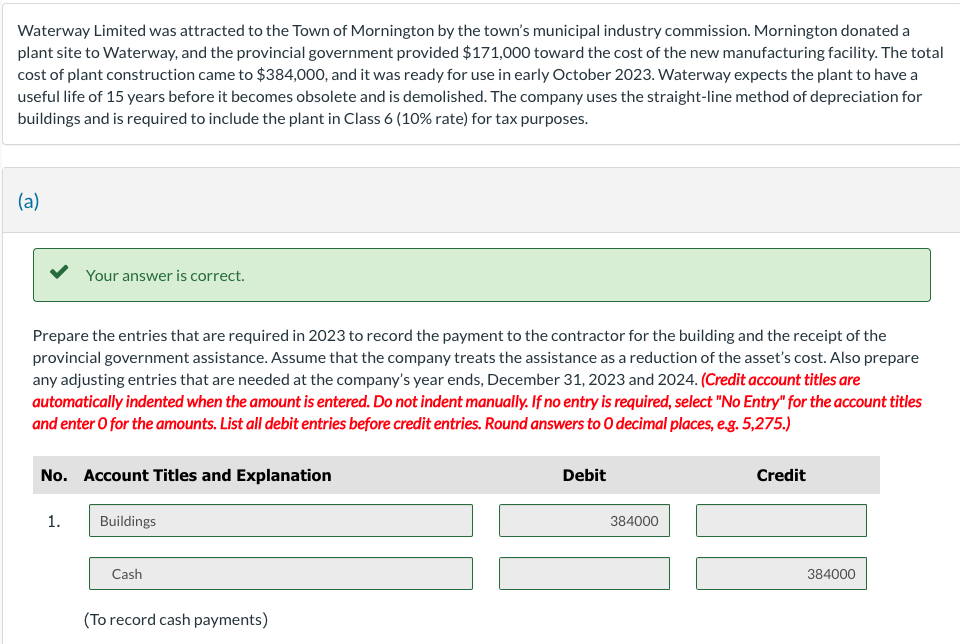

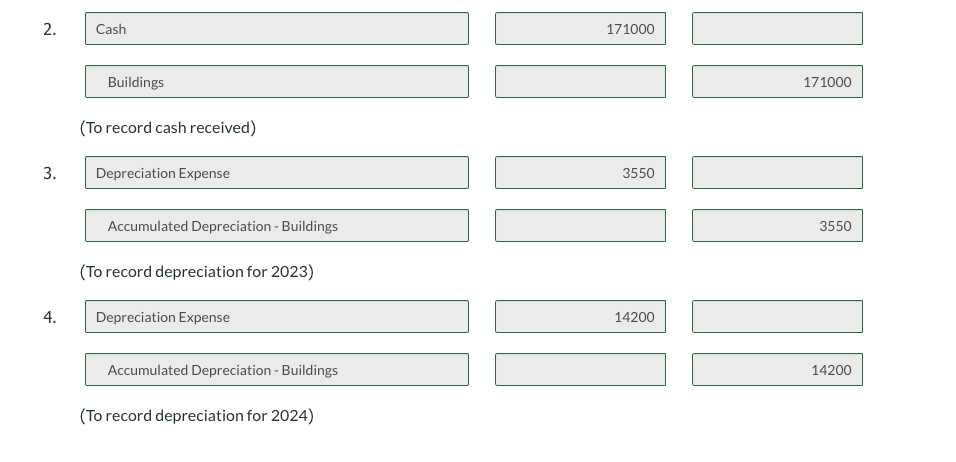

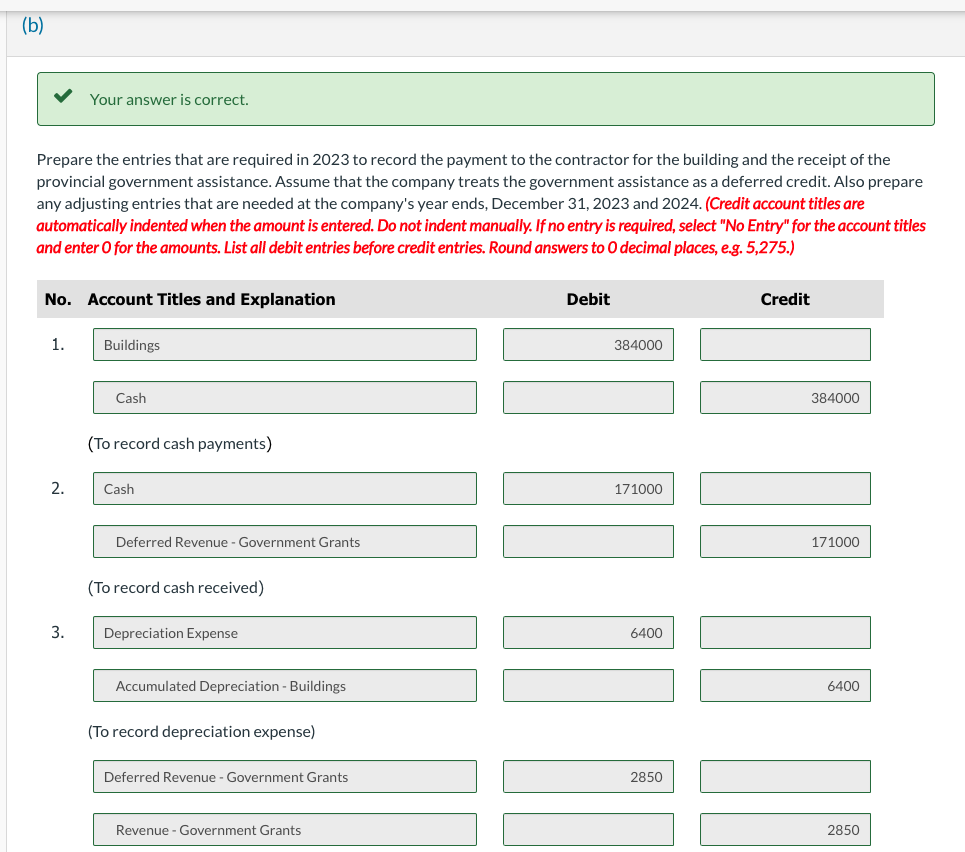

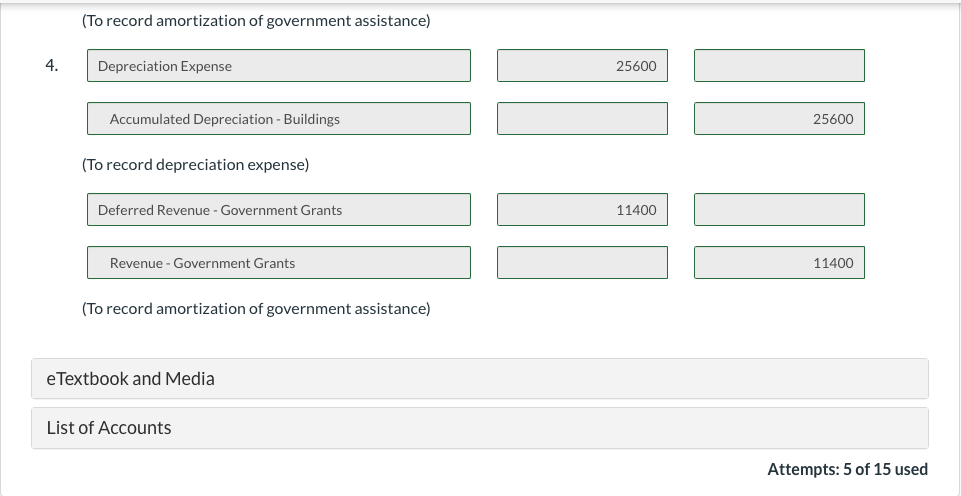

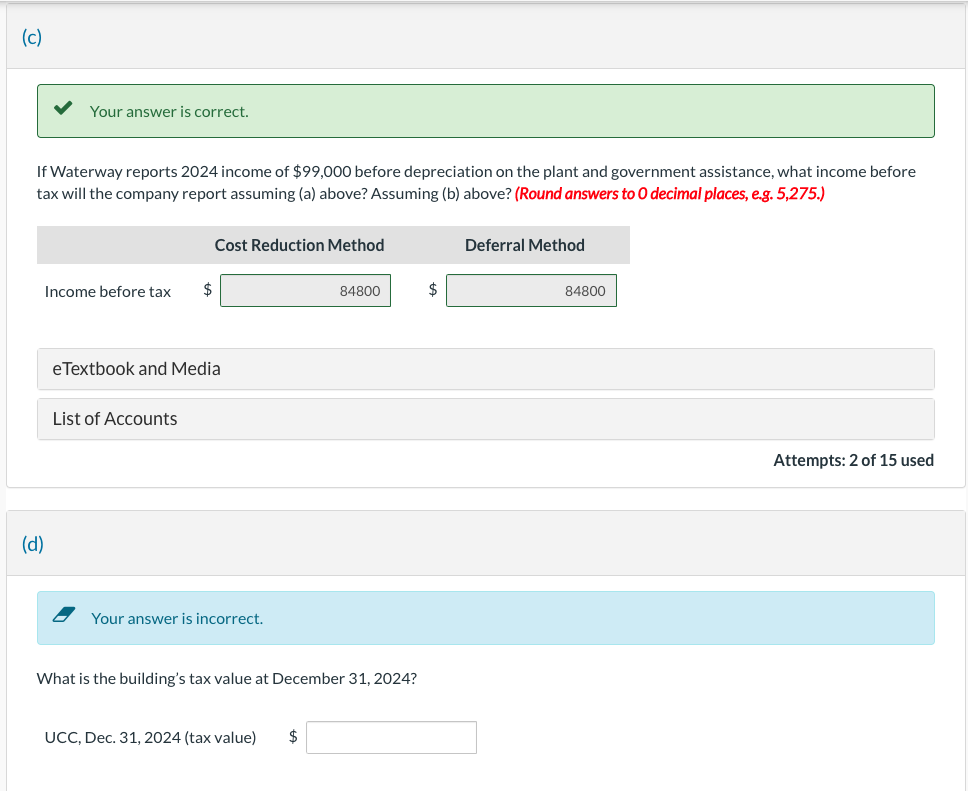

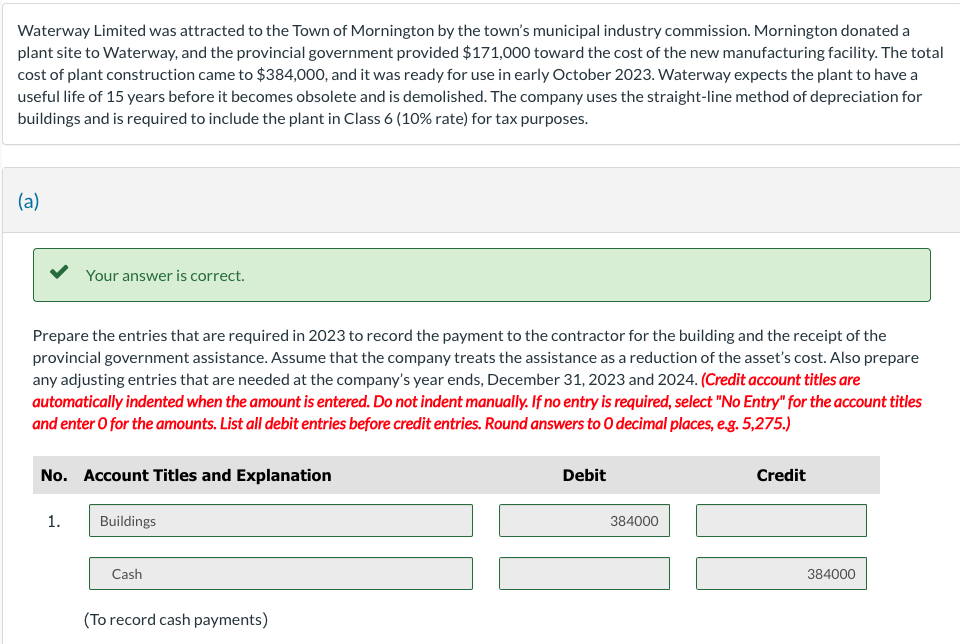

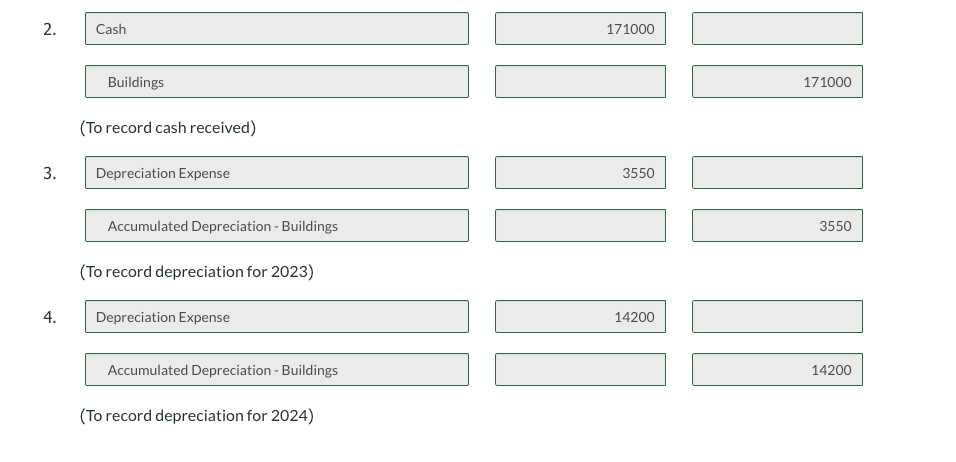

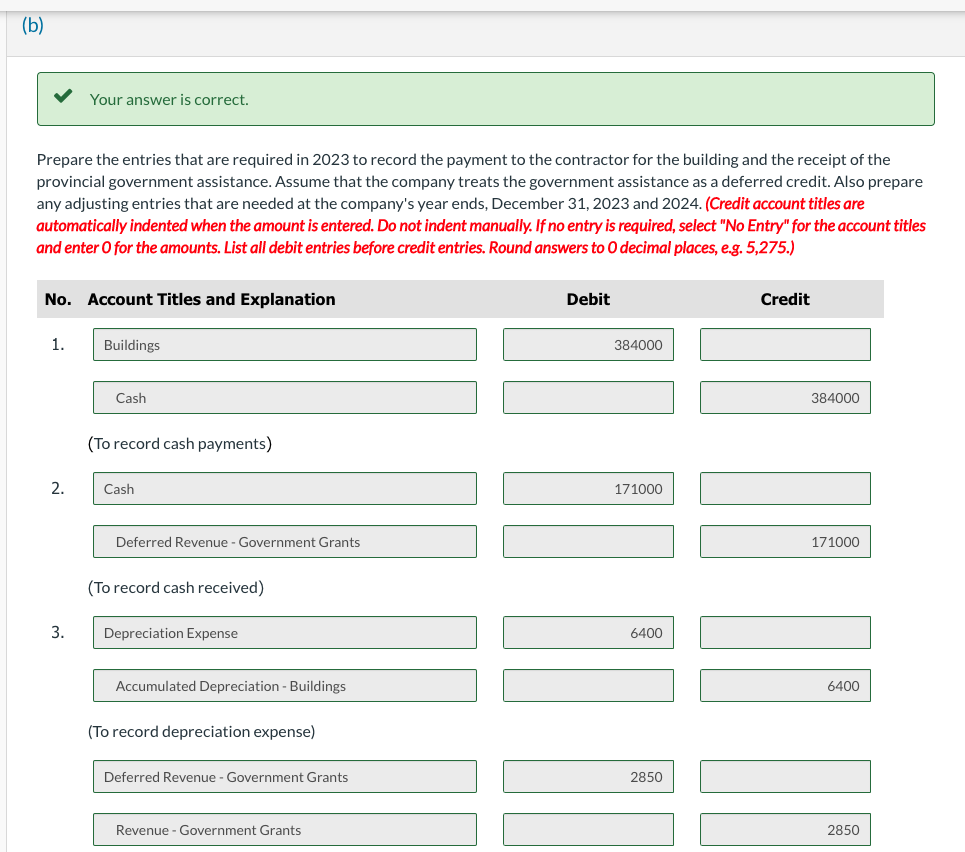

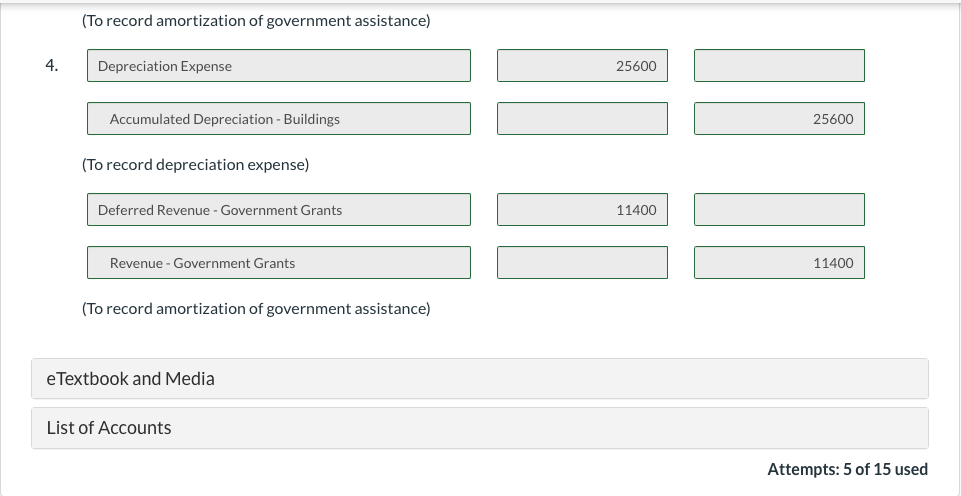

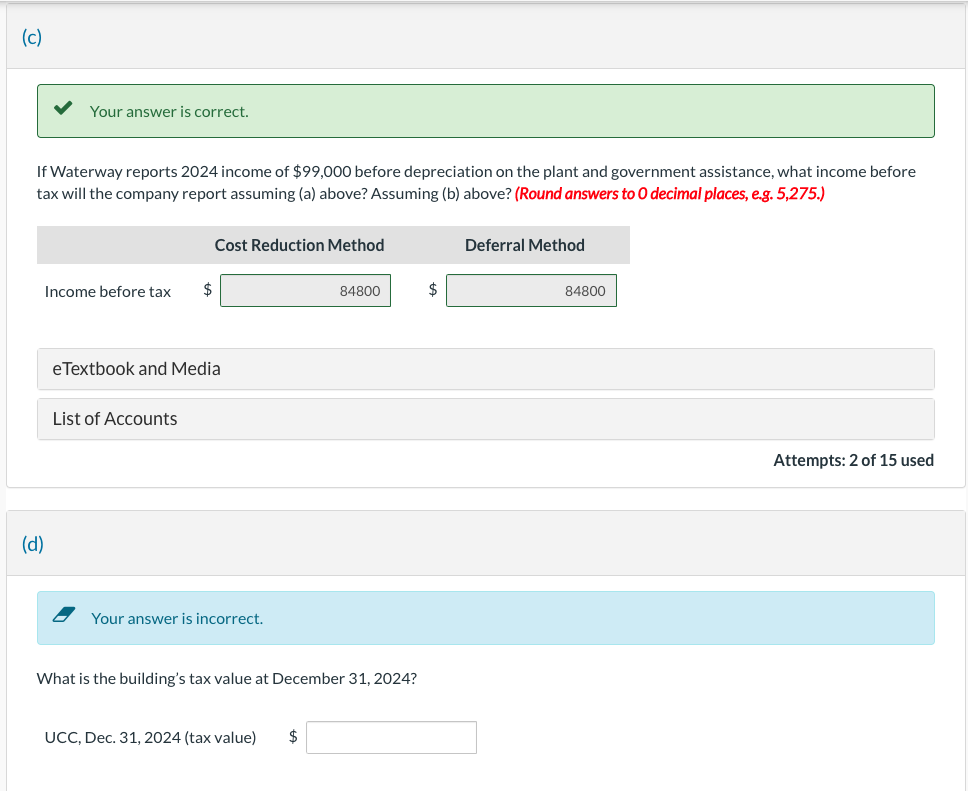

Waterway Limited was attracted to the Town of Mornington by the town's municipal industry commission. Mornington donated a plant site to Waterway, and the provincial government provided $171,000 toward the cost of the new manufacturing facility. The total cost of plant construction came to $384,000, and it was ready for use in early October 2023 . Waterway expects the plant to have a useful life of 15 years before it becomes obsolete and is demolished. The company uses the straight-line method of depreciation for buildings and is required to include the plant in Class 6 (10\% rate) for tax purposes. (a) Your answer is correct. Prepare the entries that are required in 2023 to record the payment to the contractor for the building and the receipt of the provincial government assistance. Assume that the company treats the assistance as a reduction of the asset's cost. Also prepare any adjusting entries that are needed at the company's year ends, December 31, 2023 and 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries. Round answers to 0 decimal places, e.g. 5,275.) 2. Cash 171000 Buildings (To record cash received) 3. Depreciation Expense 3550 Accumulated Depreciation - Buildings (To record depreciation for 2023) 4. Depreciation Expense 14200 Accumulated Depreciation - Buildings (To record depreciation for 2024) Prepare the entries that are required in 2023 to record the payment to the contractor for the building and the receipt of the provincial government assistance. Assume that the company treats the government assistance as a deferred credit. Also prepare any adjusting entries that are needed at the company's year ends, December 31, 2023 and 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries. Round answers to 0 decimal places, e.g. 5,275.) (To record amortization of government assistance) 4. Depreciation Expense 25600 Accumulated Depreciation - Buildings (To record depreciation expense) Deferred Revenue - Government Grants 11400 Revenue - Government Grants (To record amortization of government assistance) eTextbook and Media List of Accounts Attempts: 5 of 15 used Your answer is correct. If Waterway reports 2024 income of $99,000 before depreciation on the plant and government assistance, what income before tax will the company report assuming (a) above? Assuming (b) above? (Round answers to 0 decimal places, e.g. 5,275.) eTextbook and Media List of Accounts Attempts: 2 of 15 usec (d) Your answer is incorrect. What is the building's tax value at December 31,2024 ? Waterway Limited was attracted to the Town of Mornington by the town's municipal industry commission. Mornington donated a plant site to Waterway, and the provincial government provided $171,000 toward the cost of the new manufacturing facility. The total cost of plant construction came to $384,000, and it was ready for use in early October 2023 . Waterway expects the plant to have a useful life of 15 years before it becomes obsolete and is demolished. The company uses the straight-line method of depreciation for buildings and is required to include the plant in Class 6 (10\% rate) for tax purposes. (a) Your answer is correct. Prepare the entries that are required in 2023 to record the payment to the contractor for the building and the receipt of the provincial government assistance. Assume that the company treats the assistance as a reduction of the asset's cost. Also prepare any adjusting entries that are needed at the company's year ends, December 31, 2023 and 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries. Round answers to 0 decimal places, e.g. 5,275.) 2. Cash 171000 Buildings (To record cash received) 3. Depreciation Expense 3550 Accumulated Depreciation - Buildings (To record depreciation for 2023) 4. Depreciation Expense 14200 Accumulated Depreciation - Buildings (To record depreciation for 2024) Prepare the entries that are required in 2023 to record the payment to the contractor for the building and the receipt of the provincial government assistance. Assume that the company treats the government assistance as a deferred credit. Also prepare any adjusting entries that are needed at the company's year ends, December 31, 2023 and 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries. Round answers to 0 decimal places, e.g. 5,275.) (To record amortization of government assistance) 4. Depreciation Expense 25600 Accumulated Depreciation - Buildings (To record depreciation expense) Deferred Revenue - Government Grants 11400 Revenue - Government Grants (To record amortization of government assistance) eTextbook and Media List of Accounts Attempts: 5 of 15 used Your answer is correct. If Waterway reports 2024 income of $99,000 before depreciation on the plant and government assistance, what income before tax will the company report assuming (a) above? Assuming (b) above? (Round answers to 0 decimal places, e.g. 5,275.) eTextbook and Media List of Accounts Attempts: 2 of 15 usec (d) Your answer is incorrect. What is the building's tax value at December 31,2024