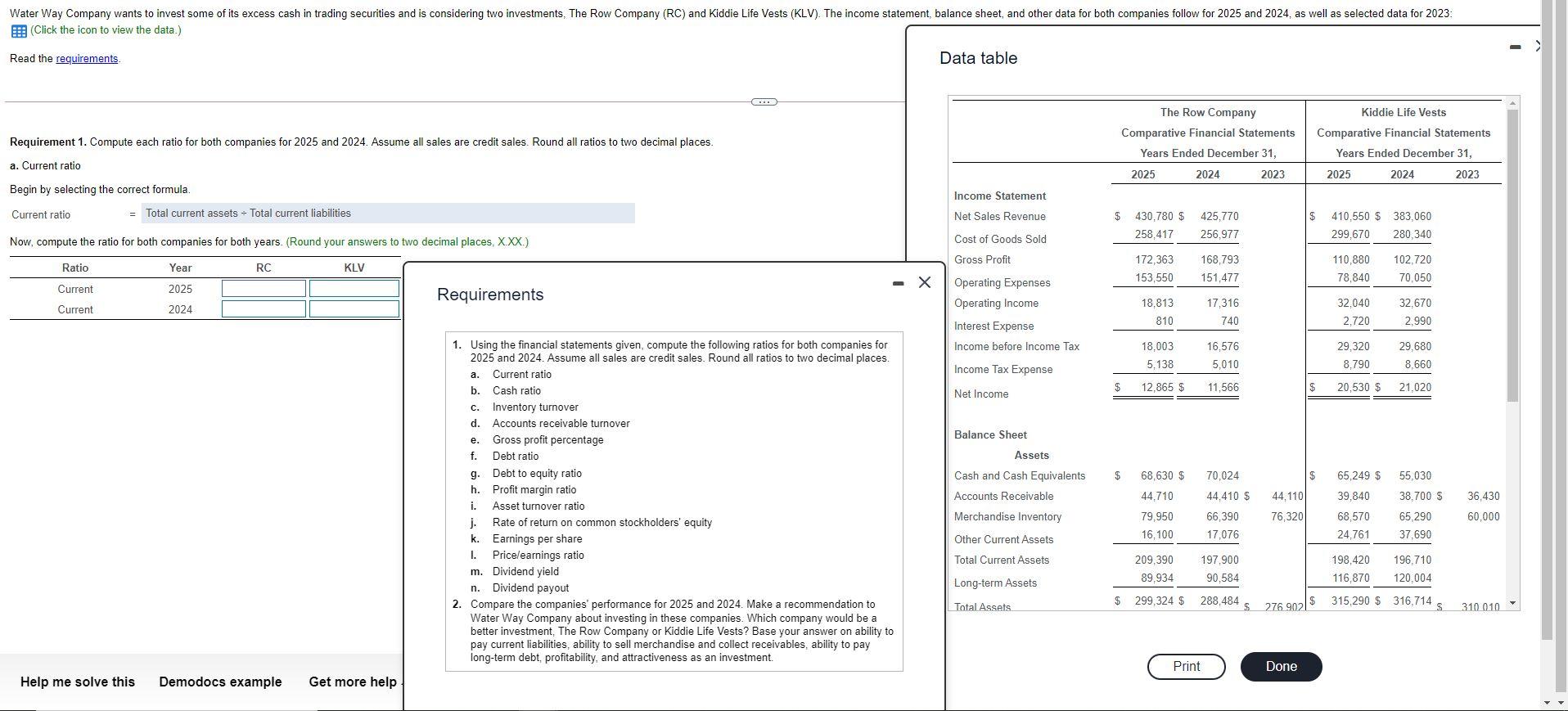

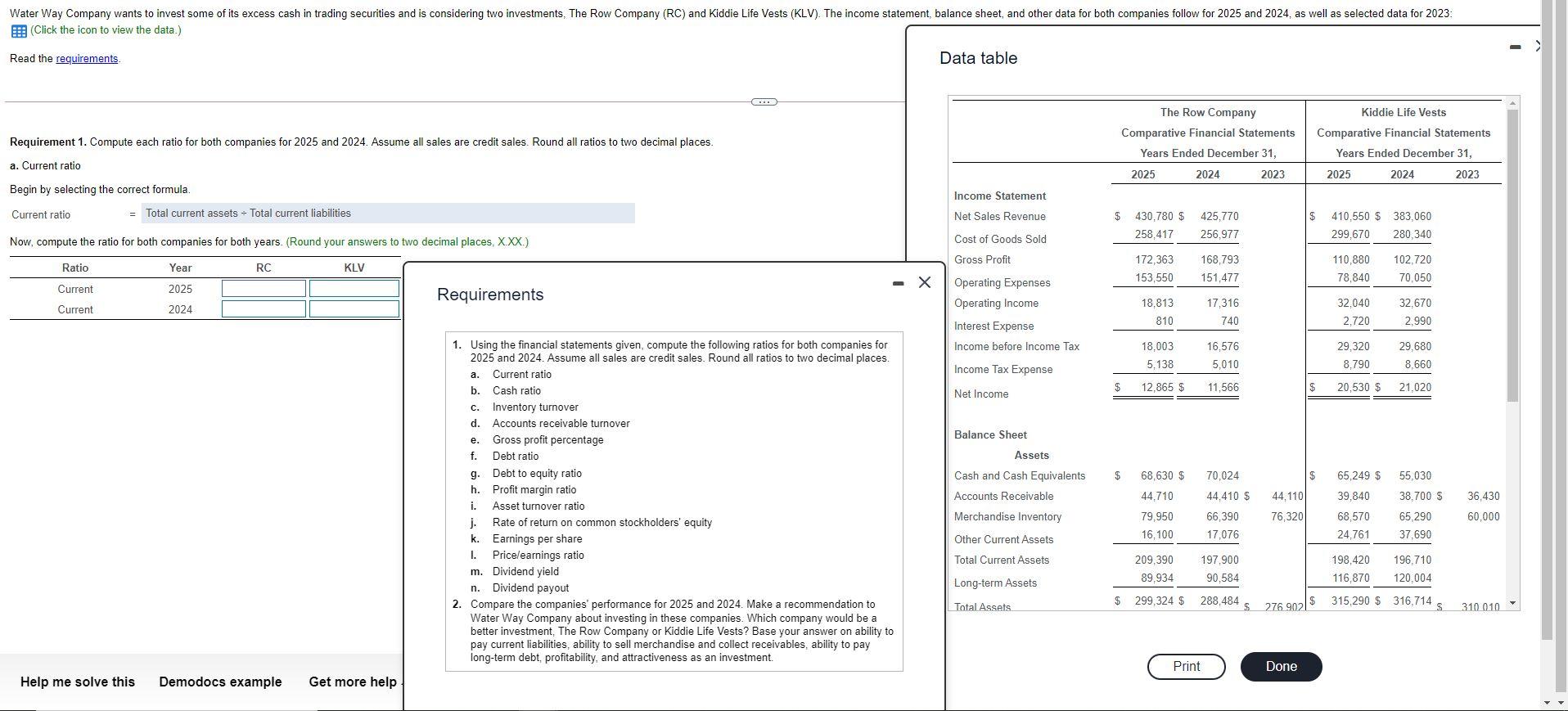

Water Way Company wants to invest some of its excess cash in trading securities and is considering two investments, The Row Company (RC) and Kiddie Life Vests (KLV). The income statement, balance sheet, and other data for both companies follow for 2025 and 2024, as well as selected data for 2023: (Click the icon to view the data.) Read the requirements Data table Kiddie Life Vests The Row Company Comparative Financial Statements Years Ended December 31, Requirement 1. Compute each ratio for both companies for 2025 and 2024. Assume all sales are credit sales. Round all ratios to two decimal places. Comparative Financial Statements Years Ended December 31, 2025 2024 2023 a. Current ratio 2025 2024 2023 Begin by selecting the correct formula. Income Statement Current ratio = Total current assets - Total current liabilities $ $ Net Sales Revenue Cost of Goods Sold 430,780 $ 258,417 425,770 256.977 410,550 $ 299,670 383,060 280,340 Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) Gross Profit Ratio Year RC KLV 172,363 153,550 168.793 151,477 110,880 78,840 102.720 70.050 - X Current 2025 Requirements 32,670 Current 2024 Operating Expenses Operating Income Interest Expense Income before Income Tax 18,813 810 17,316 740 32,040 2,720 2.990 18.003 5,138 16,576 5,010 29,320 8,790 29,680 8.660 Income Tax Expense $ 12,865 $ 11,566 $ 20,530 $ 21.020 Net Income Balance Sheet Assets Cash and Cash Equivalents Accounts Receivable Merchandise Inventory $ 70.024 68,630 $ 44.710 65,249 $ 39,840 44,410 $ 44.110 1. Using the financial statements given, compute the following ratios for both companies for 2025 and 2024. Assume all sales are credit sales. Round all ratios to two decimal places. a. Current ratio b. Cash ratio C. Inventory turnover d. Accounts receivable turnover e. Gross profit percentage f. Debt ratio g. Debt to equity ratio h. Profit margin ratio i. Asset turnover ratio j. Rate of return on common stockholders' equity k. Earnings per share 1. Price/earnings ratio m. Dividend yield n. Dividend payout 2. Compare the companies' performance for 2025 and 2024. Make a recommendation to Water Way Company about investing in these companies. Which company would be a better investment, The Row Company or Kiddie Life Vests? Base your answer on ability to pay current liabilities, ability to sell merchandise and collect receivables, ability to pay long-term debt, profitability, and attractiveness as an investment. 36,430 55,030 38,700 $ 65.290 37,690 76.320 60,000 79,950 16,100 66,390 17,076 68,570 24,761 Other Current Assets Total Current Assets Long-term Assets 209,390 89.934 197.900 90,584 198,420 116,870 196,710 120,004 $ Total Assets 299,324 $ 288,484 276.90218 315,290 $ 316,714 310 010 Print Done Help me solve this Demodocs example Get more help Water Way Company wants to invest some of its excess cash in trading securities and is considering two investments, The Row Company (RC) and Kiddie Life Vests (KLV). The income statement, balance sheet, and other data for both companies follow for 2025 and 2024, as well as selected data for 2023: (Click the icon to view the data.) Read the requirements Data table Kiddie Life Vests The Row Company Comparative Financial Statements Years Ended December 31, Requirement 1. Compute each ratio for both companies for 2025 and 2024. Assume all sales are credit sales. Round all ratios to two decimal places. Comparative Financial Statements Years Ended December 31, 2025 2024 2023 a. Current ratio 2025 2024 2023 Begin by selecting the correct formula. Income Statement Current ratio = Total current assets - Total current liabilities $ $ Net Sales Revenue Cost of Goods Sold 430,780 $ 258,417 425,770 256.977 410,550 $ 299,670 383,060 280,340 Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) Gross Profit Ratio Year RC KLV 172,363 153,550 168.793 151,477 110,880 78,840 102.720 70.050 - X Current 2025 Requirements 32,670 Current 2024 Operating Expenses Operating Income Interest Expense Income before Income Tax 18,813 810 17,316 740 32,040 2,720 2.990 18.003 5,138 16,576 5,010 29,320 8,790 29,680 8.660 Income Tax Expense $ 12,865 $ 11,566 $ 20,530 $ 21.020 Net Income Balance Sheet Assets Cash and Cash Equivalents Accounts Receivable Merchandise Inventory $ 70.024 68,630 $ 44.710 65,249 $ 39,840 44,410 $ 44.110 1. Using the financial statements given, compute the following ratios for both companies for 2025 and 2024. Assume all sales are credit sales. Round all ratios to two decimal places. a. Current ratio b. Cash ratio C. Inventory turnover d. Accounts receivable turnover e. Gross profit percentage f. Debt ratio g. Debt to equity ratio h. Profit margin ratio i. Asset turnover ratio j. Rate of return on common stockholders' equity k. Earnings per share 1. Price/earnings ratio m. Dividend yield n. Dividend payout 2. Compare the companies' performance for 2025 and 2024. Make a recommendation to Water Way Company about investing in these companies. Which company would be a better investment, The Row Company or Kiddie Life Vests? Base your answer on ability to pay current liabilities, ability to sell merchandise and collect receivables, ability to pay long-term debt, profitability, and attractiveness as an investment. 36,430 55,030 38,700 $ 65.290 37,690 76.320 60,000 79,950 16,100 66,390 17,076 68,570 24,761 Other Current Assets Total Current Assets Long-term Assets 209,390 89.934 197.900 90,584 198,420 116,870 196,710 120,004 $ Total Assets 299,324 $ 288,484 276.90218 315,290 $ 316,714 310 010 Print Done Help me solve this Demodocs example Get more help