Answered step by step

Verified Expert Solution

Question

1 Approved Answer

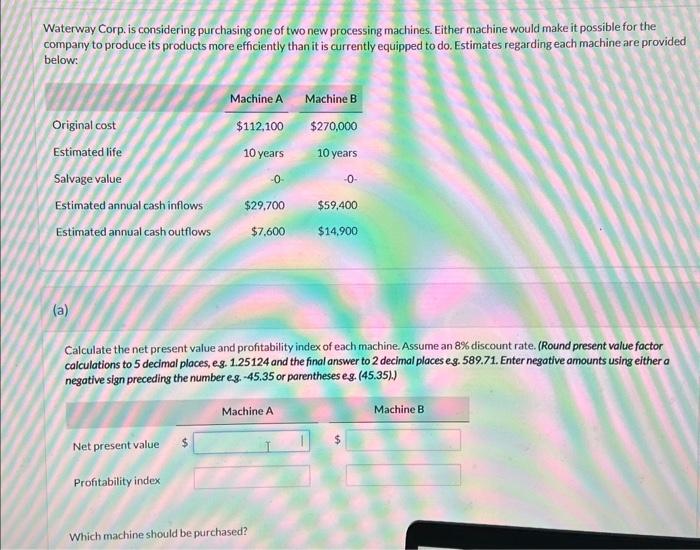

Waterway Corp. is considering purchasing one of two new processing machines. Either machine would make it possible for the company to produce its products

Waterway Corp. is considering purchasing one of two new processing machines. Either machine would make it possible for the company to produce its products more efficiently than it is currently equipped to do. Estimates regarding each machine are provided below: Machine A Machine B Original cost Estimated life $112,100 $270,000 10 years 10 years Salvage value -0- -0- Estimated annual cash inflows $29,700 $59,400 Estimated annual cash outflows $7,600 $14,900 (a) Calculate the net present value and profitability index of each machine. Assume an 8% discount rate. (Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answer to 2 decimal places eg. 589.71. Enter negative amounts using either a negative sign preceding the number eg. -45.35 or parentheses eg. (45.35).) Net present value Profitability index Machine A Which machine should be purchased? Machine B

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV and profitability index PI for each machine we need to discou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e25d24c727_960079.pdf

180 KBs PDF File

663e25d24c727_960079.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started