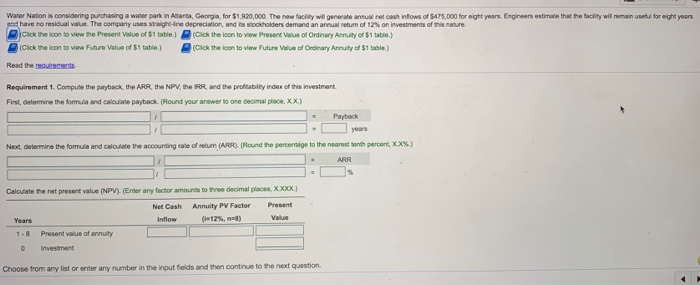

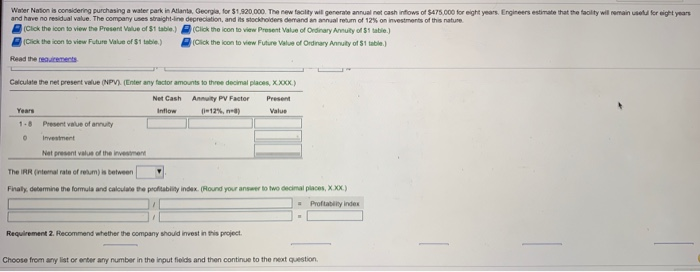

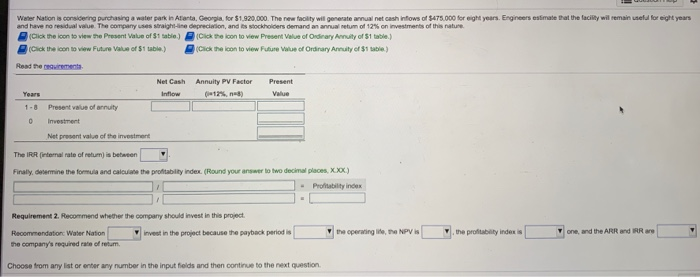

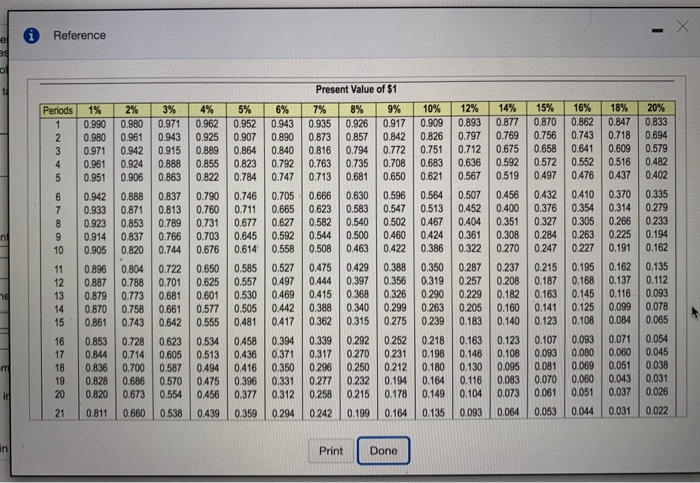

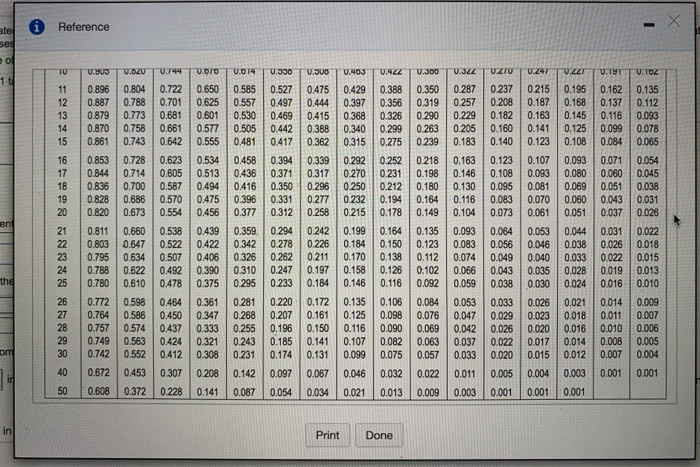

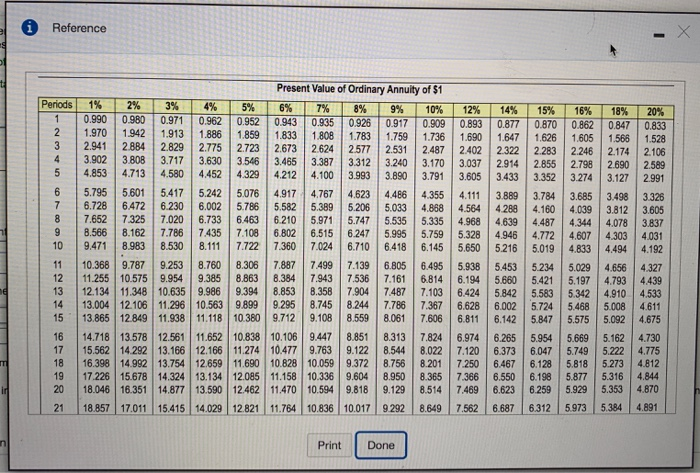

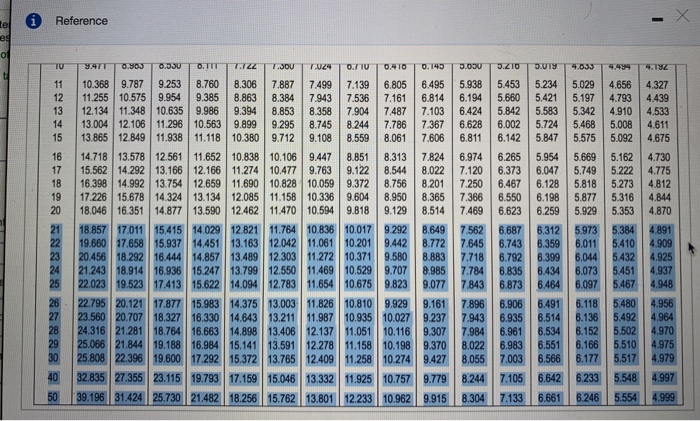

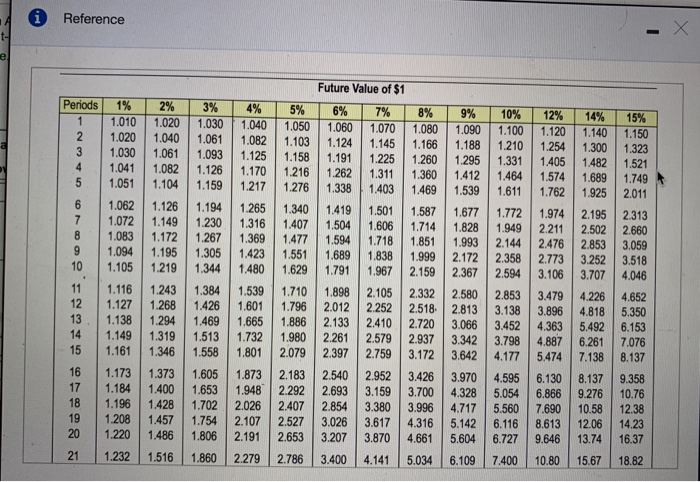

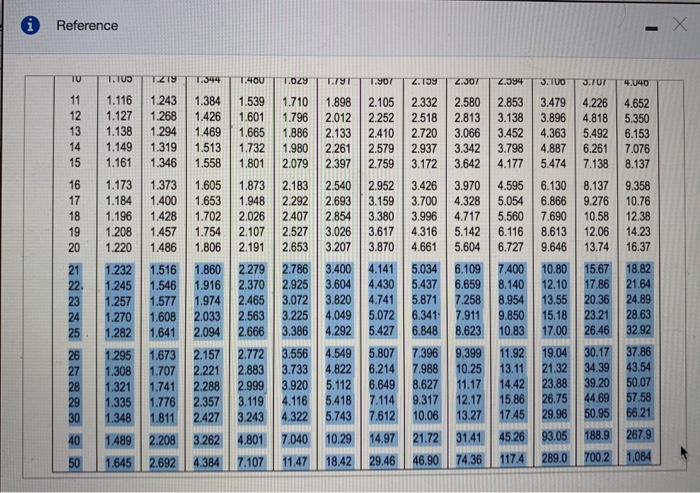

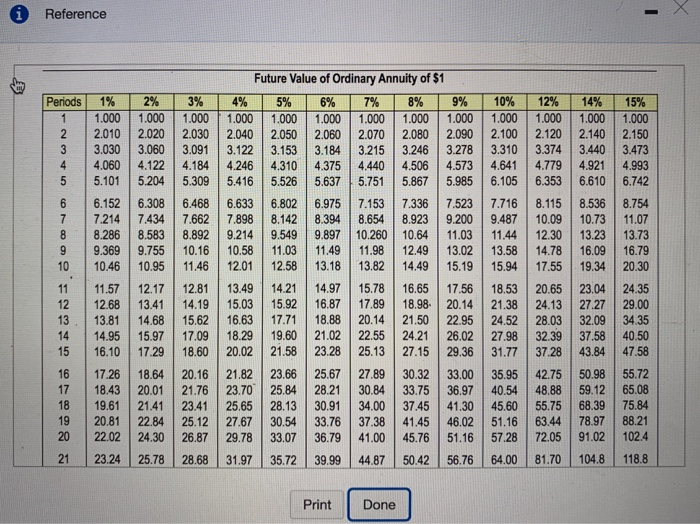

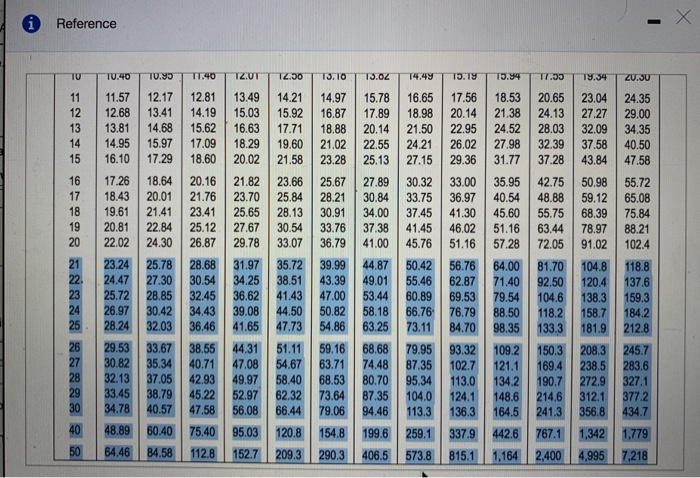

Water Nation is considering purchasing a waterpark in Atlanta, Georgia, for $1.920,000. The now facility will generate annual ret cash infows of $475,000 for eight years, Engineers estimate that the facility will remain useful for eight years pod have to residual value. The company uses straight-line depreciation, and is stockholders demand an annual return of 12% on investments of this nature. Click the loon to view the Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table) (Click the icon to view Future Value of $1 table) (Click the icon to view Future Wwe of Ordinary Annuity of State) Read the requirements Requirement 1. Compute the payback, the ARR, the NPV the IRR and the profitability index of this investment. First, determine the formula and calculate payback. (Round your answer to one decimal place, XX) Payback years Next, determine the formula and calculate the accounting role of reum (ARR) (Round the percentage to the nearestat percent, XX%) ARR Calculate the nel present value (NPV). (Enter any factor amounts to three decimal places, X.XXX.) Net Cash Annuity PV Factor Present Inflow Value Present value of annuity Investment Years Choose from any list or enter any number in the input fields and then continue to the next question Water Nation is considering purchasing a water park in Atlanta, Georgia. for $1.920,000. The new facity will generate annual net cash infows of 5475.000 for eight years, Engineers estimate that the facility will remain set for eight years and have no residual value. The company uses straight-line depreciation, and its stockholders derrand an alreum of 12% on investments of this nature (Click the loon to view the Present Value of $1 table) (Click the icon to view Present Value of Ordinary Annuity of $1 table) Click the icon to view Future Value of $1 table) (Click the icon to view Future Value of Ordinary Aruly of 1 table) Read the requirements Calculate the net present value (NPV) (Inter any factor amounts to three decimal places, xxxx) Net Cash Annuity PV Factor Present Years Intow Value 1.8 Present value of arvuty Investment Not present value of the investment The IRR (internal rate of rebum) is between Finally determine the formula and calculate the profitability index. (Round your answer to two decimal places, XXX) - Profitability index Requirement 2. Recommend whether the company should invest in this project Choose from any list or enter any number in the input fields and then continue to the next question Water Nation is considering purchasing a waterpark in Atlanta, Georgia, for $1.920,000. The new facility will generate annual net cash inflows of $475,000 for eight years. Engineers estimate that the facility will remain useful for eight years and have no residual value. The company uses straight-ine depreciation, and its stockholders demand an annual return of 12% on investments of this nature (Click the icon to view the Present Value of $1 table) Click the icon to view Present Value of Ordinary Annuity of S1 table.) (Click the icon to view Future Value of $1 table) Click the icon to view Future Value of Ordinary Annuity of $1 table) Read the remet Net Cash Annuity PV Factor Present Years Inflow Value 1 - Present value of annuity 0 Investment Net procent value of the investment The IRR (internal rate of retum) is between Finally, determine the formula and calculate the profitability index (Round your answer to two decimal places, XXX) - Profitability index Requirement 2. Recommend whether the company should invest in this project. Recommendation Water Nation invest in the project because the payback periodis the company's required rate of retum the operating in the NPV IS the profitability index is one, and the ARR and are Choose from any list or enter any number in the input fields and then continue to the next question Reference 29 Present Value of $1 Periods 1% 0.990 0.980 0.971 0.961 0.951 3% 0.971 0.943 0.915 0.888 0.863 2% 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 4% 0.962 0.925 0.889 0.855 0.822 5% 0.952 0.907 0.864 0.823 0.784 6% 0.943 0.890 0.840 0.792 0.747 9% 0.917 0.842 0.772 0.708 0.650 12% 0.893 0.797 0.712 0.636 0.567 14% 0.877 0.769 0.675 0.592 0.519 15% 0.870 0.756 0.658 0.572 0.497 16% 0.862 0.743 0.641 0.552 0.476 18% 0.847 0.718 0.609 0.516 0.437 20% 0.833 0.694 0.579 0.482 0.402 6 7 8 9 10 0.837 0.813 0.789 0.766 0.744 0.746 0.711 0.677 0.645 0.614 0.705 0.665 0.627 0.592 0.558 0.596 0.547 0.502 0.460 0.422 7% 8% 0.935 0.926 0.873 0.857 0.816 0.794 0.763 0.735 0.713 0.681 0.666 0.630 0.623 0.583 0.582 0.540 0.544 0.500 0.508 0.463 0.475 0.429 0.444 0.397 0.415 0.368 0.388 0.340 0.362 0.315 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0.853 0.844 0.836 0.828 0.820 11 12 13 14 15 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 0.475 0456 0.439 0.527 0.497 0.469 0.442 0.417 0.388 0.356 0.326 0.299 0.275 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.660 0.722 0.701 0.681 0.661 0.642 0.623 0.605 0.587 0.570 0.554 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0.507 0.456 0.452 0.400 0.404 0.351 0.361 0.308 0.322 0.270 0.287 0.237 0.257 0.208 0.229 0.182 0.205 0.160 0.183 0.140 0.163 0.123 0.146 0.108 0.130 0.095 0.116 0.083 0.104 0.073 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 0.123 0.107 0.093 0.081 0.070 0.061 0.410 0.370 0.354 0.314 0.305 0.266 0.263 0.225 0.227 0.191 0.195 0.162 0.168 0.137 0.145 0.116 0.125 0.099 0.108 0.084 0.093 0.071 0.080 0.060 0.069 0.051 0.060 0.043 0.051 0.037 0.335 0279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 16 17 18 19 20 m 0.394 0.371 0.350 0.331 0.312 0.294 0.339 0.292 0.317 0.270 0.296 0.250 0.277 0.232 0.258 0.215 0.252 0.231 0.212 0.194 0.178 0.164 0.218 0.198 0.180 0.164 0.149 ir 21 0.811 0.538 0.359 0.242 0.199 0.135 0.093 0.064 0.053 0.044 0.031 0.022 in Print Done Reference atel ses O TU UYU V.OZU 0.744 VOTO U.014 3.500 V.500 4.403 1.300 U.SZZ UZTU UZZI U.TV U.TO2 11 11 12 13 14 15 0.896 0.887 0.879 0.870 0.861 0.804 0.788 0.773 0.758 0.743 0.722 0.701 0.681 0.661 0.642 0.585 0.557 0.530 0.505 0.481 0.527 0.497 0.469 0.442 0.417 0.350 0.319 0.290 0.263 0.239 0.287 0.257 0.229 0.205 0.183 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.237 0.208 0.182 0.160 0.140 0.215 0.187 0.163 0.141 0.123 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 0.475 0.456 0.162 0.137 0.116 0.099 0.084 0.475 0.444 0.415 0.388 0.362 0.339 0.317 0.296 0.277 0.258 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.195 0.168 0.145 0.125 0.108 0.093 0.080 0.069 0.060 0.051 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 0.623 16 17 18 19 20 0.853 0.844 0.836 0.828 0.820 0.728 0.714 0.700 0.686 0.673 0.605 0.587 0.570 0.554 0.458 0.436 0.416 0.396 0.377 0.394 0.371 0.350 0.331 0.312 0.218 0.198 0.180 0.164 0.149 0.107 0.093 0.081 0.070 0.061 0.071 0.060 0.051 0.043 0.037 en 0.163 0.146 0.130 0.116 0.104 0.093 0.083 0.074 0.066 0.059 21 22 23 24 25 0.811 0.803 0.795 0.788 0.780 0.660 0.647 0.634 0.622 0.610 0.538 0.522 0.507 0.492 0.478 0.359 0.342 0.326 0.310 0.295 0.242 0.226 0.211 0.197 0.184 0.199 0.184 0.170 0.158 0.146 0.164 0.150 0.138 0.126 0.116 0.135 0.123 0.112 0.102 0.092 0.053 0.046 0.040 0.035 0.030 0.123 0.108 0.095 0.083 0.073 0.064 0.056 0.049 0.043 0.038 0.033 0.029 0.026 0.022 0.020 0.031 0.026 0.022 0.019 0.016 the 0.294 0.278 0.262 0.247 0.233 0.220 0.207 0.196 0.185 0.174 0.044 0.038 0.033 0.028 0.024 0.021 0.018 0.016 0.014 0.012 0.439 0.422 0.406 0.390 0.375 0.361 0.347 0.333 0.321 0.308 0.208 0.01 0.018 0.015 0.013 0.010 0.009 0.007 0.006 0.005 0.004 26 27 28 29 30 0.772 0.764 0.757 0.749 0.742 0.672 0.598 0.586 0.574 0.563 0.552 0.453 0.464 0.450 0.437 0.424 0.412 0.281 0.268 0.255 0.243 0.231 0.172 0.161 0.150 0.141 0.131 0.135 0.125 0.116 0.107 0.099 0.106 0.098 0.090 0.082 0.075 0.032 0.084 0.076 0.069 0.063 0.057 0.053 0.047 0.042 0.037 0.033 0.026 0.023 0.020 0.017 0.015 0.004 0.001 0.014 0.011 0.010 0.008 0.007 0.001 om 40 0.142 0.097 0.067 0.046 0.005 0.003 0.001 0.307 0.228 0.022 0.009 0.011 0.003 50 0.608 0.372 0.141 0.087 0.054 0.034 0.021 0.013 0.001 0.001 in Print Done Reference Periods 1 0.990 N 3 4 5 12% 0.893 1.690 2.402 3.037 3.605 14% 0.877 1.647 2.322 2.914 3.433 Present Value of Ordinary Annuity of $1 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 4.853 4.713 4.580 4.452 4329 4.212 4.100 3.993 3.890 3.791 5.795 5.601 5.417 5.242 5,076 4.917 4.767 4.623 4.486 4.355 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 10.368 | 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 12.134 11.348 10.6359.986 9.394 8.853 8.358 7.904 7.487 7.103 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 15.562 14.292 13.166 12.166 11.274 10.4779.763 9.122 8.544 8.022 16.398 14.992 13.754 12.659 11.690 10.828 10.0599.372 8.756 8.201 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 18.046 16.351 14.877 13.590 12.462 11.470 10.5949.818 9.129 8.514 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9292 8.649 16% 0.862 1.605 2.246 2.798 3.274 3.685 4.039 4.344 4.607 4.833 20% 0.833 1.528 2.106 2.589 2.991 18% 0.847 1.568 2.174 2.690 3.127 3.498 3.812 4.078 4.303 4.494 6 7 8 9 10 15% 0.870 1.626 2.283 2.855 3.352 3.784 4.160 4.487 4.772 5.019 5.234 5.421 5.583 5.724 5.847 4.111 4.564 4.968 5.328 5.650 3.326 3.605 3.837 4,031 4.192 11 12 13 14 15 3.889 4 288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.265 6.373 6.467 6.550 6.623 5.938 6.194 6.424 6.628 6.811 4.327 4.439 4.533 4.611 4.675 5.029 5.197 5.342 5.468 5.575 5.669 5.749 5.818 5.877 5.929 4.656 4.793 4.910 5.008 5.092 5.162 5.222 5.273 5.316 5.353 16 17 18 19 20 6.974 7.120 7.250 7.366 7.469 7.562 5.954 6.047 6.128 6.198 6.259 4.730 4.775 4.812 4.844 4.870 id 21 6.687 6.312 5.973 5.384 4.891 Print Done Reference tel eg 0 3.050 O.ZTO DUTY 4.035 4.TYZ 5.234 5.421 5.583 5.724 5.847 5.029 5.197 5.342 5.468 5.575 4.656 4.793 4.910 5.008 5.092 4.327 4.439 4.533 4.611 4.675 5.954 6.047 6.128 6.198 6.259 5.669 5.749 5.818 5.877 5.929 5.162 5.222 5.273 5.316 5.353 4.730 4.775 4.812 4.844 4.870 TU 9.471 0.963 0.03 0.111 7.722 7.300 7.024 0.7 IU 0.410 0.145 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 13 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 17 15.562 14.292 13.166 12.166 11.274 10.4779.763 9.122 8.544 8.022 18 16.398 14.992 13.754 12.659 11.690 10.828 10.0599.372 8.756 8.201 19 17.226 15.678 14.32413.134 12.085 11.158 10.336 9.604 8.950 8.365 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 21 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 8.649 22 19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.2019.442 8.772 23 20.456 18.292 16.444 14.857 13.489 12.303 11.272 10.371 9.580 8.883 24 21.243 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.707 8.985 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 26 22.795 20.121 17.877 15.983 14.375 13.003 11.826 10.810 9.929 9.161 27 23.560 20.707 18.32716.330 14.643 13.21111.987 10.935 10.027 9.237 28 24.316 21.28118.764 16.663 14.898 13.406 12.137 11.051 10.116 9.307 29 25.066 21.844 19.188 16.984 15.141 13.591 | 12.278 11.158 10.1989.370 30 25.80822.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 40 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 50 39.196 31.42425.730 21.482 18.256 15.762 13.801 12.233 10.962 9.915 5.938 5.453 6.194 5.680 6.424 5.842 6.628 6.002 6.811 6.142 6.974 6.265 7.120 6.373 7.250 6.467 7.366 6.550 7.469 6.623 7.562 6.687 7.645 6.743 7.718 6.792 7.784 6.835 7.843 6.873 7.896 6.906 7.943 6.935 7.984 6.961 8.022 6.983 8.055 7.003 8.244 7.105 8.304 7.133 5.384 4.891 5.410 4.909 5.432 4.925 5.451 4.937 5.467 4.948 6.312 5.973 6.359 6.011 6.399 6.044 6.434 6.073 6.464 6.097 6.491 6.118 6.514 6.136 6.534 6.152 6.551 6.166 6.566 6.177 6.642 6.233 6.661 6.246 5.480 5.492 5.502 5.510 5.517 4.956 4.964 4.970 4.975 4.979 4.997 5.548 5.554 4.999 TA i Reference e. Future Value of $1 Periods 1 14% 1% 1.010 1.020 1.030 1.041 1.051 2% 1.020 1.040 1.061 1.082 1.104 1.126 1.149 1.172 1.195 1.219 3% 1.030 1.061 1.093 1.126 1.159 4% 1.040 1.082 1.125 1.170 1.217 5% 1.050 1.103 1.158 1.216 1.276 7% 1.070 1.145 1.225 1.311 1.403 8% 1.080 1.166 1.260 1.360 1.469 10% 1.100 1.210 1.331 1.464 1.611 12% 1.120 1.254 1.405 1.574 1.762 1.140 1.300 1.482 1.689 1.925 6 15% 1.150 1.323 1.521 1.749 2.011 2.313 2.660 3.059 3.518 4.046 1.501 1.606 8 1.062 1.072 1.083 1.094 1.105 1.265 1.316 1.369 1.423 1.480 6% 1.060 1.124 1.191 1.262 1.338 1.419 1.504 1.594 1.689 1.791 1.898 2.012 2.133 2.261 2.397 1.340 1.407 1.477 1.551 1.629 1.194 1.230 1.267 1.305 1.344 1.384 1.426 1.469 1.513 1.558 1.772 1.949 2.144 2.358 2.594 9% 1.090 1.188 1.295 1.412 1.539 1.677 1.828 1.993 2.172 2.367 2.580 2.813 3.066 3.342 3.642 3.970 4.328 4.717 5.142 5.604 1.974 2.211 2.476 2.773 3.106 10 2.195 2.502 2.853 3.252 3.707 1.587 1.714 1.851 1.999 2.159 2.332 2.518 2.720 2.937 3.172 11 12 13 14 15 1.116 1.127 1.138 1.243 1.268 1.294 1.319 1.346 1.718 1.838 1.967 2.105 2.252 2.410 2.579 2.759 1.539 1.601 1.665 1.732 1.801 1.710 1.796 1.886 1.980 2.079 3.479 3.896 4.363 4.887 5.474 4.226 4.818 5.492 6.261 7.138 4.652 5.350 6.153 7.076 8.137 1.149 1.161 16 17 18 19 20 1.173 1.184 1.196 1.208 1.220 1.373 1.400 1.428 1.457 1.486 1.516 1.605 1.653 1.702 1.754 1.806 1.873 1.948 2.026 2.107 2.191 2.183 2.292 2.407 2.527 2.653 2.540 2.693 2.854 3.026 3.207 2.952 3.159 3.380 3.617 3.870 3.426 3.700 3.996 4.316 4.661 2.853 3.138 3.452 3.798 4.177 4.595 5.054 5.560 6.116 6.727 7.400 6.130 6.866 7.690 8.613 9.646 8.137 9.276 10.58 12.06 13.74 9.358 10.76 12.38 14.23 16.37 18.82 21 1.232 1.860 2.279 2.786 3.400 4.141 5.034 6.109 10.80 15.67 Reference - TU 1.029 1.191 T.907 2.159 Z.JOT 2.594 3. TUO 3.TUT 4.0440 11 12 13 14 15 1.710 1.796 1.886 1.980 2.079 1.898 2.012 2.133 2.261 2.397 2.105 2.252 2.410 2.579 2.759 2332 2.518 2.720 2.937 3.172 2.580 2.813 3.066 3.342 3.642 3.479 3.896 4.363 4.887 5.474 4.226 4.818 5.492 6.261 7.138 4.652 5.350 6.153 7.076 8.137 2.853 3.138 3.452 3.798 4.177 4.595 5.054 5.560 6.116 6.727 16 17 18 19 20 2.183 2.292 2.407 2.527 2.653 2.540 2.693 2.854 3.026 3.207 2.952 3.159 3.380 3.617 3.870 3.426 3.700 3.996 4.316 4.661 3.970 4.328 4.717 5.142 5.604 6.130 6.866 7.690 8.613 9.646 8.137 9.276 10.58 12.06 13.74 9.358 10.76 12.38 14.23 16.37 21 22 23 24 25 1.TU5 1.ZTY 1.344 1:400 1.116 1.243 1.384 1.539 1.127 1.268 1.426 1.601 1.138 1.294 1.469 1.665 1.149 1.319 1.513 1.732 1.161 1.346 1.558 1.801 1.173 1.373 1.605 1.873 1.184 1.400 1.653 1.948 1.196 1.428 1.702 2.026 1.208 1.457 1.754 2.107 1.220 1.486 1.806 2.191 1.232 1.516 1.860 2 279 1.245 1.546 1.916 2.370 1.257 1.577 1.974 2.465 1.270 1.608 2.033 2.563 1.282 1.641 2.094 2.666 1.295 1.673 2.157 2.772 1.308 1.707 2.221 2.883 1.321 1.741 2.288 2.999 1.335 1.776 2.357 3.119 1.348 1.811 2.427 3.243 1.489 2.208 3.262 4.801 1.645 2.692 4.384 7.107 3.400 3.604 3.820 4.049 4.292 4.141 4.430 4.741 5.072 5.427 5.034 5.437 5.871 6.341 6.848 7.400 8.140 8.954 9.850 10.83 18.82 21.64 24.89 28.63 32.92 2.786 2.925 3.072 3.225 3.386 3.556 3.733 3.920 4.116 4.322 6.109 6.659 7.258 7.911 8.623 9.399 10.25 11.17 12.17 13.27 10.80 15.67 12.10 17.86 13.55 20.36 15.18 23.21 17.00 26.46 19.04 30.17 21.32 34.39 23.88 39.20 26.75 44.69 29.96 50.95 26 27 28 29 30 4.549 4.822 5.112 5.418 5.743 5.807 6.214 6.649 7.114 7.612 14.97 7.396 7.988 8.627 9.317 10.06 11.92 13.11 14.42 15.86 17.45 37.86 43.54 50.07 57 58 66.21 40 7.040 10.29 21.72 31.41 45 26 93.05 188.9 267.9 1,084 50 11.47 18.42 29.46 46.90 74.36 117.4 700.2 289.0 Reference Vu Periods 1 2 1% 1.000 2.010 3.030 4.060 5.101 2% 1.000 2.020 3.060 4.122 5.204 3% 1.000 2.030 3.091 4.184 5.309 10% 1.000 2.100 3.310 4.641 6.105 12% 1.000 2.120 3.374 4.779 6.353 14% 1.000 2.140 3.440 4.921 6.610 15% 1.000 2.150 3.473 4.993 6.742 w 4 5 6 7 8 9 10 6.152 7.214 8.286 9.369 10.46 6.308 7.434 8.583 9.755 10.95 6.468 7.662 8.892 10.16 11.46 Future Value of Ordinary Annuity of $1 4% 5% 6% 7% 8% 9% 1.000 1.000 1.000 1.000 1.000 1.000 2.040 2.050 2.060 2.070 2.080 2.090 3.122 3.153 3.184 3.215 3.246 3.278 4.246 4.310 4.375 4.440 4.506 4.573 5.416 5.526 5.637 5.751 5.867 5.985 6.633 6.802 6.975 7.153 7.336 7.523 7.898 8.142 8.394 8.654 8.923 9.200 9.214 9.549 9.897 10.260 10.64 11.03 10.58 11.03 11.49 11.98 12.49 13.02 12.01 12.58 13.18 13.82 14.49 15.19 13.49 14.21 14.97 15.78 16.65 17.56 15.03 15.92 16.87 17.89 18.98 20.14 16.63 17.71 18.88 20.14 21.50 22.95 18.29 19.60 21.02 22.55 24.21 26.02 20.02 21.58 23.28 25.13 27.15 29.36 21.82 23.66 25.67 27.89 30.32 33.00 23.70 25.84 28.21 30.84 33.75 36.97 25.65 28.13 30.91 34.00 37.45 41.30 27.67 30.54 33.76 37.38 41.45 46.02 29.78 33.07 36.79 41.00 45.76 51.16 7.716 9.487 11.44 13.58 15.94 8.115 10.09 12.30 14.78 17.55 8.536 10.73 13.23 16.09 19.34 8.754 11.07 13.73 16.79 20.30 11 12 13 14 15 11.57 12.68 13.81 14.95 16.10 12.17 13.41 14.68 15.97 17.29 18.53 21.38 24.52 27.98 31.77 20.65 24.13 28.03 32.39 37.28 23.04 27.27 32.09 37.58 43.84 24.35 29.00 34 35 40.50 47.58 12.81 14.19 15.62 17.09 18.60 20.16 21.76 23.41 25.12 26.87 16 17 18 19 20 17.26 18.43 19.61 20.81 22.02 18.64 20.01 21.41 22.84 24.30 35.95 40.54 45.60 51.16 57.28 42.75 48.88 55.75 63.44 72.05 50.98 59.12 68.39 78.97 91.02 55.72 65.08 75.84 88.21 102.4 21 23 24 25.78 28.68 31.97 35.72 39.99 44.87 50.42 56.76 64.00 81.70 104.8 118.8 Print Done Reference TU 10.40 TU.95 11.40 TZ.UT 12.50 13.10 TS.OZ 14.49 T5.TY 13.94 T7.53 19.54 20.30 11 12 13 14 15 11.57 12.68 13.81 14.95 16.10 12.17 13.41 14.68 15.97 17.29 12.81 14.19 15.62 17.09 18.60 13.49 15.03 16.63 18.29 20.02 14.21 15.92 17.71 19.60 21.58 15.78 17.89 20.14 22.55 25.13 17.56 20.14 22.95 26.02 29.36 18.53 21.38 24.52 27.98 31.77 20.65 24.13 28.03 32.39 37.28 23.04 27.27 32.09 37.58 43.84 24.35 29.00 34.35 40.50 47.58 14.97 16.87 18.88 21.02 23.28 25.67 28.21 30.91 33.76 36.79 16 17 18 19 20 17.26 18.43 19.61 20.81 22.02 18.64 20.01 21.41 22.84 24.30 20.16 21.76 23.41 25.12 26.87 21.82 23.70 25.65 27.67 29.78 23.66 25.84 28.13 30.54 33.07 27.89 30.84 34.00 37 38 41.00 16.65 18.98 21.50 24.21 27.15 30.32 33.75 37.45 41.45 45.76 50.42 55.46 60.89 66.76 73.11 33.00 36.97 41.30 46.02 51.16 21 22 23 24 25 23.24 24.47 25.72 26.97 28.24 25.78 27.30 28.85 30.42 32.03 28.68 30.54 32.45 34.43 36.46 31.97 34.25 36.62 39.08 41.65 35.72 38.51 41.43 44.50 47.73 39.99 43.39 47.00 50.82 54.86 44.87 49.01 53.44 58.18 63.25 56.76 62.87 69.53 76.79 84.70 35.95 42.75 50.98 55.72 40.54 48.88 59.12 65.08 45.60 55.75 68.39 75.84 51.16 63.44 78.97 88.21 57.28 72.05 91.02 102.4 64.00 81.70 104.8 118.8 71.40 92.50 120.4 137.6 79,54 104.6 138.3 159.3 88.50 1182 158.7 184.2 98.35 133.3 181.9 212.8 109.2 150.3 208.3 245.7 121.1 169.4 238.5 283.6 134.2 190.7 272.9 327.1 148.6 214,6 312.1 377.2 164.5 241.3 356.8 434.7 442.6 767.1 1,342 1,779 1,164 2.400 4,995 7.218 26 27 28 29 30 29.53 33.67 30.82 35.34 32.13 37.05 33.45 38.79 34.78 40.57 38.55 40.71 42.93 45.22 47.58 75.40 44.31 47.08 49.97 52.97 56.08 51.11 54.67 58.40 62.32 66.44 59.16 63.71 68.53 73.64 79.06 68.68 74.48 80.70 87.35 94.46 79.95 87.35 95.34 104.0 113.3 93.32 102.7 113.0 124.1 136.3 40 48.89 60.40 95.03 120.8 154.8 199.6 259.1 337.9 815.1 50 64.46 84.58 112.8 152.7 209.3 290.3 406.5 573.8