Warner and Augustine Robins, both 35, have been married for 9 years rand have no dependents. Warner is the president of Jaystar Corporation located

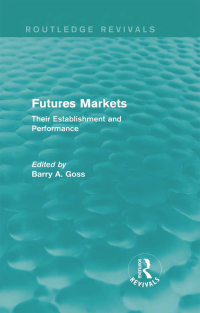

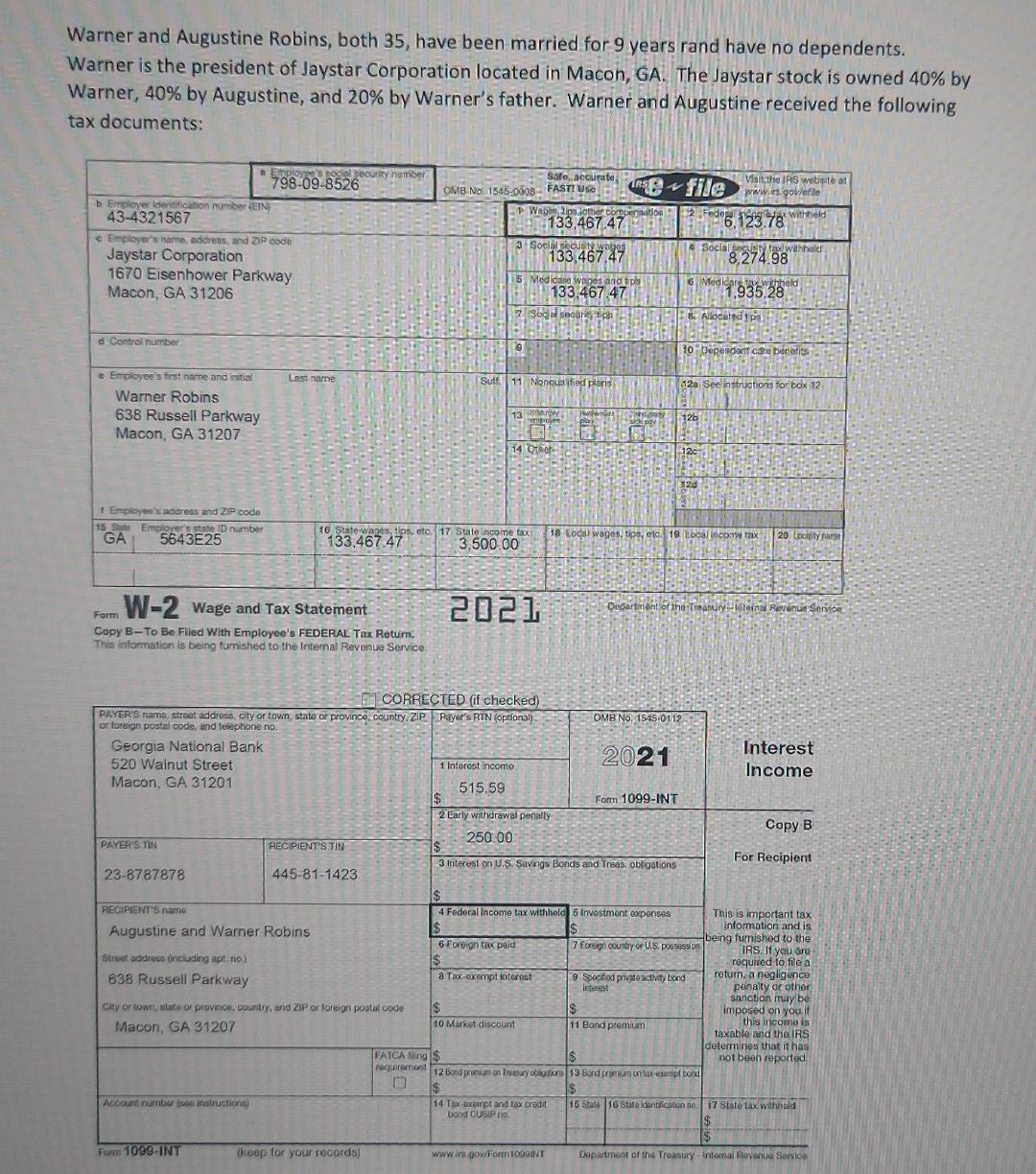

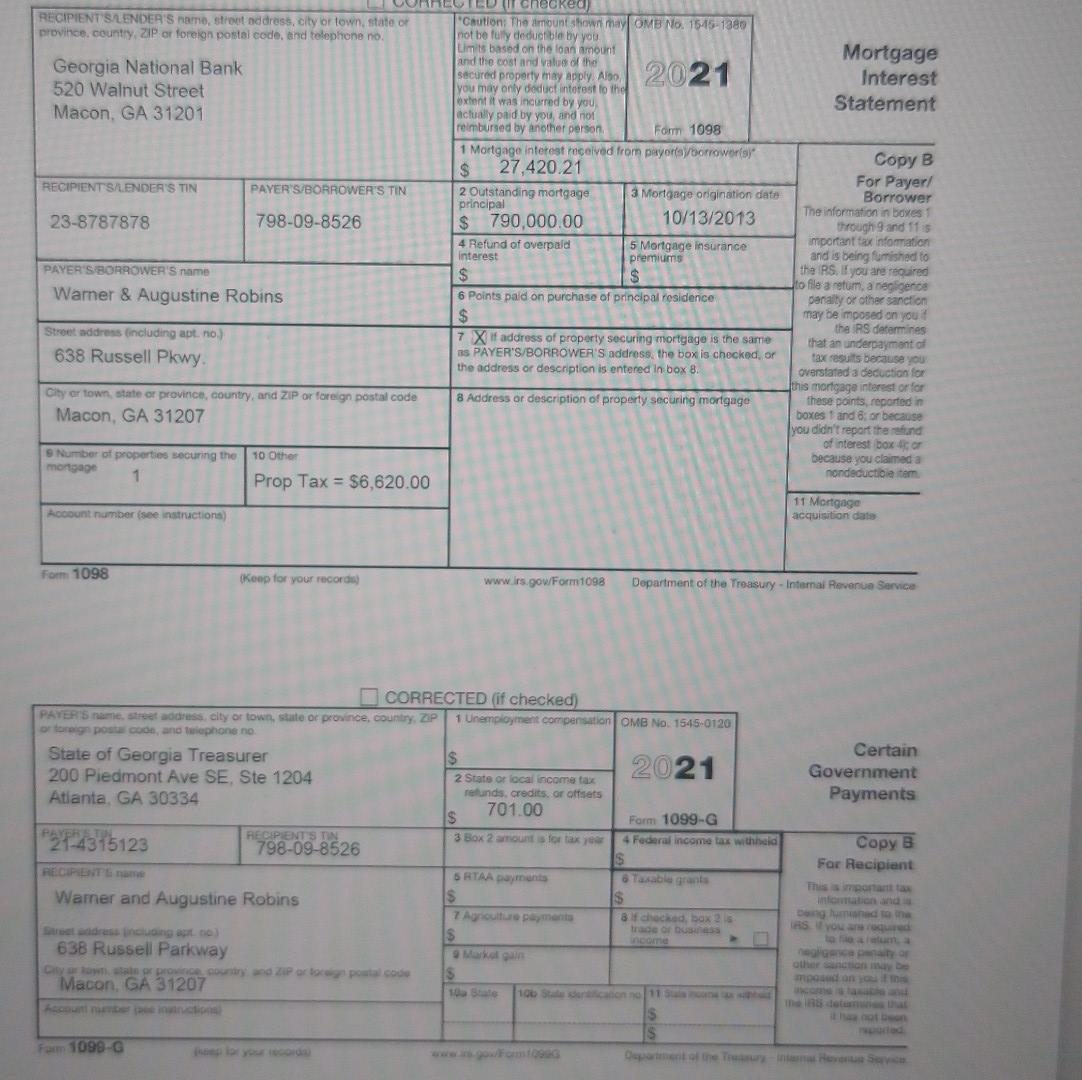

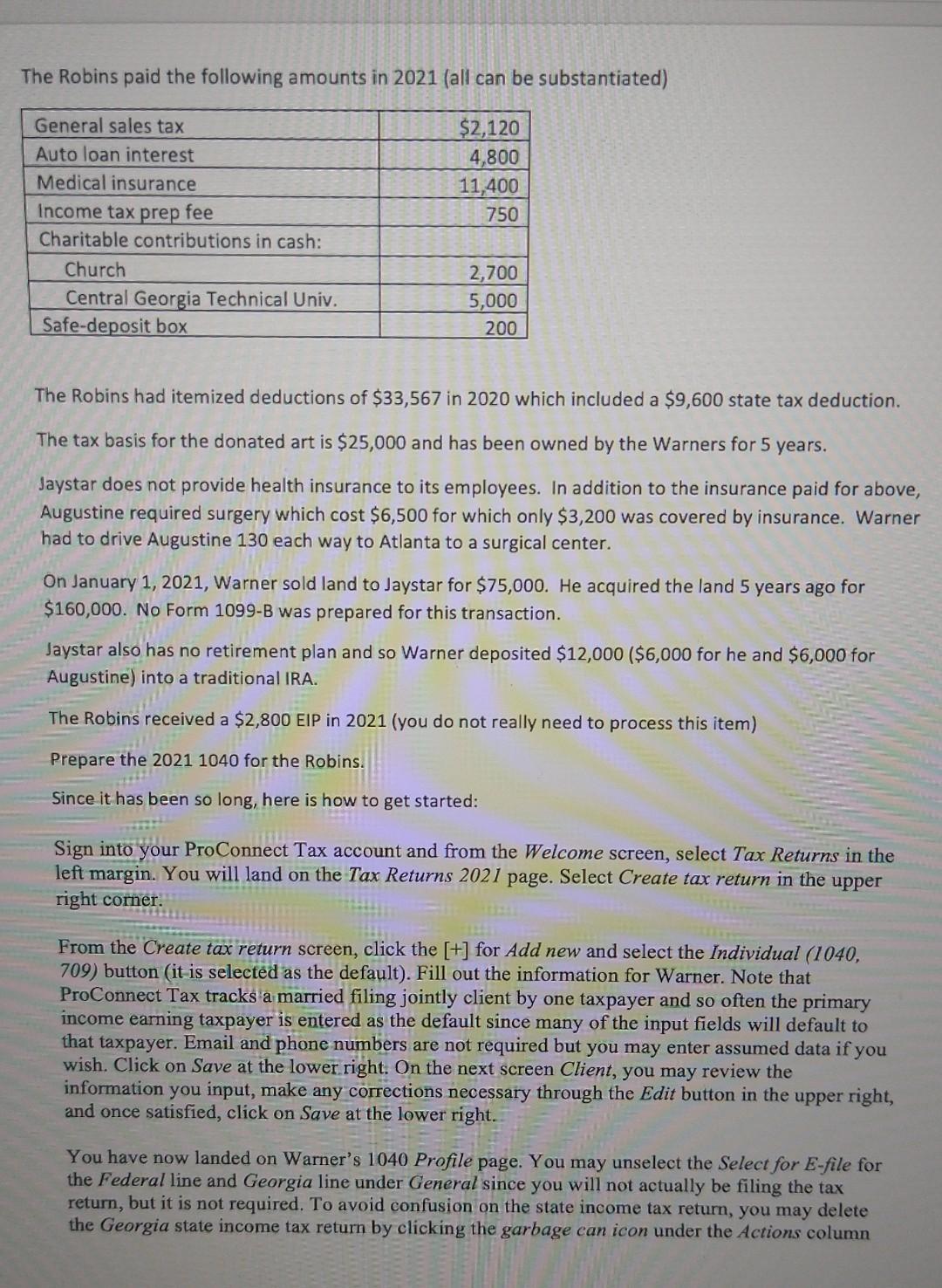

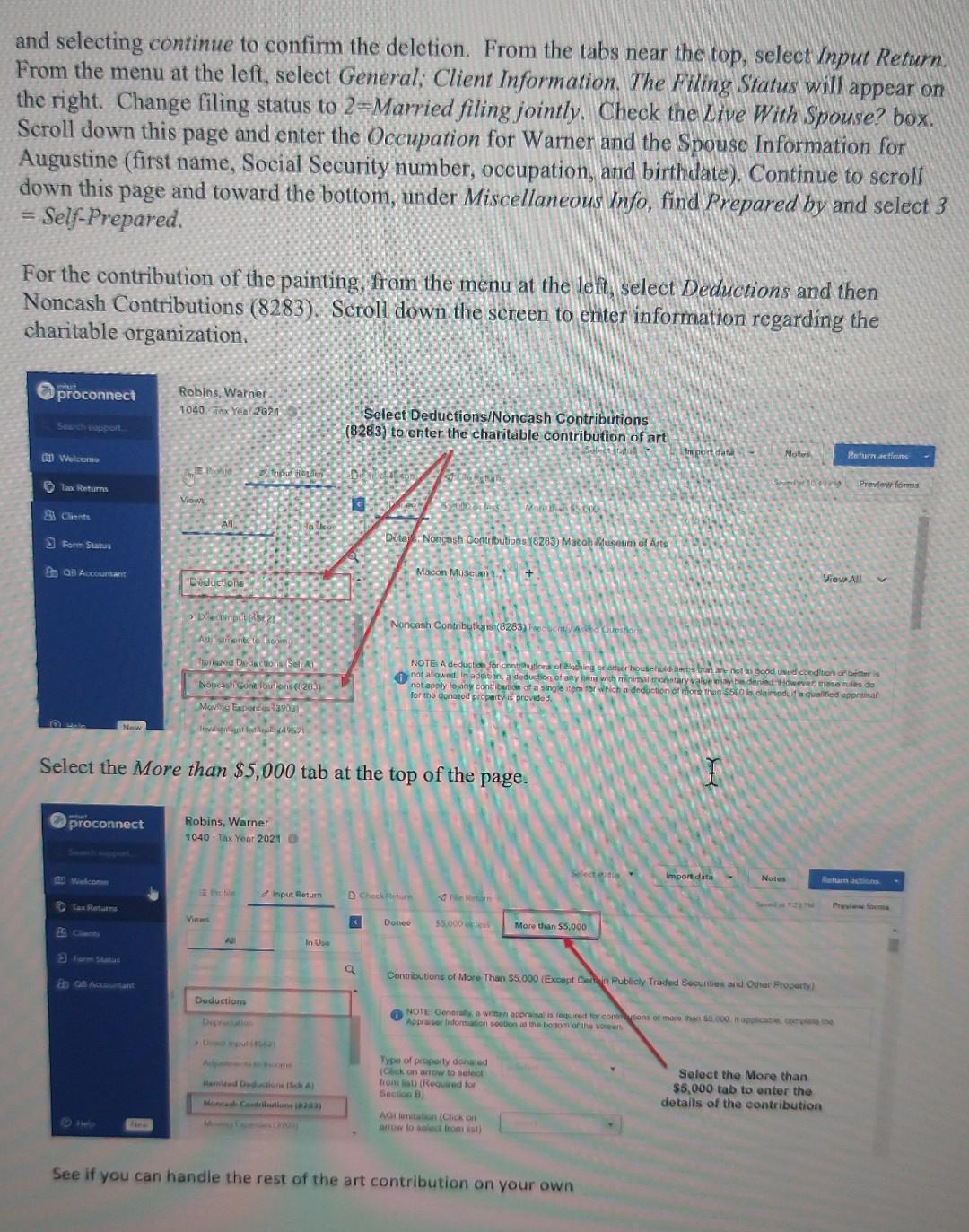

Warner and Augustine Robins, both 35, have been married for 9 years rand have no dependents. Warner is the president of Jaystar Corporation located in Macon, GA. The Jaystar stock is owned 40% by Warner, 40% by Augustine, and 20% by Warner's father. Warner and Augustine received the following tax documents: b Employer identification number (EIN 43-4321567 c Employer's name, address, and ZIP code Jaystar Corporation 1670 Eisenhower Parkway Macon, GA 31206 d Control number e Employee's first name and initial Warner Robins 638 Russell Parkway Macon, GA 31207 1 Employee's address and ZIP code Employee 798-09-8526 ty number: Safe, accurate. OMB No. 1545-0008- FAST! Use RS file Feder 1 Wage Lips jother compensation 133.467.47 3 Social security wages 133,467.47 Medicase wapes and tips 133.467.47 7 Sog security tip Visit the IRS website at www.irs.gov/efle 6,123.78 withheld Social security tax withhold 8,274.98 Medicare tax withheld 1,935.28 8. Allocated 1 ps 10 Dependant care benefits Last name Suff 11 Nonqualified plans 12a See instructions for bax 12 14 Other 12b 12c 15 State Employer's state ID number GA 5643E25 16 State wages, tips, etc. 17 State income tax 133,467.47 3,500.00 18 Local wages, tips, etc. 19 Local income tax 20 Locality pare Form W-2 Wage and Tax Statement Copy B-To Be Filled With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service. 2021 Department of the Treasuryleinal Revenue Service CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, Zie Payer's RTN (optional) or foreign postal code, and telephone no. Georgia National Bank 520 Walnut Street Macon, GA 31201 OMB No. 1545-0112 2021 1 Interest incomo Interest Income 515.59 Form 1099-INT 2 Early withdrawal penalty Copy B 250.00 PAYER'S TIN 23-8787878 RECIPIENT'S TIN 3 Interest on U.S. Savings Bonds and Treas, obligations For Recipient 445-81-1423 RECIPIENT'S name Augustine and Warner Robins $ 6 Foreign tax paid Street address (including apt no.) 638 Russell Parkway 8 Tax-exempt interest City or town, state or province, country, and ZIP or foreign postal code: Macon, GA 31207 $ 10 Market discount 11 Bond premium FATCA filing $ $ requirement 4 Federal Income tax withheld 5 Investment expenses 12 Bond premium on Treasury obligations 13 Bond premium on lax-exempt bond This is important tax information and is being furnished to the IRS If you aro required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported 7 Eoreign country or U.S. possession 9 Specified private activity bond interest $ $ Account number (so instructions) 14 Tax axempt and tax credit bond CUSIP no. 15 State 16 State identification no. 17 State tax withhold $ Form 1099-INT (keep for your records) www.irs.gov/Form 1000INT Department of the Treasury intomal Revenue Service RECIPIENT'S/LENDER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. Georgia National Bank 520 Walnut Street Macon, GA 31201 checked) "Caution: The amount shown may OMB No. 1545-1380 not be fully deductible by you Limits based on the loan amount and the cost and value of the secured property may apply. Also, you may only deduct interest to the extent it was incurred by you, actually paid by you, and not reimbursed by another person. 2021 Form 1098 1 Mortgage interest received from payor(s)/borrower(s) $ 27,420.21 $ RECIPIENTS/LENDER'S TIN PAYER'S/BORROWER'S TIN 2 Outstanding mortgage principal 23-8787878 798-09-8526 790,000.00 3 Mortgage origination date 10/13/2013 4 Refund of overpald interest 5 Mortgage insurance premiums $ PAYER'S BORROWER'S name Warner & Augustine Robins Street address (including apt. no.) 638 Russell Pkwy. City or town, state or province, country, and ZIP or foreign postal code Macon, GA 31207 9 Number of properties securing the mortgage 1 Account number (see instructions) 10 Other Prop Tax = $6,620.00 $ 6 Points paid on purchase of principal residence $ 7 If address of property securing mortgage is the same as PAYER'S/BORROWER'S address, the box is checked, or the address or description is entered in box 8. 8 Address or description of property securing mortgage Mortgage Interest Statement Copy B For Payer/ Borrower The information in boxes through 9 and 11 is important tax information and is being fumished to the IRS. If you are required to file a retum, a negligence penalty or other sanction may be imposed on you the IRS determines that an underpayment of tax results because you overstated a deduction for this mortgage interest or for these points, reported in boxes 1 and 6; or because you didn't report the refund of interest box 4 or because you claimed a nondeductible item 11 Mortgage acquisition date Form 1098 (Keep for your records) www.irs.gov/Form1098 Department of the Treasury - Internal Revenue Service CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP 1 Unemployment compensation OMB No. 1545-0120 or foreign postal code, and telephone no. State of Georgia Treasurer 200 Piedmont Ave SE, Ste 1204 Atlanta, GA 30334 PAYERE TIN 21-4315123 RECIPIENTS name 2 State or local income tax refunds, credits, or offsets 701.00 2021 Form 1099-G 4 Federal income tax withheid 6 Taxable grants trade or business income Certain Government Payments Copy B For Recipient This is important tax infor tion and is being humaned to the RS yo $ RECIPIENT'S TIN 798-09-8526 3 Box 2 amount is for tax year 5 RTAA payments $ 7 Agriculture payments 8 if checked, box 2 is $ 9Markel gain foreign postal code $ 10 State 106 Stale der no 11 other on may be mpo cons The 188 detun that S eep for your records) gov/Form10990 Department Treasury Internal Revenue Serv Warner and Augustine Robins Street address including apt no) 638 Russell Parkway City or low, state or province country Macon, GA 31207 Account number pee instructions Farm 1099-G neglige Macon Museum of Arts 3231 Vineville Ave. Macon, GA 312041 November 23, 2021 Mr. and Mrs. Warner and Augustine Robins 628 Russell Parkway Macon, GA 31207 T Dear Mr. and Mrs. Robins: Thank you for your contribution of the original album cover art for the Almond-Sisters Band to the Macon Museum of Arts. T This gift-supports the Macon Museum's efforts to bring original and locally-sourced-art- work to Macon. This continuing-support-will-guarantee our ability to display-Almond- Sister art work for many years to come. T We have attached a copy of the appraiser's market valuation. Her analysis estimates the value of the painting at $54,505. -> Please keep this written acknowledgement of your donation for your tax records. As-a- token of our appreciation for your support, we have mailed you the Macon-Museum-tote- bag. We estimate the value of the tote bag to be $5. We are required to inform you that- your federal income-tax-deduction for your contribution is the amount of your contribution-less the value of the tote-bag.--Thank you for your continuing support for our important-work-in-this-field! Please retain this letter as proof of your charitable contribution. Thank you for helping us to help veterans. Sincerely, 1 Jack T. Mann Jack T.-Mann Art Development Officer Employer Identification Number 22-1234567 Macon Museum of Arts is a registered 501(c)(3) corporation The Robins paid the following amounts in 2021 (all can be substantiated) General sales tax $2,120 Auto loan interest 4,800 Medical insurance 11,400 Income tax prep fee 750 Charitable contributions in cash: Church 2,700 Central Georgia Technical Univ. Safe-deposit box 5,000 200 The Robins had itemized deductions of $33,567 in 2020 which included a $9,600 state tax deduction. The tax basis for the donated art is $25,000 and has been owned by the Warners for 5 years. Jaystar does not provide health insurance to its employees. In addition to the insurance paid for above, Augustine required surgery which cost $6,500 for which only $3,200 was covered by insurance. Warner had to drive Augustine 130 each way to Atlanta to a surgical center. On January 1, 2021, Warner sold land to Jaystar for $75,000. He acquired the land 5 years ago for $160,000. No Form 1099-B was prepared for this transaction. Jaystar also has no retirement plan and so Warner deposited $12,000 ($6,000 for he and $6,000 for Augustine) into a traditional IRA. The Robins received a $2,800 EIP in 2021 (you do not really need to process this item) Prepare the 2021 1040 for the Robins. Since it has been so long, here is how to get started: Sign into your ProConnect Tax account and from the Welcome screen, select Tax Returns in the left margin. You will land on the Tax Returns 2021 page. Select Create tax return in the upper right corner. From the Create tax return screen, click the [+] for Add new and select the Individual (1040, 709) button (it is selected as the default). Fill out the information for Warner. Note that ProConnect Tax tracks a married filing jointly client by one taxpayer and so often the primary income earning taxpayer is entered as the default since many of the input fields will default to that taxpayer. Email and phone numbers are not required but you may enter assumed data if you wish. Click on Save at the lower right. On the next screen Client, you may review the information you input, make any corrections necessary through the Edit button in the upper right, and once satisfied, click on Save at the lower right. You have now landed on Warner's 1040 Profile page. You may unselect the Select for E-file for the Federal line and Georgia line under General since you will not actually be filing the tax return, but it is not required. To avoid confusion on the state income tax return, you may delete the Georgia state income tax return by clicking the garbage can icon under the Actions column and selecting continue to confirm the deletion. From the tabs near the top, select Input Return. From the menu at the left, select General; Client Information. The Filing Status will appear on the right. Change filing status to 2-Married filing jointly. Check the Live With Spouse? box. Scroll down this page and enter the Occupation for Warner and the Spouse Information for Augustine (first name, Social Security number, occupation, and birthdate). Continue to scroll down this page and toward the bottom, under Miscellaneous Info, find Prepared by and select 3 = Self-Prepared. For the contribution of the painting, from the menu at the left, select Deductions and then Noncash Contributions (8283). Scroll down the screen to enter information regarding the charitable organization. proconnect Robins, Warner 1040 Tax Year 2021 Search support Select Deductions/Noncash Contributions (8283) to enter the charitable contribution of art Import data T Notes Return actions Welcome Preview forms Tax Returns View Moth Co Clients All Duta Noncash Contributions (8283) Matoh Museum of Arts Form Status Macon Museum + View All QB Accountant Deductions Decimal (521 Austments to scomp Toriszod Deductions (Seh A) Noncash Gontributions (8283) Movthe Expenfas 3903 Inligtigt let Noncash Contributions (8283) Fe NOTE: A deduction for contributions of Blochi e other household striatan not a good used condition or better is not a owed. In addition, a deduction of any hem with minimal monetary value may be denied However rese rules do not apply to any contibution of a single item for which a deduction of more than $500 la claimed, if a qualified appraisal for the donated property is provided. Select the More than $5,000 tab at the top of the page. proconnect Robins, Warner 1040 Tax Year 2021 Search support Welcome Proble Input Return D Check Return Select its Import data Notes Return actions Seved Preview forms Tax Returns Views Doneo $5,000 less More than $5,000 80 Clients All In Use 5 Form Status a 808 Accountant Deductions Contributions of More Than $5,000 (Except Certain Publicly Traded Securities and Other Property) NOTE Generally a written appraisal is required for condtions of more than $0.000 it applicable, complete Appraiser Information section at the bottom of the soleers Depreciation 170 Dinput (4562) Adpt to come Remized Deductions (SA) Noncash Contributions (283) Moving Expenses (90) Type of property donated (Click on arrow to select from at) (Required for Section B) AGI imitation (Click on arrow to select from list) See if you can handle the rest of the art contribution on your own Select the More than $5,000 tab to enter the details of the contribution Because the Robins itemized deductions in 2020 included a state tax deduction, the state tax refund received reflected on Form 1099-G must be reported. From the menu at the left, select Income: Tax Refund, Unempl. Comp. (1099-G) which will land you on the Details: Tax Refund, Unempl. Comp. (1099-G) page. Click on the State Refund Wksht written in blue, in the top right which will land you on the State and Local Tax Refund Worksheet. preconnect Sand soppret Robins, Warner 1040 Tax Year 2021 Select to Import data Notes Return actions Welcome Impot Retur DO Preview forms Tax Returns Views The Red Wh Claim In Us Details: Tax Refund. Unempl. Comp (1099-G) Form Status a New Tab 808 Accountant Income Select Income/Tax Refund, Unempl. Comp and then click State Refund View All Wksht and Local Tax Refunds Compensation, etc. (Form 1099-G) 5 Best Amy Mis Tax Refund Unempl. Comp (109 Name of payer Diss (1099) Additional Payer Enter the state income tax refund amount in the Taxpayer column of the Income tax refunds, if itemized last year [Override]. Warner sold the land at a loss to a related party. To record this nondeductible loss, from the menu at the left, select Income; Dispositions (Sch D, etc.); Schedule D/4797/etc. You will likely land on the Quick Entry screen by default. Instead, you want to click on the blue Details box on the right. Enter the Description of property and for the Date acquired (negative date=various), enter a date that is 5 years before 2021. Enter the Date sold (negative date-various), the total Sales price, and the total Cost or other basis (do not reduce by depreciation). Scroll down and check the box for Related party loss.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the 2021 Form 1040 for Warner and Augustine Robins we need to go through their income deductions and any applicable credits Follow these st...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started