Question

Part 3 Daemon Corporation is preparing a flexible budget and desires to separate its electricity expense which is semi-variable and fluctuates with total machine

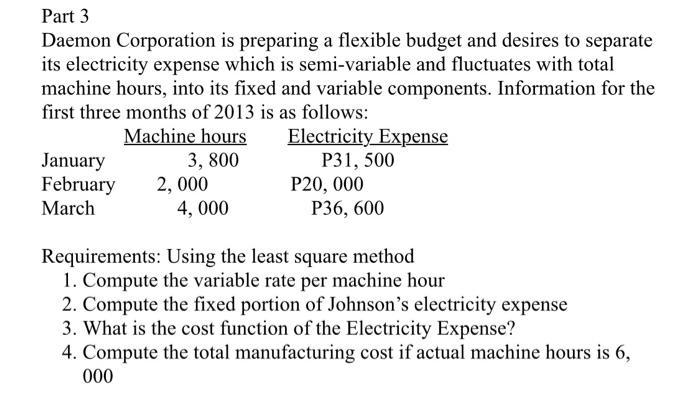

Part 3 Daemon Corporation is preparing a flexible budget and desires to separate its electricity expense which is semi-variable and fluctuates with total machine hours, into its fixed and variable components. Information for the first three months of 2013 is as follows: January February March Machine hours 3, 800 2,000 4,000 Electricity Expense P31, 500 P20, 000 P36, 600 Requirements: Using the least square method 1. Compute the variable rate per machine hour 2. Compute the fixed portion of Johnson's electricity expense 3. What is the cost function of the Electricity Expense? 4. Compute the total manufacturing cost if actual machine hours is 6, 000

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer1 Variable cost per hour Calculation Y a bx Where Y Total Cost a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Cost Accounting

Authors: William Lanen, Shannon Anderson, Michael Maher

3rd Edition

9780078025525, 9780077517359, 77517350, 978-0077398194

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App