Question

Watermark Company had a net defined benefit asset of P1,000,000 on its defined benefit plan as of January 1, 2020. The present value of

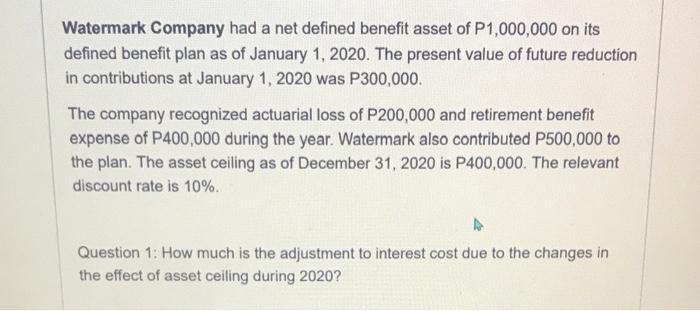

Watermark Company had a net defined benefit asset of P1,000,000 on its defined benefit plan as of January 1, 2020. The present value of future reduction in contributions at January 1, 2020 was P300,000. The company recognized actuarial loss of P200,000 and retirement benefit expense of P400,000 during the year. Watermark also contributed P500,000 to the plan. The asset ceiling as of December 31, 2020 is P400,000. The relevant discount rate is 10%. Question 1: How much is the adjustment to interest cost due to the changes in the effect of asset ceiling during 2020? Refer to Watermark Company. Question 2: How much pension asset should be recognized at the end of December 31, 2020?

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Defined benefit plan on 1st Jan 2020 P1000000 Present value of future reduction in contributions P30...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting principles and analysis

Authors: Terry d. Warfield, jerry j. weygandt, Donald e. kieso

2nd Edition

471737933, 978-0471737933

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App