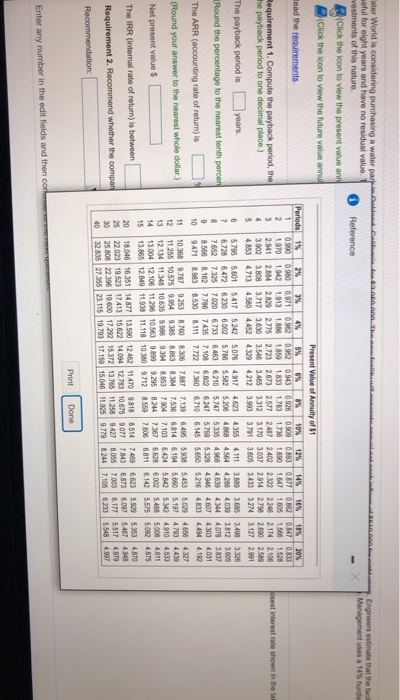

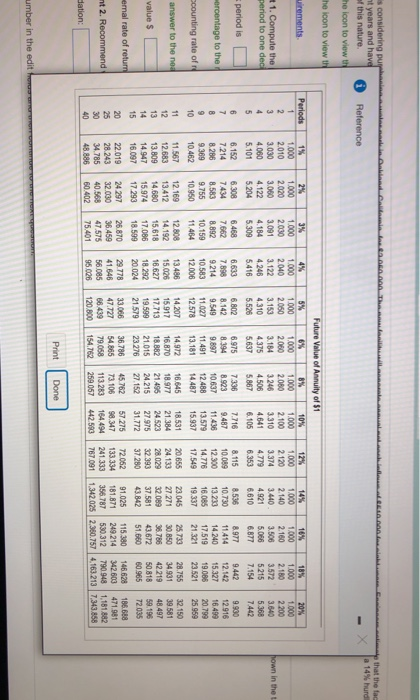

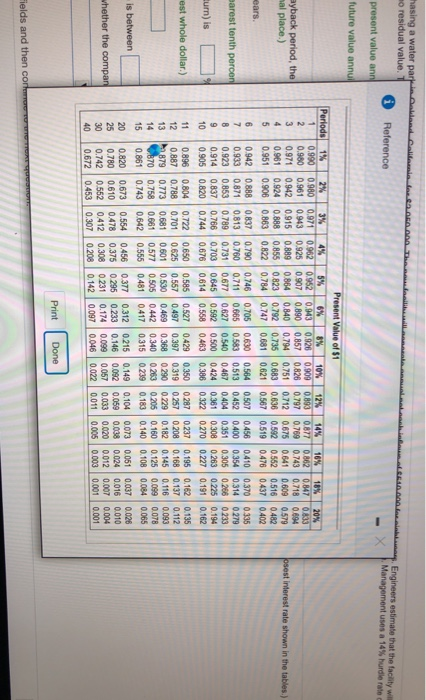

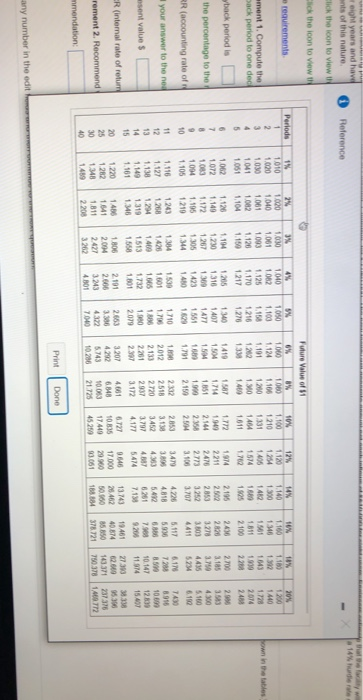

Water World is considering purchasing a waterpark in Oakland, California, for $2,060,000. The new facility will generate annual net cash infows of $10,000 for eight years, Engineers estimate that the facility will remain useful for eight years and have no residual value. The company uses straight line depreciation its owners want payback in less than five years and an AR of 12 or more Management ses a 14% hurdle rate on Investments of this nature Click the icon to view the present value annuity table) Click the icon to view the present valuable Click the icon to view the future value annuity table) (Click the loon to view the future value table) Read the requirements Requirement 1. Compute the payback period, the ARR, the NPV, and the approximate IRR of this investment. If you who the tables to compute the IRR, arower with the domest interest rate shown in the tables.) Round the payback period to one decimal place) The payback periodis years (Round the percentage to the nearest tenth percent) The ARR (accounting rate of retum) is (Round your answer to the nearest whole dollar) Net present values The IRR (internal rate of retum) is between Requirement 2. Recommend whether the company should invest in this project Recommendation Enter any number in the edit fields and then continue to the next question Engineers estimate that the face Management uses a 14% hurdie psest interest rate shown in the tal Water World is considering purchasing a water parjual............ seful for eight years and have no residual value vestments of this nature. Reference (Click the icon to view the present value and (Click the icon to view the future value annu Present Value of Annuity of 1 tead the requirements Periods 1% 2% 3% 5% 6% 10% 12% 14% 10% 18% 20% 1 0.990 0.980 0.97109120952694309260.809 0.890 0.877 0.362 087 0833 2 1.970 1.942 1.913 1886 1859 1833 Requirement 1. Compute the payback period, the 1.783 1736 1.8901.647 1.605 1.566 1.528 3 the payback period to one decimal place) 2.9412.8842820 2.775 2.723 2673 2577 2487 2.4022.322 2246 2174 2.106 4 39023808 3.717 3.630 3.5463465 3.312 3.170 3.037 2.914 2.798 2.690 2589 5 48594.713 4.580 4.452 4.329 4.2123.900 3.791 3.605343332143.127 2.991 The payback period is years 6 5.796 5.601 5.417 5242 5.076 4917 4623 4355 4.111 3.8893.685 3.499 3.326 7 (Round the percentage to the nearest tenth percent 6.728 64726230 6.0025.786 5582 5201 4868 4.564 4.288 4.099 3.812 3.505 8 7.65273257.000 6.73364606210 5.7475335 4.968 4.63943444.0783.837 9 8.5668.1627.786 74357.1086 802627 5.759 53284.90 4 607 4.3034091 The ARR (accounting rate of return) is 10 94718.983 8.530 7.722 7360 6.710 6.145 5.6505.216 4.833 4494 4.192 (Round your answer to the nearest whole dollar.) 11 10.368 9.787 9.2538.760 8.3067.887 7.139 6495 5.9385.453 5.029 46564327 12 11 255 10.575 9.954 9.38588838.3847536 6.814 6.1945.660 5.197 4.790 4430 13 12 134 11 348 10.635 9.9969.39 8.853 7.9047.100 6.42458425.3424.910 4533 Net present values 14 13.004 12.106 11.296 10.5639.89 9.295 82447367 6.0025.4585.008 4611 15 13.865 12 849 11.08 11.118 10:380 9.712 8.55976056811 6.142 5.575 5.092 4675 The IRR (internal rate of return) is between 20 18.046 16.351 14877 18.500 12.462 11470 9.818 8.514 7480 6 623 5.9295353 4.870 Requirement 2. Recommend whether the compan 22023 19.52317413 15 622 14.094 12783 10.675 9.077 7.843 6.873 6.097 5.467 4.968 30 25.80822.396 19.600 17 252 15.872 13.705 11.250 9.427 8.056 7.000 6.177 5.517 4.879 40 32.835 27.356 23.115 19.793 17.150 15.046 11.925 9.779 8.244 7.105 6233 5.548 4.997 Recommendation: Print Done Enter any number in the edit fields and then core Anal.000 Thailand is considering pure htyears and have of this nature the icon to view the that the fac a 14% hurd Reference the icon to view the uirements Periods 10% 2 12% 1.000 2.120 3.374 4.779 6.353 t 1. Compute the period to one dec hown in the t 4 5 period is orcentage to the 6 7 8 $ counting rate of 1% 1.000 2.010 3.030 4.060 5.101 6.152 7.214 8.286 9389 10.462 11.567 12.683 13.08 14.947 16.097 22.019 28.243 34.785 48.886 2% 1.000 2.020 3.050 4.122 5.204 6.308 7434 8.583 9.755 10.950 12.169 13.412 14.680 15.974 17 293 24 297 32.030 40.568 60.402 10 3% 1.000 2.030 3.091 4.184 5.309 6.468 7.662 8.892 10.159 11.464 12.808 14.192 15.618 17.086 18.599 26.870 36.459 47 575 75.401 Future Value of Annuity of $1 5% 6% 8% 1.000 1000 1.000 1.000 2.050 2.060 2.080 2.100 3.153 3.184 3.246 3.310 4.310 4.375 4.506 4.641 5.526 5.637 5.867 6.105 6.802 6.975 7.336 7.716 8.142 8.394 8.923 9.487 9.549 9.897 10 637 11.436 11.027 11.491 12.488 13.579 12.578 13.181 14487 15.937 14.207 14.972 16.545 18.531 15.917 16.870 18.977 21384 17.713 18.882 21.495 24 523 19.599 21.015 24 215 27.975 21 579 23 276 27.152 31.772 33 066 36.786 45.762 57 275 47.727 54.865 73.106 98.347 68.439 79.058 113.283 164 494 120.800 154.762 259.057 442.590 4% 1.000 2.040 3.122 4.248 5.416 6.633 7.898 9.214 10.583 12.006 13.486 15.026 16.627 18.292 20.024 29.778 41 646 56.085 95 026 14% 16% 18% 20% 1.000 1.000 1.000 1.000 2.140 2.160 2.180 2.200 3.440 3.500 3.572 3.640 4.921 5.066 5215 5.368 6.610 6.877 7.154 7.442 8536 8.977 9.442 9.900 10.730 11414 12.142 12916 13.233 14.240 15.327 16.499 16.085 17.519 19.085 20.799 19.337 21.321 23.521 25959 23.045 25.738 28.755 32.150 27.271 30.850 34931 39 581 32089 38.786 42219 48.497 37.581 43.672 50 818 59.196 43.842 51.660 80.965 72035 91.025 115.380 146 628 186688 181.871 249.214 342603 471.981 356787 530.312 790.948 1.181.882 1,342025 2.360.757 4.163.2137.343.858 answer to the noa 8.115 10.089 12 300 14.778 17.549 20.655 24.133 28 029 32393 37.280 72.062 133 334 241 333 767.091 11 12 13 14 15 value $ emal rate of return mt 2. Recommend 20 26 30 40 dation: Print Done umber in the edit hasing a water par mo residual value. RELA .. Reference Engineers estimate that the facility w Management uses a 14% hurdle rate present value anni future value annul 10% ayback period, the mal place) Periods 1 2 3 4 osest interest rate shown in the tables.) ears arest tenth percen 6 7 8 9 10 Burn) is Present Value of $1 1% 2% 3% 4% 5% 6% 8% 10% 12% 0.990 0.9800.971 14% 18% 0.962 20% 0.9520,943 0.9260.909 0.8930.877 0.862 0.980 0.961 0.847 0.833 0.943 0.925 0.907 0.890 0.8570.826 0.797 0.769 0.743 0.971 0.942 0.915 0.889 0.7180.004 0.864 0.840 0.794 0.751 0.712 0.675 0.641 0.609 0.579 0.961 0.924 0.888 0.855 0.8230.792 0.735 0.683 0.636 0.592 0.562 0.516 0.482 0.951 0.906 0.863 0.822 0.784 0.747 0.681 0.621 0.567 0.519 0.4760437 0.402 0.942 0.888 0.837 0.790 0.746 0.705 0.630 0.564 0.507 0.456 0.410 0.370 0.335 0.933 0.871 0.813 0.760 0.711 0.665 0.583 0.513 0.452 0.400 0.3540.314 0279 0.923 0.853 0.789 0.731 0.677 0.627 0.540 0.467 0.404 0.351 0.305 0.266 0233 0.914 0.837 0.766 0.703 0.645 0.592 0.500 0.424 0.361 0.308 0.263 0.225 0.194 0.905 0.820 0.744 0.676 0.614 0.558 0463 0.386 0.322 0.270 0.227 0.191 0.162 0.896 0.804 0.722 0.650 0.585 0.527 0.429 0.350 0287 0.237 0.195 0.162 0.135 0.887 0.788 0.701 0.625 0.557 0.497 0.397 0.319 0257 0.208 0.168 0.137 0.112 879 0.773 0.681 0.601 0.530 0.469 0.368 0.290 0.229 0.1820.145 0.116 0.093 B70 0.758 0.661 0.577 0.505 0.442 0.340 0.263 0.205 0.160 0.125 0.099 0.078 0.861 0.743 0.642 0.556 0.481 0.417 0.315 0.2390.183 0.140 0.108 0.084 0.065 0.820 0.673 0.456 0.377 0.3120.215 0.149 0.1040.073 0.051 0.037 0.026 0.780 0.610 0.478 0.375 0.295 0.233 0.146 0.092 0.059 0.038 0.024 0.016 0.010 0.742 0.552 0.412 0.308 0231 0.174 0.099 0.057 0.033 0.0200012 0.007 0.004 0.672 0.453 0.307 0.208 0.142 0.097 0.046 0.022 0.011 0.005 0.003 0.001 0.001 est whole dollar.) 11 12 13 14 15 is between 0554 whether the compan 20 25 30 40 Print Done Fields and then correre eight years and have nts of this nature Click the icon to view it Reference Click the icon to view it Future Value of 1 requirements Periods 3% 12% 5% 1050 1100 14% 1.140 1030 2 3 ament 1. Compute the back period to one des 4% 1040 1 OR 1.125 1.170 1.217 own in the tables 2% 1020 1040 1.061 1.002 1.104 1.126 8% 1080 1.100 1.200 100 1460 5 1% 1010 1.020 1.030 1041 1051 1062 1072 1083 1004 1.105 1.116 1.127 6% 1000 1.124 1.191 1202 13 1419 1504 1504 160 1791 back period is 1061 1093 1.126 1.150 1.194 1.230 1267 1.300 1.344 10% 1.100 1346 1961 1811 2100 2436 2.820 1.216 1.276 1340 1407 1477 1551 1020 6 7 8 9 10 1205 1316 the percentage to the 1412 16 1.525 2.195 2502 2850 322 3.707 10% 1.100 1210 1331 1464 1611 1772 1949 2.544 2.950 2.54 2850 3.18 3452 3.797 4177 1574 1709 1914 2211 2470 277 3.100 3.470 30 41 1423 3.803 RR (accounting rate of 18% 20% 1.100 1200 1992 1440 1643 1919 2014 22 2.45 2700 2.99 3101 3.750 4.300 4495 5234 610 7430 7201 8996 10690 10.147 12.01 1154 15400 27300 8338 62.609 95300 13371 237370 750378 1402 140 1.710 your answer to the ne 11 12 13 14 15 1587 1714 1851 1990 2.150 2332 2518 2720 2937 3.172 4.601 6.648 10063 21725 1.172 1.195 1.210 120 1.268 1.294 1319 1.346 1400 1641 1811 2208 1.00 2012 2.13 2.261 sent values 1149 1530 1601 1666 1.732 1.801 2191 2.600 3.243 4801 1426 1400 1513 1.550 1806 2014 2424 3202 5474 4.818 5.42 6261 7.1 13.745 16 1.90 2079 2.653 3.86 5.117 8930 6. 790 20 19.461 40814 85.00 378 721 R (internal rate of retum 10835 3.201 4292 5.743 1.220 12R2 1348 1480 20 25 30 40 9646 17 000 20.00 3051 SO remont 2. Recommend 45200 7040 mmendation Print Done any number in the edit