Answered step by step

Verified Expert Solution

Question

1 Approved Answer

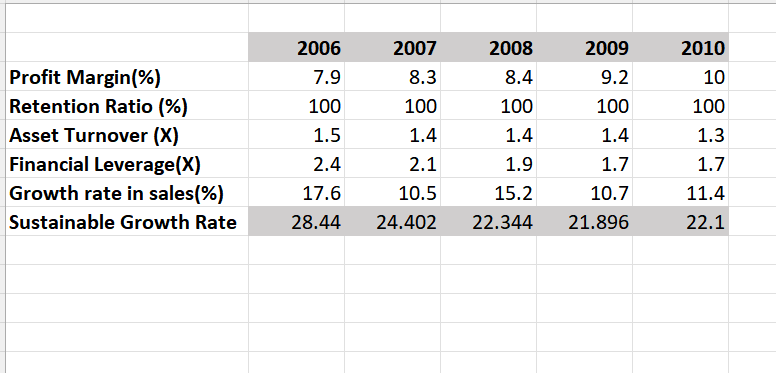

Was Jos Bank a rapid or slow growth firm in this context of this chapter? Further, would this have led to cash depletion or cash

Was Jos Bank a rapid or slow growth firm in this context of this chapter? Further, would this have led to cash depletion or cash buildup for Hos Bank?

Provide a decision related to an operating Ration that would have brought Jos Bank into balanced growth (one that would be acceptable by management)

What could Jos Bank have done with its common stock that would have eliminated this problem?

\begin{tabular}{|l|r|r|r|r|r|} \hline & 2006 & 2007 & 2008 & 2009 & 2010 \\ \hline Profit Margin(\%) & 7.9 & 8.3 & 8.4 & 9.2 & 10 \\ \hline Retention Ratio (\%) & 100 & 100 & 100 & 100 & 100 \\ \hline Asset Turnover (X) & 1.5 & 1.4 & 1.4 & 1.4 & 1.3 \\ \hline Financial Leverage(X) & 2.4 & 2.1 & 1.9 & 1.7 & 1.7 \\ \hline Growth rate in sales(\%) & 17.6 & 10.5 & 15.2 & 10.7 & 11.4 \\ \hline Sustainable Growth Rate & 28.44 & 24.402 & 22.344 & 21.896 & 22.1 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started