Question

Melody lives under an imputation tax system. Her income tax rate is 28%, which applies to all of her income, including wages, interest income

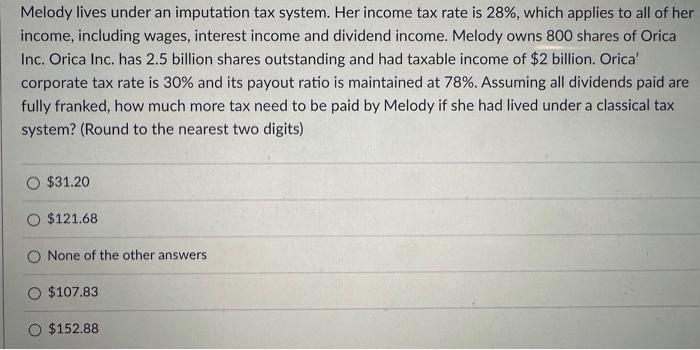

Melody lives under an imputation tax system. Her income tax rate is 28%, which applies to all of her income, including wages, interest income and dividend income. Melody owns 800 shares of Orica Inc. Orica Inc. has 2.5 billion shares outstanding and had taxable income of $2 billion. Orica' corporate tax rate is 30% and its payout ratio is maintained at 78%. Assuming all dividends paid are fully franked, how much more tax need to be paid by Melody if she had lived under a classical tax system? (Round to the nearest two digits) $31.20 $121.68 None of the other answers O $107.83 $152.88

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Under an imputation tax system dividends are taxed at the individuals personal income tax rate but t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Investing

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

12th edition

978-0133075403, 133075354, 9780133423938, 133075400, 013342393X, 978-0133075359

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App