Answered step by step

Verified Expert Solution

Question

1 Approved Answer

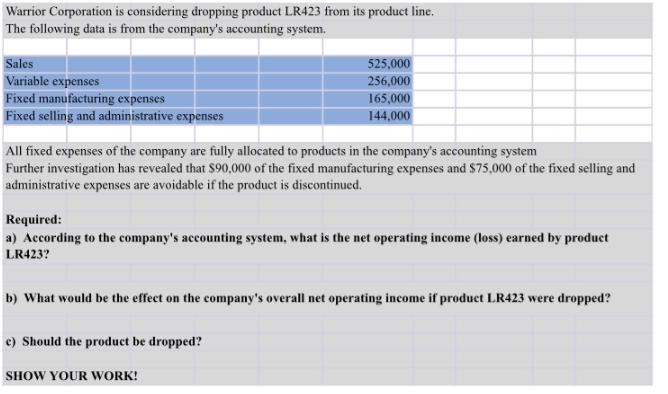

Warrior Corporation is considering dropping product LR423 from its product line. The following data is from the company's accounting system. Sales Variable expenses Fixed

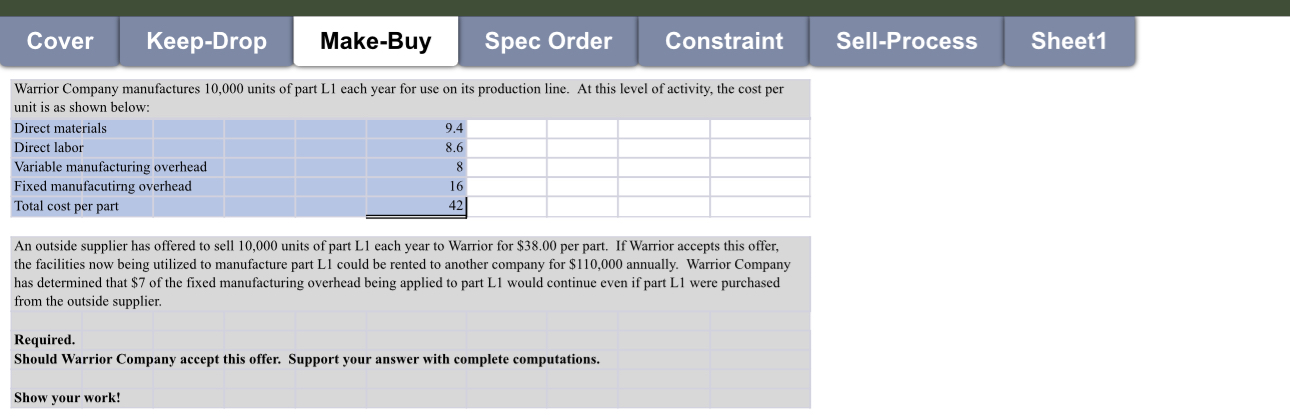

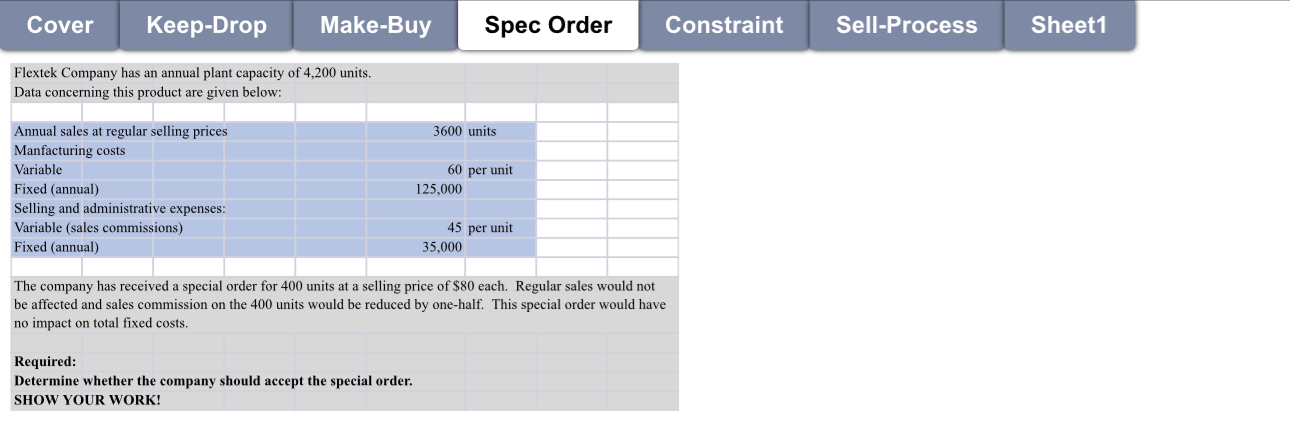

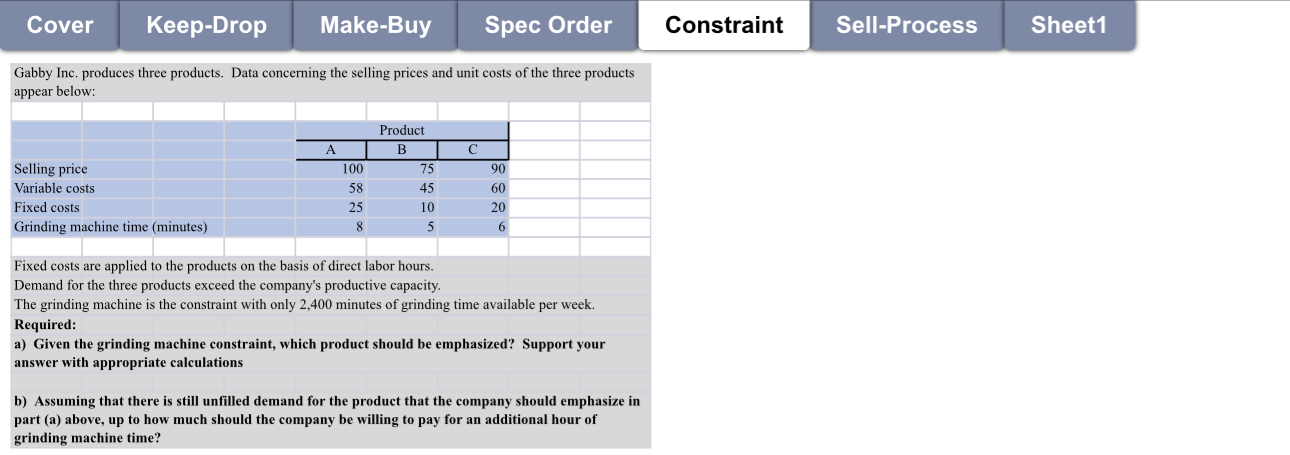

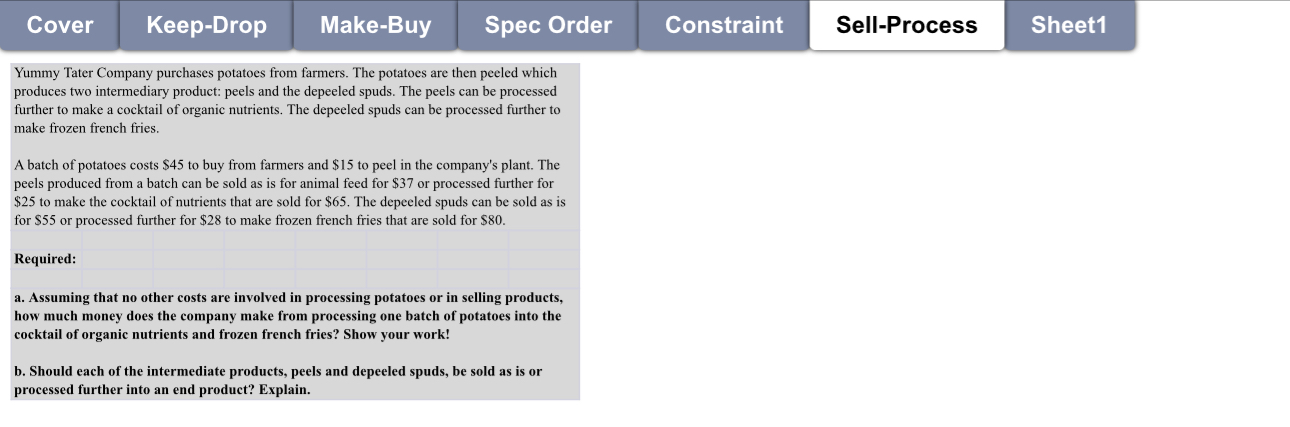

Warrior Corporation is considering dropping product LR423 from its product line. The following data is from the company's accounting system. Sales Variable expenses Fixed manufacturing expenses Fixed selling and administrative expenses 525,000 256,000 165,000 144,000 All fixed expenses of the company are fully allocated to products in the company's accounting system Further investigation has revealed that $90,000 of the fixed manufacturing expenses and $75,000 of the fixed selling and administrative expenses are avoidable if the product is discontinued. Required: a) According to the company's accounting system, what is the net operating income (loss) earned by product LR423? b) What would be the effect on the company's overall net operating income if product LR423 were dropped? e) Should the product be dropped? SHOW YOUR WORK! Cover Keep-Drop Make-Buy Spec Order Constraint Warrior Company manufactures 10,000 units of part L1 each year for use on its production line. At this level of activity, the cost per unit is as shown below: Direct materials Direct labor Variable manufacturing overhead Fixed manufacutirng overhead 9.4 8.6 8 16 42 Total cost per part An outside supplier has offered to sell 10,000 units of part L1 each year to Warrior for $38.00 per part. If Warrior accepts this offer, the facilities now being utilized to manufacture part LI could be rented to another company for $110,000 annually. Warrior Company has determined that $7 of the fixed manufacturing overhead being applied to part L1 would continue even if part L1 were purchased from the outside supplier. Required. Should Warrior Company accept this offer. Support your answer with complete computations. Show your work! Sell-Process Sheet1 Make-Buy Spec Order Constraint Sell-Process Sheet1 Cover Keep-Drop Flextek Company has an annual plant capacity of 4,200 units. Data concerning this product are given below: Annual sales at regular selling prices Manfacturing costs Variable Fixed (annual) Selling and administrative expenses: 3600 units 60 per unit 125,000 Variable (sales commissions) Fixed (annual) 45 per unit 35,000 The company has received a special order for 400 units at a selling price of $80 each. Regular sales would not be affected and sales commission on the 400 units would be reduced by one-half. This special order would have no impact on total fixed costs. Required: Determine whether the company should accept the special order. SHOW YOUR WORK! Cover Keep-Drop Make-Buy Spec Order Gabby Inc. produces three products. Data concerning the selling prices and unit costs of the three products appear below: Selling price Variable costs Fixed costs Grinding machine time (minutes) Product A B 100 75 90 58 45 60 25 10 20 8 5 6 Fixed costs are applied to the products on the basis of direct labor hours. Demand for the three products exceed the company's productive capacity. The grinding machine is the constraint with only 2,400 minutes of grinding time available per week. Required: a) Given the grinding machine constraint, which product should be emphasized? Support your answer with appropriate calculations b) Assuming that there is still unfilled demand for the product that the company should emphasize in part (a) above, up to how much should the company be willing to pay for an additional hour of grinding machine time? Constraint Sell-Process Sheet1 Cover Keep-Drop Make-Buy Spec Order Constraint Sell-Process Sheet1 Yummy Tater Company purchases potatoes from farmers. The potatoes are then peeled which produces two intermediary product: peels and the depeeled spuds. The peels can be processed further to make a cocktail of organic nutrients. The depeeled spuds can be processed further to make frozen french fries. A batch of potatoes costs $45 to buy from farmers and $15 to peel in the company's plant. The peels produced from a batch can be sold as is for animal feed for $37 or processed further for $25 to make the cocktail of nutrients that are sold for $65. The depeeled spuds can be sold as is for $55 or processed further for $28 to make frozen french fries that are sold for $80. Required: a. Assuming that no other costs are involved in processing potatoes or in selling products, how much money does the company make from processing one batch of potatoes into the cocktail of organic nutrients and frozen french fries? Show your work! b. Should each of the intermediate products, peels and depeeled spuds, be sold as is or processed further into an end product? Explain. 1. The attached Excel file contains a test including a series of Differential Analysis problems, including: Keep or Drop Make or Buy . Special Order Constraint Sell or Process 2. Please complete the differential analysis problems in this Excel file. 3. Be sure to show all work and responses on each Excel worksheet tab. 4. Properly label all information, and please highlight your answers in yellow. 5. Submit your completed Excel file to this. assignment link.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started