Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ward A-Z Datal X The Value XJ Carbon T x Cengage X *Cengagel x Q Are trust: X | + xeAssignment/takeAssignmentMain.do?invoker-assignments&takeAssignmentSession Locator-assignment-take&in... < E

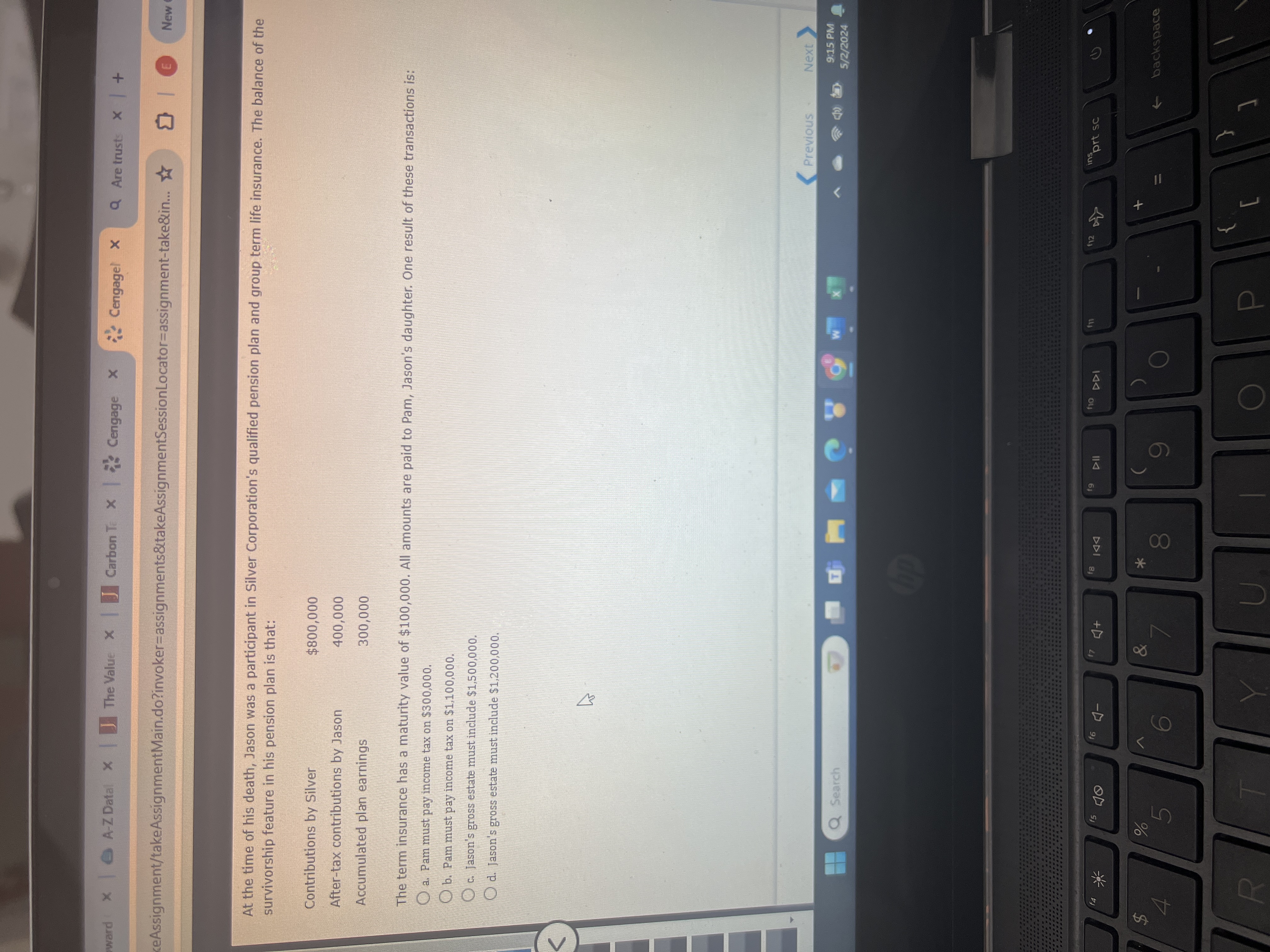

ward A-Z Datal X The Value XJ Carbon T x Cengage X *Cengagel x Q Are trust: X | + xeAssignment/takeAssignmentMain.do?invoker-assignments&takeAssignmentSession Locator-assignment-take&in... < E New At the time of his death, Jason was a participant in Silver Corporation's qualified pension plan and group term life insurance. The balance of the survivorship feature in his pension plan is that: Contributions by Silver $800,000 After-tax contributions by Jason 400,000 300,000 Accumulated plan earnings The term insurance has a maturity value of $100,000. All amounts are paid to Pam, Jason's daughter. One result of these transactions is: a. Pam must pay income tax on $300,000. Ob. Pam must pay income tax on $1,100,000. c. Jason's gross estate must include $1,500,000. Od. Jason's gross estate must include $1,200,000. S Q Search W f5 f4 R % 5 f6 4- 6 174+ & 7 f8 * IAA 8 f9 9 Previous Next 9:15 PM 5/2/2024 f10 DDI f12 ins prt sc + [ } backspace

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started