Answered step by step

Verified Expert Solution

Question

1 Approved Answer

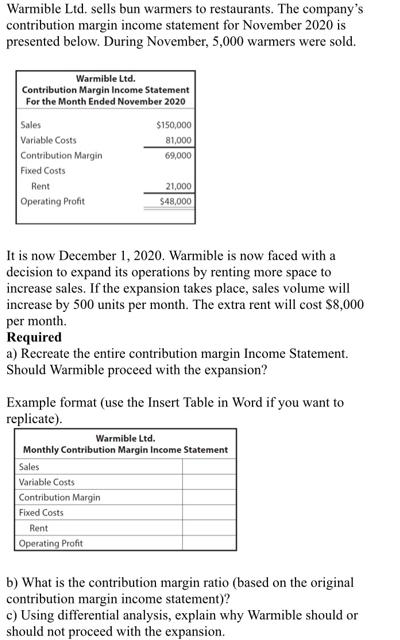

Warmible Ltd. sells bun warmers to restaurants. The company's contribution margin income statement for November 2020 is presented below. During November, 5,000 warmers were

Warmible Ltd. sells bun warmers to restaurants. The company's contribution margin income statement for November 2020 is presented below. During November, 5,000 warmers were sold. Warmible Ltd. Contribution Margin Income Statement For the Month Ended November 2020 Sales Variable Costs Contribution Margin Fixed Costs Rent Operating Profit $150,000 81,000 69,000 21,000 $48,000 It is now December 1, 2020. Warmible is now faced with a decision to expand its operations by renting more space to increase sales. If the expansion takes place, sales volume will increase by 500 units per month. The extra rent will cost $8,000 per month. Required a) Recreate the entire contribution margin Income Statement. Should Warmible proceed with the expansion? Example format (use the Insert Table in Word if you want to replicate). Warmible Ltd. Monthly Contribution Margin Income Statement Sales Variable Costs Contribution Margin Fixed Costs Rent Operating Profit b) What is the contribution margin ratio (based on the original contribution margin income statement)? c) Using differential analysis, explain why Warmible should or should not proceed with the expansion.

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

November 2020 Expansion December 2020 Sales 150000 170000 Variable Costs 81000 91000 Contribution Ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started