Answered step by step

Verified Expert Solution

Question

1 Approved Answer

wanting to invest in either a dividend paying stock or a series of short term investment in fixed income instruments, whichever one provides a higher

wanting to invest in either a dividend paying stock or a series of short term investment in fixed income instruments, whichever one provides a higher effective p.a% return on investment as described below for the same period, calculate:

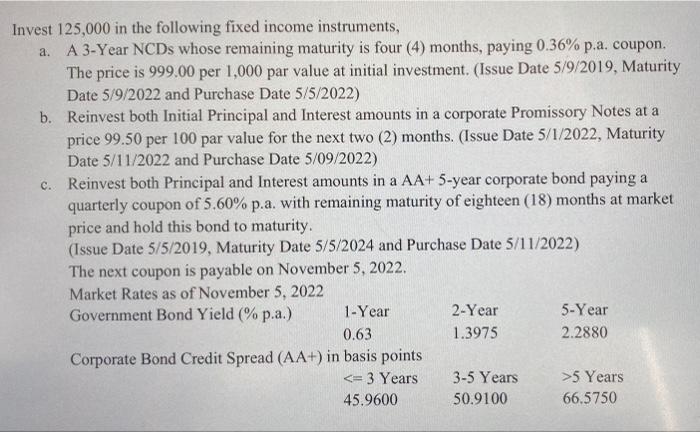

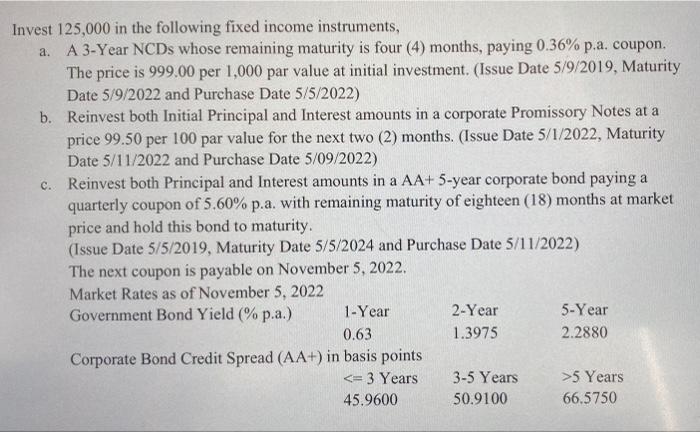

Invest 125,000 in the following fixed income instruments, a. A 3-Year NCDs whose remaining maturity is four (4) months, paying 0.36% p.a. coupon. The price is 999.00 per 1,000 par value at initial investment. (Issue Date 5/9/2019, Maturity Date 5/9/2022 and Purchase Date 5/5/2022) b. Reinvest both Initial Principal and Interest amounts in a corporate Promissory Notes at a price 99.50 per 100 par value for the next two (2) months. (Issue Date 5/1/2022, Maturity Date 5/11/2022 and Purchase Date 5/09/2022) C. Reinvest both Principal and Interest amounts in a AA+ 5-year corporate bond paying a quarterly coupon of 5.60% p.a. with remaining maturity of eighteen (18) months at market price and hold this bond to maturity. (Issue Date 5/5/2019, Maturity Date 5/5/2024 and Purchase Date 5/11/2022) The next coupon is payable on November 5, 2022. Market Rates as of November 5, 2022 Government Bond Yield (% p.a.) 1-Year 2-Year 5-Year 0.63 1.3975 2.2880 Corporate Bond Credit Spread (AA+) in basis points 5 Years 45.9600 50.9100 66.5750 Invest 125,000 in the following fixed income instruments, a. A 3-Year NCDs whose remaining maturity is four (4) months, paying 0.36% p.a. coupon. The price is 999.00 per 1,000 par value at initial investment. (Issue Date 5/9/2019, Maturity Date 5/9/2022 and Purchase Date 5/5/2022) b. Reinvest both Initial Principal and Interest amounts in a corporate Promissory Notes at a price 99.50 per 100 par value for the next two (2) months. (Issue Date 5/1/2022, Maturity Date 5/11/2022 and Purchase Date 5/09/2022) C. Reinvest both Principal and Interest amounts in a AA+ 5-year corporate bond paying a quarterly coupon of 5.60% p.a. with remaining maturity of eighteen (18) months at market price and hold this bond to maturity. (Issue Date 5/5/2019, Maturity Date 5/5/2024 and Purchase Date 5/11/2022) The next coupon is payable on November 5, 2022. Market Rates as of November 5, 2022 Government Bond Yield (% p.a.) 1-Year 2-Year 5-Year 0.63 1.3975 2.2880 Corporate Bond Credit Spread (AA+) in basis points 5 Years 45.9600 50.9100 66.5750

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started