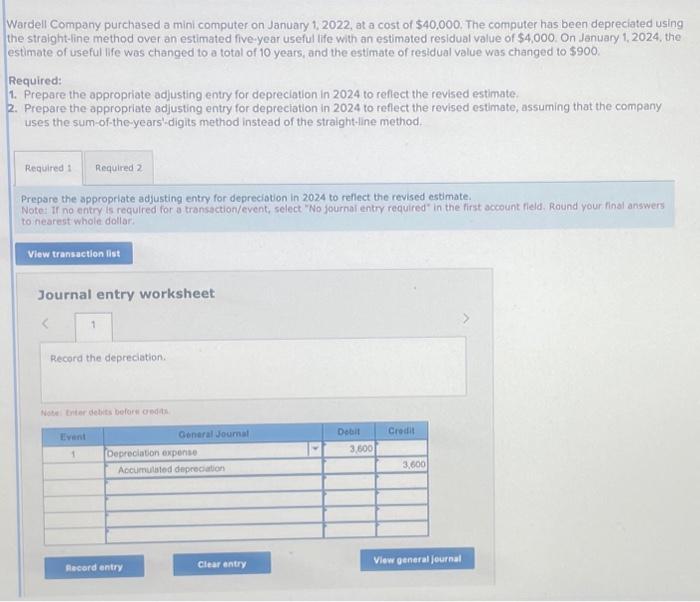

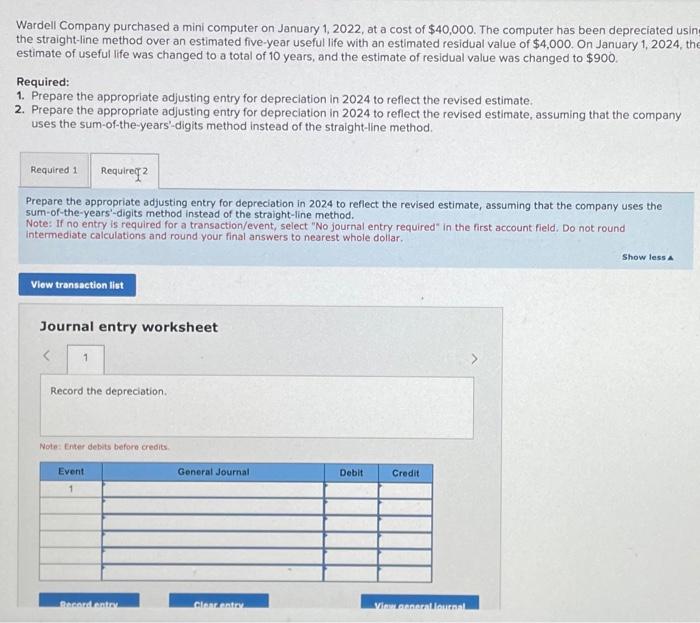

Wardell Company purchased a mini computer on January 1, 2022, at a cost of $40,000. The computer has been depreciated using the straight-line method over an estimated five-year useful life with an estimated residual value of $4,000,0 On January 1,2024 , the estimate of useful life was changed to a total of 10 years, and the estimate of residual value was changed to $900. Required: 1. Prepare the appropriate adjusting entry for depreciation in 2024 to reflect the revised estimate. 2. Prepare the appropriate adjusting entry for depreciation in 2024 to reflect the revised estimate, assuming that the company uses the sum-of-the-years'-digits method instead of the straight-line method. Prepsre the appropriate adjusting entry for depreciation in 2024 to reflect the revised estimate. Note: If no entry is required for a tronsaction/event, select "No fournal entry required" in the first account field. Round your final answers. to nearest whole dollar: Journal entry worksheet Nata. trier detuts beford ondati Wardell Company purchased a mini computer on January 1, 2022, at a cost of $40,000. The computer has been depreciated usin the straight-line method over an estimated five-year useful life with an estimated residual value of $4,000. On January 1,2024 , th estimate of useful life was changed to a total of 10 years, and the estimate of residual value was changed to $900. Required: 1. Prepare the appropriate adjusting entry for depreclation in 2024 to reflect the revised estimate. 2. Prepare the appropriate adjusting entry for depreciation in 2024 to reflect the revised estimate, assuming that the company uses the sum-of-the-years'-digits method instead of the straight-line method. Prepare the appropriate adjusting entry for depreciation in 2024 to reflect the revised estimate, assuming that the company uses the sum-of-the-years'-digits method instead of the straight-line method. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations and round your final answers to nearest whole dollar. Journal entry worksheet