Answered step by step

Verified Expert Solution

Question

1 Approved Answer

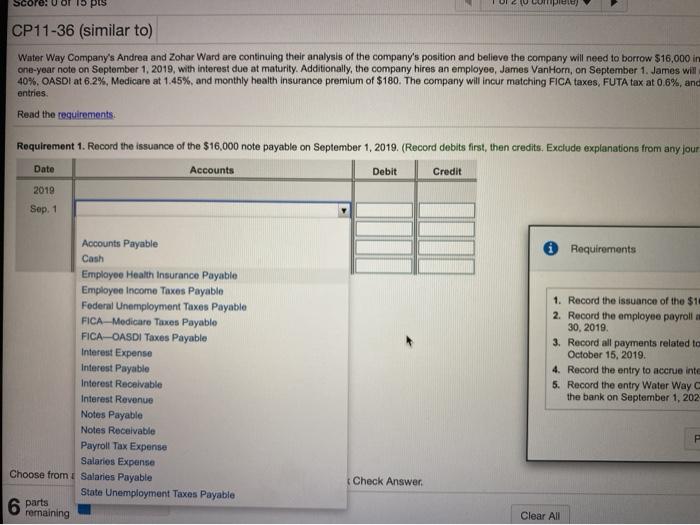

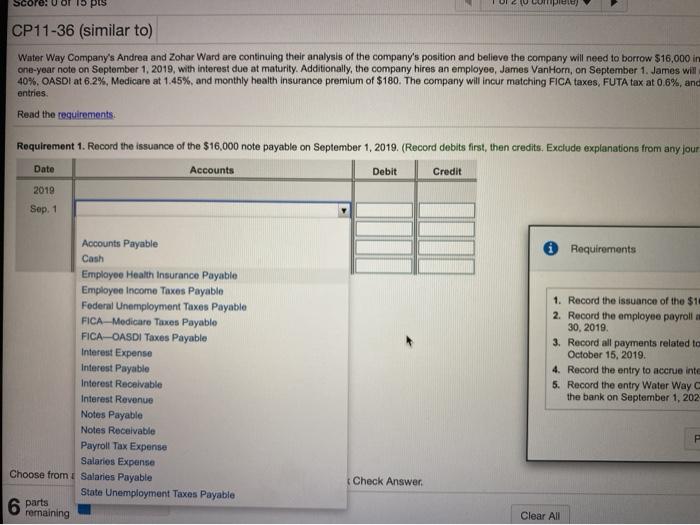

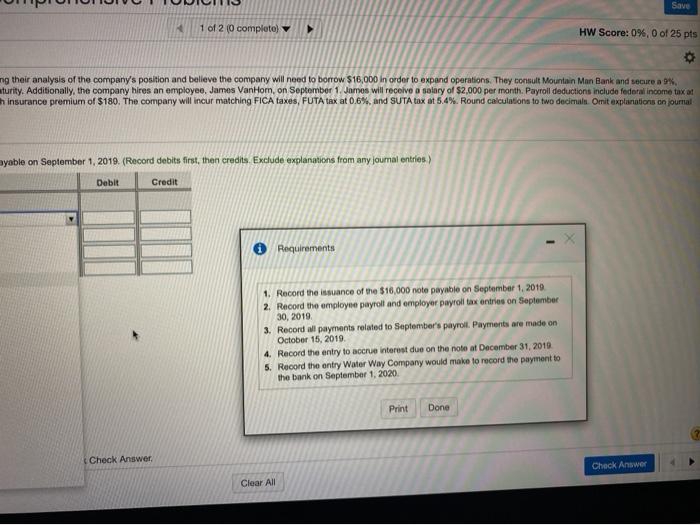

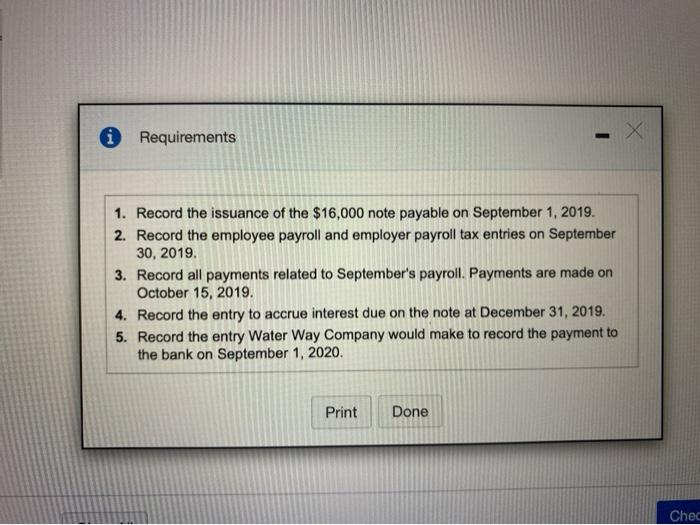

Water way Company's Andrea and Zohar Ward are continuing their analysis of the companys position and believe the company will need to borrow $16,000 in

Water way Company's Andrea and Zohar Ward are continuing their analysis of the companys position and believe the company will need to borrow $16,000 in order to expand operations. they consult mountain man bank and secure a 9% one-year note on September 1, 2019 with interest due at maturity. additionally the company hires employee employee James Vanhorn on september 1. James will receive a salary of $2000 per month payroll deductions include federal income tax at 40%. OSADI at 6.2% Medicare at 1.45% and monthly health insurance premium of $180 the company will incur matching FICA taxes, FUTA tax at 0.6%, and SUTA tax at 5.4%. round calculations to to decimals. omit explanations on journal entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started