Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Waterkraft rents canoes and other water crafts to campers and hikers. On April 15, 2020, Waterkraft prepared their semi- monthly payroll for their employees.

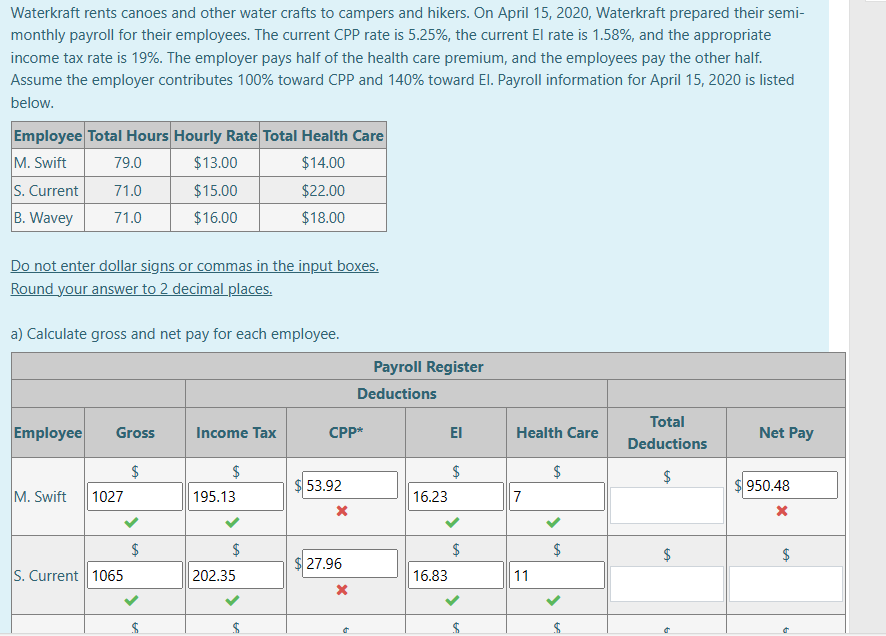

Waterkraft rents canoes and other water crafts to campers and hikers. On April 15, 2020, Waterkraft prepared their semi- monthly payroll for their employees. The current CPP rate is 5.25%, the current El rate is 1.58%, and the appropriate income tax rate is 19%. The employer pays half of the health care premium, and the employees pay the other half. Assume the employer contributes 100% toward CPP and 140% toward El. Payroll information for April 15, 2020 is listed below. Employee Total Hours Hourly Rate Total Health Care M. Swift 79.0 $13.00 $14.00 S. Current 71.0 $15.00 $22.00 B. Wavey 71.0 $16.00 $18.00 Do not enter dollar signs or commas in the input boxes. Round your answer to 2 decimal places. a) Calculate gross and net pay for each employee. Payroll Register Deductions Total Employee Gross Income Tax CPP* Health Care Net Pay Deductions $ $ $ $ 53.92 950.48 M. Swift 1027 195.13 16.23 7 S. Current 1065 $ 202.35 $ 27.96 16.83 $ $ $ $ 11 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

For M Swift Gross pay Hours worked 79 hrs Hourly rate 13hr Gross pay Hours x Hour...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started