Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Watcher (Pty) Ltd, a company that sells automobile parts, had the following transactions in relation to its assets: Required: 2.1 On 1 February 2020,

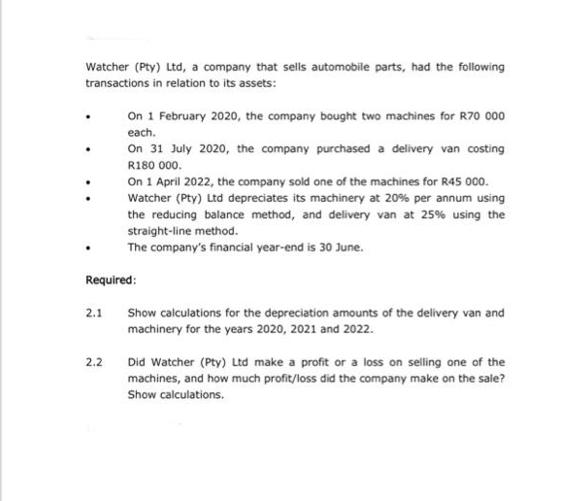

Watcher (Pty) Ltd, a company that sells automobile parts, had the following transactions in relation to its assets: Required: 2.1 On 1 February 2020, the company bought two machines for R70 000 each. On 31 July 2020, the company purchased a delivery van costing R180 000. On 1 April 2022, the company sold one of the machines for R45 000. Watcher (Pty) Ltd depreciates its machinery at 20% per annum using the reducing balance method, and delivery van at 25% using the straight-line method. The company's financial year-end is 30 June. 2.2 Show calculations for the depreciation amounts of the delivery van and machinery for the years 2020, 2021 and 2022. Did Watcher (Pty) Ltd make a profit or a loss on selling one of the machines, and how much profit/loss did the company make on the sale? Show calculations.

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 21 Depreciation calculations For the machinery Year 1 2020 Depreciation 20 x R70 000 x 512 R5 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started