Question

Warren has discovered a good stock S. Since he believes in a focused investment strategy, Warren invests all his money in the stock. Jack Treynor

Warren has discovered a good stock S. Since he believes in a focused investment strategy, Warren invests all his money in the stock. Jack Treynor believes diversification is as important as picking the right stock, so he includes the market index fund in his portfolio in addition to holding the stock S. The correlation coefficient between return on stock S and return on the market index fund is 0.5.

Required:

(1) Suppose CAPM holds, verify whether stock S is undervalued.

(2) Jack forms an equally weighted portfolio (C) with stock S and market index fund M. What are expected return and standard deviation for portfolio C?

(3) Can Jack beat Warren's investment strategy?

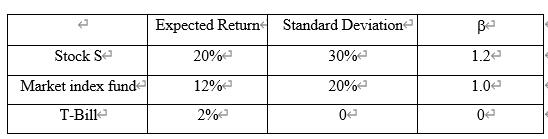

Expected Return Standard Deviation < Stock S 20% 30% 1.2 Market index fund 12% 20% 1.0 < T-Bill 2% 0 < 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solutions 1 To determine if stock S is undervalued using the Capital Asset Pricing Model CAPM we need to calculate its expected return and compare it to its actual return The CAPM states that the expe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started