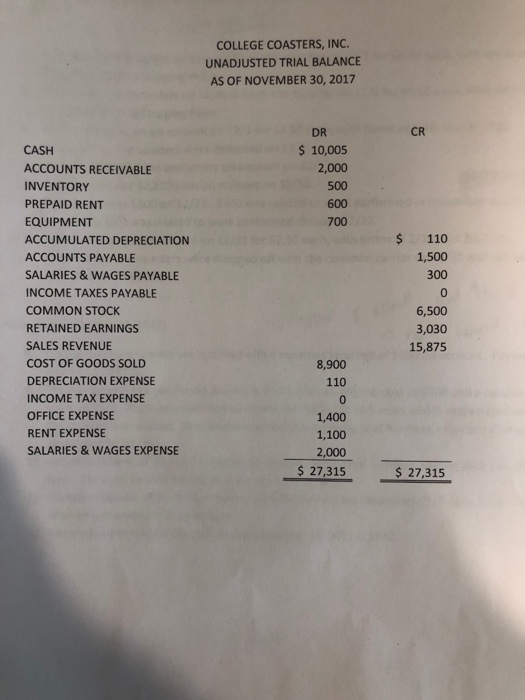

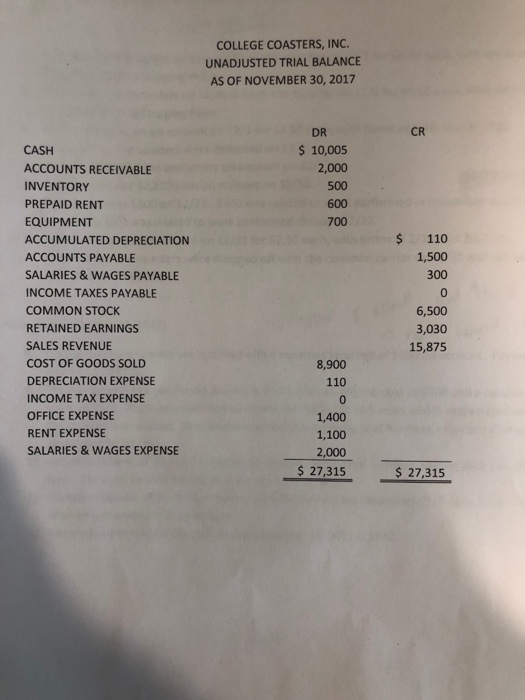

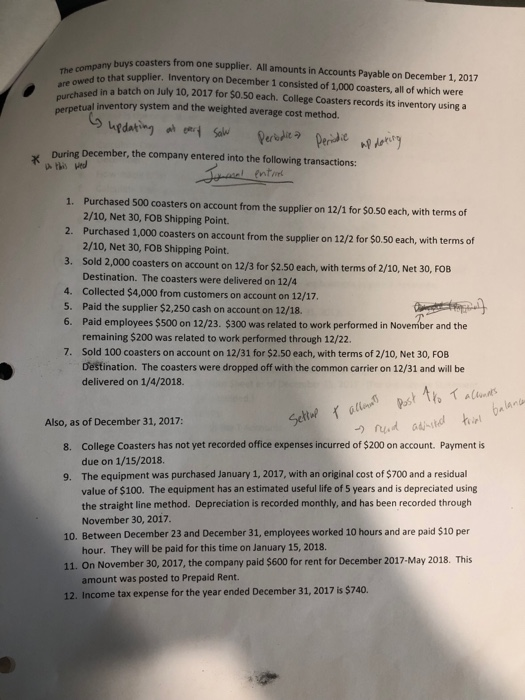

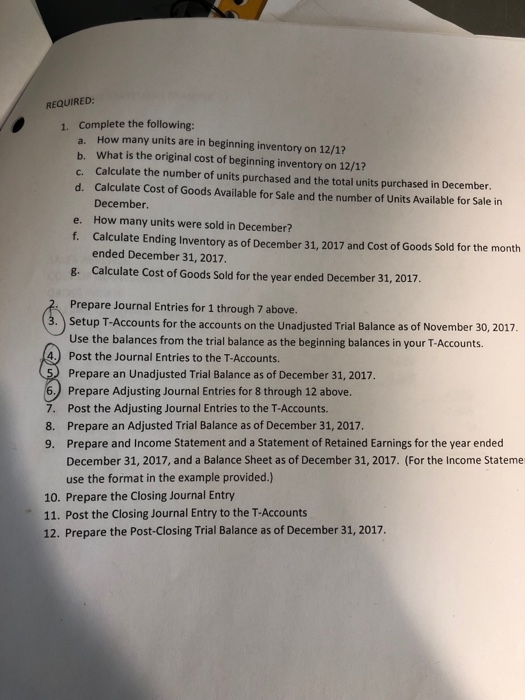

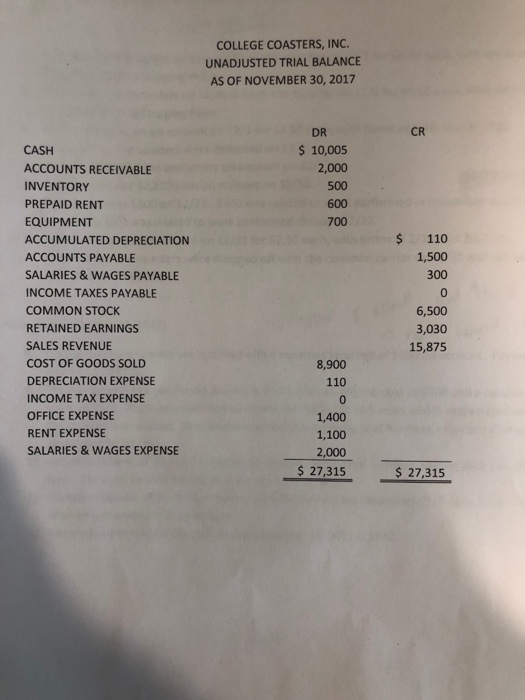

COLLEGE COASTERS, INC UNADJUSTED TRIAL BALANCE AS OF NOVEMBER 30, 2017 DR CR 10,005 2,000 500 600 700 CASH ACCOUNTS RECEIVABLE INVENTORY PREPAID RENT EQUIPMENT ACCUMULATED DEPRECIATION ACCOUNTS PAYABLE SALARIES &WAGES PAYABLE INCOME TAXES PAYABLE COMMON STOCK RETAINED EARNINGS SALES REVENUE COST OF GOODS SOLD DEPRECIATION EXPENSE INCOME TAX EXPENSE OFFICE EXPENSE RENT EXPENSE SALARIES&WAGES EXPENSE $110 1,500 300 6,500 3,030 15,875 8,900 110 1,400 1,100 2,000 $27,315 27.31S $ company buys coasters from one supplier. All amounts in Accounts Payable on December 1, 2017 owed to that supplier. Inventory on December 1 consisted of 1,000 coasters, all of which were sed in a batch on July 10, 2017 for $0.50 each. College Coasters records its inventory using a tual inventory system and the weighted average cost method. The During December, the company entered into the following transactions: thise Purchased 500 coasters on account from the supplier on 12/1 for $0.50 each, with terms of 2/10, Net 30, FOB Shipping Point. 1. 2. Purchased 1,000 coasters on account from the supplier on 12/2 for $0.50 each, with terms of 2/10, Net 30, FOB Shipping Point. Sold 2,000 coasters on account on 12/3 for $2.50 each, with terms of 2/10, Net 30, FOB Destination. The coasters were delivered on 12/4 Collected $4,000 from customers on account on 12/17 Paid the supplier $2,250 cash on account on 12/18. Paid employees $500 on 12/23. $300 was related to work performed in November and the remaining $200 was related to work performed through 12/22. Sold 100 coasters on account on 12/31 for $2.50 each, with terms of 2/10, Net 30, FOB Destination. The coasters were dropped off with the common carrier on 12/31 and will be delivered on 1/4/2018. 3. 4. 5. 6. 7. 0a Also, as of December 31, 2017: College Coasters has not yet recorded office expenses incurred of $200 on account. Payment is due on 1/15/2018. The equipment was purchased January 1, 2017, with an original cost of $700 and a residual value of $100. The equipment has an estimated useful life of 5 years and is depreciated using the straight line method. Depreciation is recorded monthly, and has been recorded through November 30, 2017. 8. 9. 10. Between December 23 and December 31, employees worked 10 hours and are paid $10 per 11. On November 30, 2017, the company paid $600 for rent for December 2017-May 2018. This 12. Income tax expense for the year ended December 31, 2017 is $740 hour. They will be paid for this time on January 15, 2018. amount was posted to Prepaid Rent. REQUIRED: Complete the following: a. How many units are in beginning inventory on 12/1? b. What is the original cost of beginning inventory on 12/1? c. Calculate the number of units purchased and the total units purchased in December d. Calculate Cost of Goods Available for Sale and the number of Units Available for Sale in 1. December How many units were sold in December? e. f. Calculate Ending Inventory as of December 31, 2017 and Cost of Goods Sold for the month ended December 31, 2017 8. Calculate Cost of Goods Sold for the year ended December 31, 2017. Prepare Journal Entries for 1 through 7 above. Setup T-Accounts for the accounts on the Unadjusted Trial Balance as of November 30, 2017 Use the balances from the trial balance as the beginning balances in your T-Accounts. 4.) Post the Journal Entries to the T-Accounts. Prepare an Unadjusted Trial Balance as of December 31, 2017. Prepare Adjusting Journal Entries for 8 through 12 above. Post the Adjusting Journal Entries to the T-Accounts. Prepare an Adjusted Trial Balance as of December 31, 2017. Prepare and Income Statement and a Statement of Retained Earnings for the year ended December 31, 2017, and a Balance Sheet as of December 31, 2017. (For the Income Stateme use the format in the example provided.) 7. 8. 9. 10. Prepare the Closing Journal Entry 11. Post the Closing Journal Entry to the T-Accounts 12. Prepare the Post-Closing Trial Balance as of December 31, 2017 on ta 11235 300 2 So Soo Ca sh 700 s 120 200 loo 74a 6S00 3030 087s la0 740 l b 20,5 73 9900 310915 Cost of Ga 0,97s Offive erp Vaut elf Seloges thys 600 200-5320 5o15 3030 Sols 0 3.ous nsers li,Ass 1600 issos liRo curent tieb L00