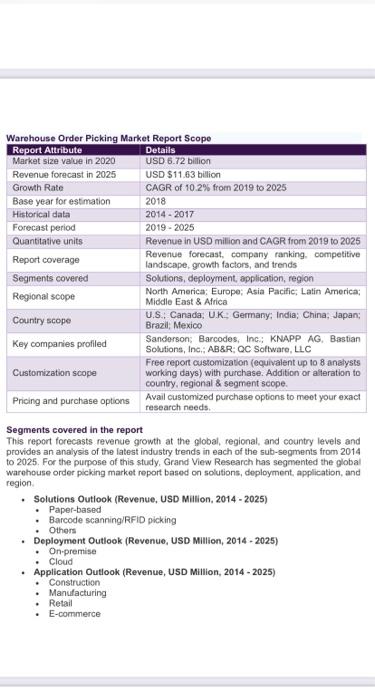

Warehouse Order Picking Market Size, Share \& Trends Analysis Report By Solutions (Paper-based, Barcode Scanning/RFID Picking), By Deployment (Onpremise, Cloud), By Application, By Region, And Segment Forecasts, 2019 - 2025 The global warehouse order picking market size was valued at USD 5.84 billion in 2018 and is expected to grow at a compound annual growth rate (CAGR) of 10.2% from 2019 to 2025. The rapid development of the e-commerce industry, which has led to the emergence of order fulfillment centers worldwide, is the key factor driving the market growth. The growing preference among warehouse owners to incorporate automation technologies to reduce the lifting response time and increase order fulfillment productivity is anticipated to boost the deployment of order fulfillment systems. Furthermore, the globalization of supply chain networks is expected to majorly contribute to the increasing adoption of lifting technologies among warehouse operators. U.S. warehouse order picking market size, by solutions, 2014 - 2025 (USD Million) The order picking process is reported to account for 5055% of the total warehouse operating cost. In recent years, the warehouse industry has undergone a paradigm shift from traditional manual lifting methods to semi-automated technologies that require lesser labor force. Among the various capabilities offered by order picking systems, attributes such as reduced marginal lifting errors, increased productivity, and reduced labor \& training cost are expected to play a pivotal role in their adoption. In addition, these systems also assist in the lifting of single as well as multiple-piece orders that are in one line. This is expected to encourage the adoption of picking techniques in warehouses. Warehouse and distribution centers are essential attributes of commodity storage and maintenance worldwide. With the rapid giobalization of the economy, logistics and transportation hubs, from where cross border businesses supply goods, are gaining prominence. Warehouse and distribution centers represent the crystallzation of globalized capitalist production processes under these conditions: their ability to fulfill customers' varying requirements and to work with multiple suppliers along various distribution channels are encouraging end-use organizations to adopt technologies for improvising their supply chain management processes. As a result of this, the order liffing systems are projected to gain traction over the forecast period Some of the growing concerns faced by end-use industries in the management of a warehouse include on-time shipments, addressing till rate, and maintaining the average warehouse capacity. To cater to these requirements, prominent players in the order picking industry are launching systems that leverage the latest technologies to ease the Ifting operations. The growing trend of incorporating Big Data and Artificial Intelligence (AI) is also expected to provide opportunities to market players in the coming years. Voice-directed picking involves the use of At to actively listen to the instructor's voice for commands such as where the system is directed to pick tems from as well as to provide accuracy of inventory management records. One of the biggest challenges in the effective implementation of order picking systems is the lack of know-how among operators. This results in fewer processed orders and increased response time, consequently hampering the overall productivity. Another challenge is hiring skilled prolessionals that are trained by industry experts, which subsequently increases the human capltal investments of the company. The need to employ professionals with appropriate skill sets for operating technologies that require relevant integration of the hardware and software, while fuliling orders from the source to the destination, are expected to hinder the market growth for warehouse order picking. Solutions lnsights The warehouse order picking market has been segmented based on solutions into barcode scanning/RFID picking. paper-based, and others. The barcode scanning/RFID picking segment accounted for the largest revenue share in 2018 and is expected to continue dominating the market over the forecast period. This can be attribuled to the various features offered by these scanning tags, including their ablity to scan the code mounted on products maintained in the inventory with greater accuracy and ease of using the scanners. The tags are also deployed for tracking inventory shrinkage and reducing product counterfeiting Contemporary technology solutions such as voice-ditected, Augmented Reality (AR). and pick-to-light have been included in the "others" category. These solutions, athough in their nascent stage at the moment, are expected to witness significant growth, exhibiting a CAGR of close to 20% over the next six years. These solutions aim to provide navigation facilitios to the employoes in warehouses without any hassle of data inputting, scanning. and notetaking. For instance, AR-based technology is a combination of voice and visionbased order picking solutions. The technology uses smart glasses to provide virtual images and helps to improve the speed of operations and accuracy. Deployment Insights Based on deployment, the market for warehouse order picking has been classifiod into cloud and on-premise. The cloud segment is anticipated to withess significant growth over the next six years. This is due to the fact that a majority of the operations ifvolving contemporary technologles such as voice-based and pick-to-light are carried out with the holp of cloud solutions. These solutions are designed to help companios track their logistics in real.Eme and reduce the margin of error, thereby improving the efficiency and productivity of the warehouses. Cloud solutions are also doployed in medium and large warehouses that use advanced RFID picking techniques for minimizing the turnaround time. The on-premise segment accounted for a significant revenue share of the total market. Traditional order picking techniques such as barcode scanning and paper-based picking are operated within the premises as thete solutions reguire manual tabor for inventory handing. Furthermore, small- and medum-sised businesses prefer low budget operations, owing to which they deploy cost-etfective solutions in their warehouse. This is contributing to the growth of the market for warehouse order picking. Application lnsights Based on application, the market for warehouse order picking has been segregated into constructiony manulacturing; retai; e-commerce; healthcare, pharma, and cosmetics, Iransportation \& logistics; and others. The e-commerce sogment is peojected to witness the fastest growth over the noxt six years. The ungrecedented growth of the e-commerce industry has led to a rise in the number of distribution centers. This can be attribuled to the fact that futfilment technologies are capable of processing onders with lesser travel time and increased accuracy. Thus, e-commetce warehouse operators are shiting toward incorporating these tochnologies in their premises The manufacturing segment dominated the market for warehouse order picking in 2018 , a trend which is projected to continue over the next six years. The rising concern of the industry for cycle time reductions, moving into smaller lot sizes, and point-of-use delivery is expected to highly contribute to the revenue share of this market. Furthermore, the emerging foreign trade activies are expected to contribute to the deployment of solutions in the transportation and logistics warehouses where the shipments are stored. Thus, the transportation and logistics segment is anticipated to capture a significant revenue share in the market. Regional Insights North America was the dominant market for warehouse order picking in 2018 . High adoption of order fulfllment technologies by industries operating majorly in e-commerce. manufacturing. and retail is expected to boost the market share of North America. In addition. the presence of a large number of significant order picking solution providers. including American Barcode and RFID and SalesWarp, is contributing to the market growth. The U.S. has emerged as the second-largest market for e-commeroe globally. after China. thus driving the demand for warehouse onder picking solutions in the country's e-conmerce sector. The Asia Pacific market is projected to grow at the highest rate with an estimated CAGR of over 10% over the forecast period. The growth can be attributed to the increasing retail and e-commerce sales as well as rapid digitalication in the industry. Furthermore, the fast-frowing logistics industry, manulacturing sector, and favorable policies promoting domestic production in prominent economies such as Japan and India are significant factors influencing the growth of the market in this region. Owing to the wide presence of foreign trade and online retail sales in China, the country's transport and logistics industry is anticipated to flourish, leading to an increasing demand for automated warehouse order picking solutions over the forecast period. Key Companies \& Market Share Insights New product launches, mergers & acquisitions, and collaborations are some of the business strateples adopted by key players for business expansion. For instance, in February 2019, KNAPP AG parthered with a configurator of the modular design system. VOLA, to optimize its storage and distribution processes using KNAPP AG's automation solution. This new system is scheduled to commence its operation in August 2019. Moreover, in May 2018. AB\&R entered into a strategic alliance with RAIN RFID to incomorate the latter's system with UHF RFID and cloud. The integration enabled the company to stockple, manage, and share is RFID-based data via the internet. Some of the prominent players in the warehouse order picking market include: - Sanderson - Barcodes, inc. - KNAPP AG - Bastian Solutions, Inc. - AB\&R - QC Software, LLC Segments covered in the report This report forecasts revenue growth at the plobal, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study. Grand View Research has segmented the globa warehouse order picking market report based on solutions, deployment, application, and region - Solutions Outiook (Revenue, USD Million, 2014 - 2025) - Paper-based - Barcode scanning/RFlD picking * Othors - Deployment Outlook (Revenue, USD Million, 2014 - 2025) * On-premise - Cloud - Application Outlook (Revenue, USD Million, 2014 - 2025) - Construction - Manufacturing - Retail - E-commerce - Region Outiook (Revenue, USD Million, 2014 - 2025) - North America U.S. Canada - Europe UK Germany - Asia Pacific China India Japan - Latin America - Brazil - Mexico - Middle East \& Africa Questions: 1. How big is the warehouse order picking market? 2. What is the warehouse order picking market growth? 3. Which segment accounted for the largest warehouse order picking market share? 4. Who are the key companies/players in warehouse order picking market? 5. What are the factors driving the warehouse order picking market