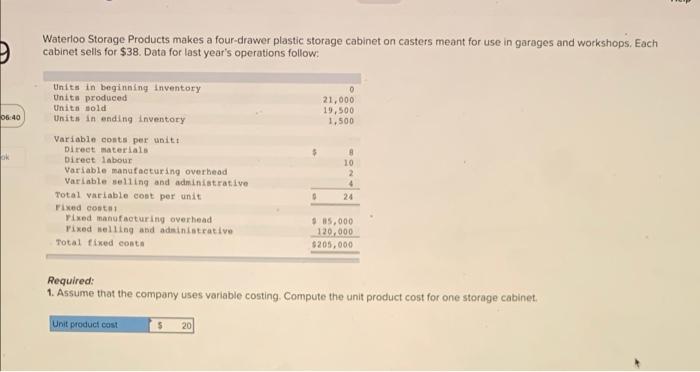

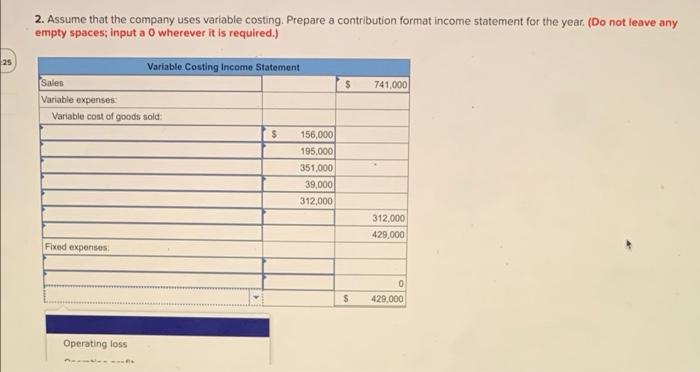

Waterloo Storage Products makes a four-drawer plastic storage cabinet on casters meant for use in garages and workshops. Each cabinet sells for $38. Data for last year's operations follow: 0 21,000 19,500 1.500 06:40 OK Unitn in beginning inventory Units produced Units sold units in ending Inventory Variable conta per unit Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative Total variable cont per unit Fixed costs Fixed manufacturing overhead Fixed selling and administrative Total fixed conta 10 2 24 $85.000 120,000 $205,000 Required: 1. Assume that the company uses variable costing Compute the unit product cost for one storage cabinet Unit product cost 20 2. Assume that the company uses variable costing Prepare a contribution format income statement for the year. (Do not leave any empty spaces; input a 0 wherever it is required.) 25 $ 741,000 Variable Costing Income Statement Sales Variable expenses Variable cost of goods sold: $ 156,000 195.000 351,000 39,000 312.000 312,000 429.000 Fixed expenses 0 $ 429,000 Operating loss 3. What is the company's break-even point in terms of units sold? (Round your answer to the nearest whole number) Break-even units sales units Waterloo Storage Products makes a four-drawer plastic storage cabinet on casters meant for use in garages and workshops. Each cabinet sells for $38. Data for last year's operations follow: 0 21,000 19,500 1.500 06:40 OK Unitn in beginning inventory Units produced Units sold units in ending Inventory Variable conta per unit Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative Total variable cont per unit Fixed costs Fixed manufacturing overhead Fixed selling and administrative Total fixed conta 10 2 24 $85.000 120,000 $205,000 Required: 1. Assume that the company uses variable costing Compute the unit product cost for one storage cabinet Unit product cost 20 2. Assume that the company uses variable costing Prepare a contribution format income statement for the year. (Do not leave any empty spaces; input a 0 wherever it is required.) 25 $ 741,000 Variable Costing Income Statement Sales Variable expenses Variable cost of goods sold: $ 156,000 195.000 351,000 39,000 312.000 312,000 429.000 Fixed expenses 0 $ 429,000 Operating loss 3. What is the company's break-even point in terms of units sold? (Round your answer to the nearest whole number) Break-even units sales units