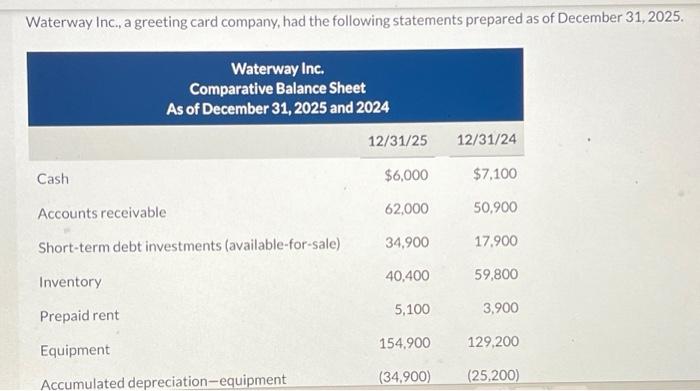

Waterway Inc., a greeting card company, had the following statements prepared as of December 31, 2025. Waterway Inc. Comparative Balance Sheet As of December

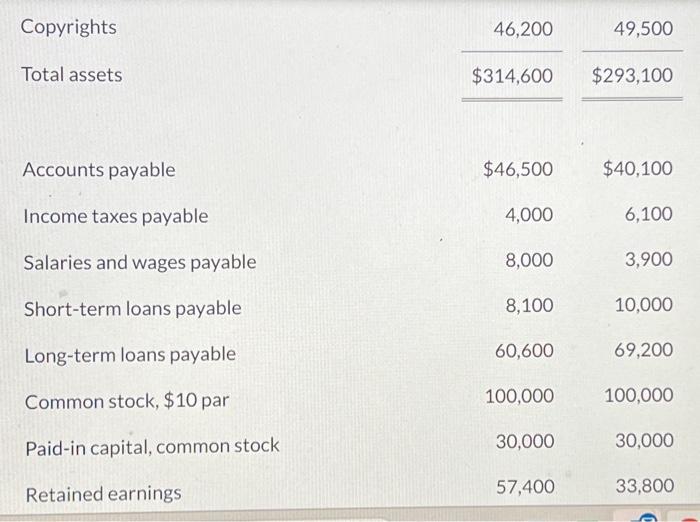

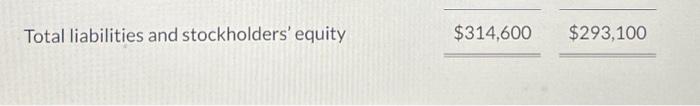

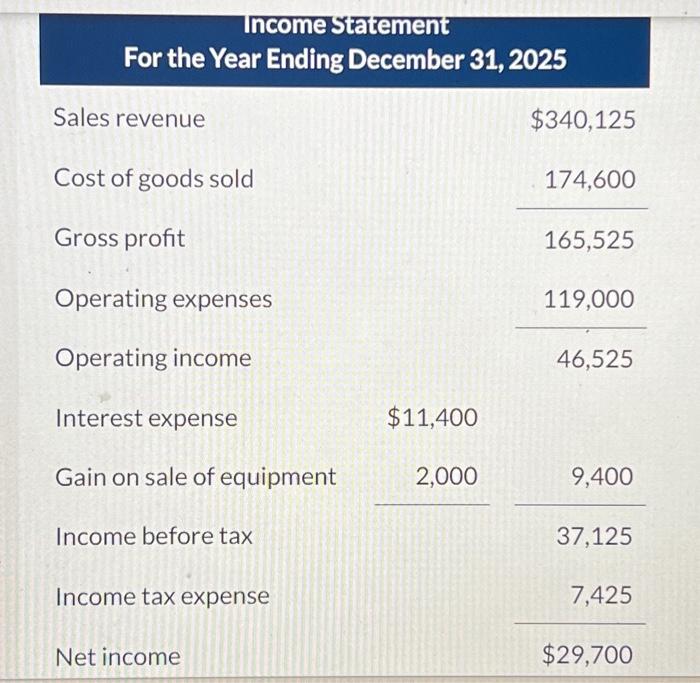

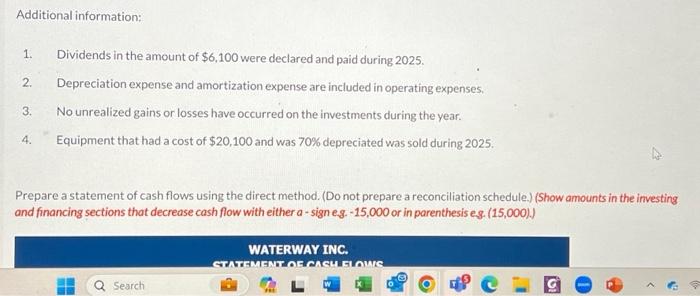

Waterway Inc., a greeting card company, had the following statements prepared as of December 31, 2025. Waterway Inc. Comparative Balance Sheet As of December 31, 2025 and 2024 12/31/25 12/31/24 Cash $6,000 $7,100 Accounts receivable 62,000 50,900 Short-term debt investments (available-for-sale) 34,900 17,900 Inventory 40,400 59,800 Prepaid rent 5,100 3,900 Equipment 154,900 129,200 Accumulated depreciation-equipment (34,900) (25,200) Copyrights Total assets 46,200 49,500 $314,600 $293,100 Accounts payable $46,500 $40,100 Income taxes payable 4,000 6,100 Salaries and wages payable 8,000 3,900 Short-term loans payable 8,100 10,000 Long-term loans payable 60,600 69,200 Common stock, $10 par 100,000 100,000 Paid-in capital, common stock 30,000 30,000 Retained earnings 57,400 33,800 Total liabilities and stockholders' equity $314,600 $293,100 Income Statement For the Year Ending December 31, 2025 Sales revenue Cost of goods sold Gross profit $340,125 174,600 165,525 Operating expenses 119,000 Operating income 46,525 Interest expense $11,400 Gain on sale of equipment 2,000 9,400 Income before tax 37,125 Income tax expense 7,425 Net income $29,700 Additional information: 1. 2. 3. Dividends in the amount of $6,100 were declared and paid during 2025. Depreciation expense and amortization expense are included in operating expenses. No unrealized gains or losses have occurred on the investments during the year. 4. Equipment that had a cost of $20,100 and was 70% depreciated was sold during 2025. Prepare a statement of cash flows using the direct method. (Do not prepare a reconciliation schedule.) (Show amounts in the investing and financing sections that decrease cash flow with either a-sign e.g.-15,000 or in parenthesis e.g. (15,000).) Search WATERWAY INC. STATEMENT OF CASH FLOWS W 15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started