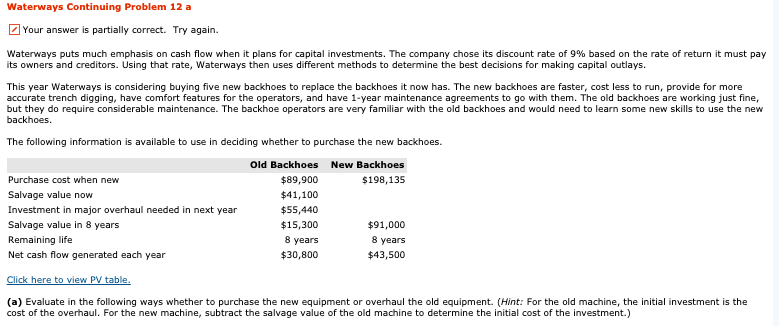

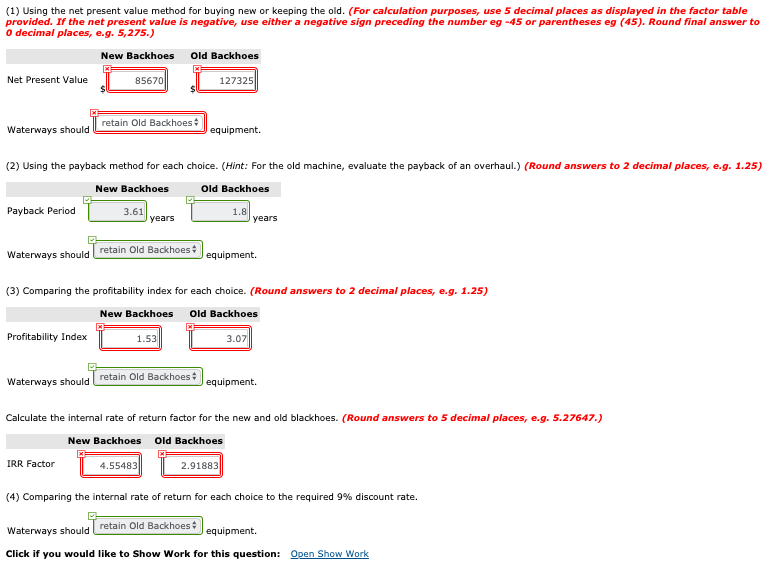

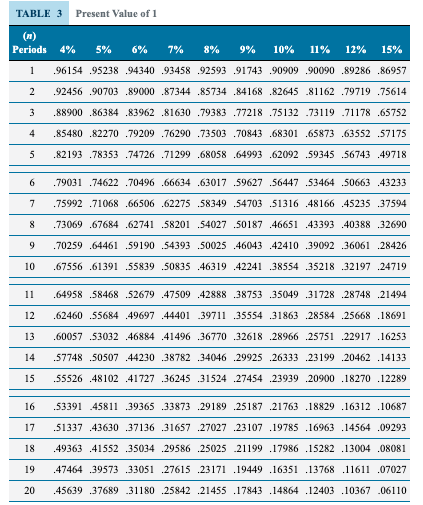

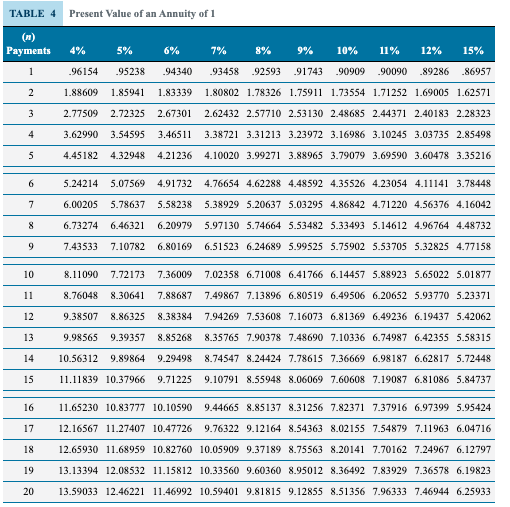

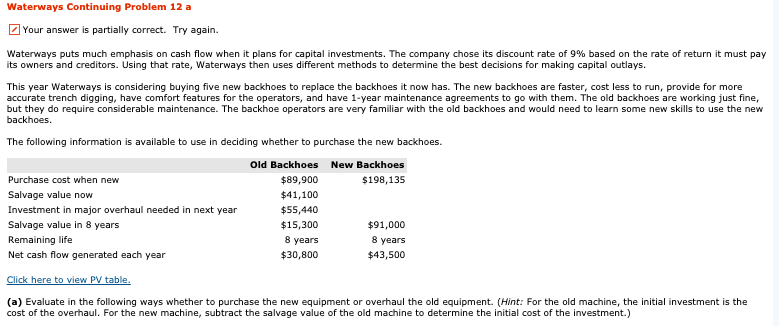

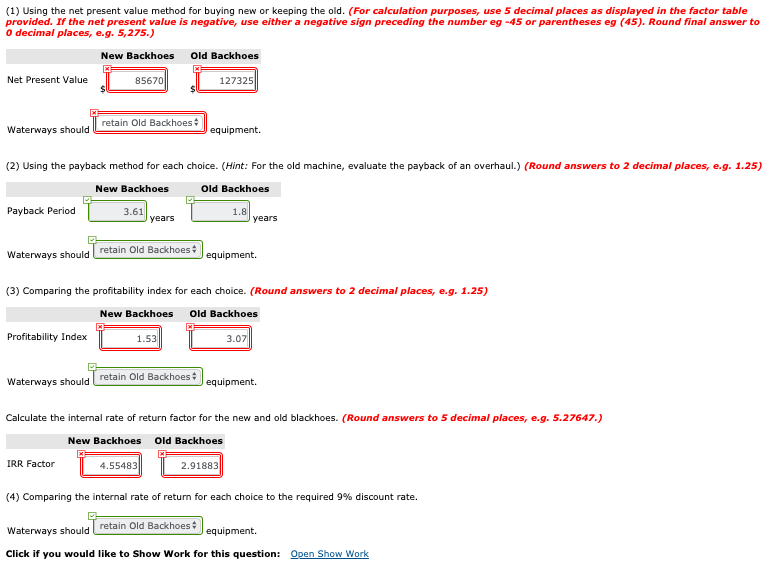

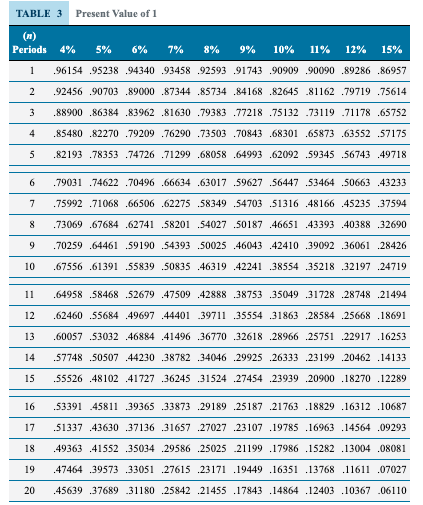

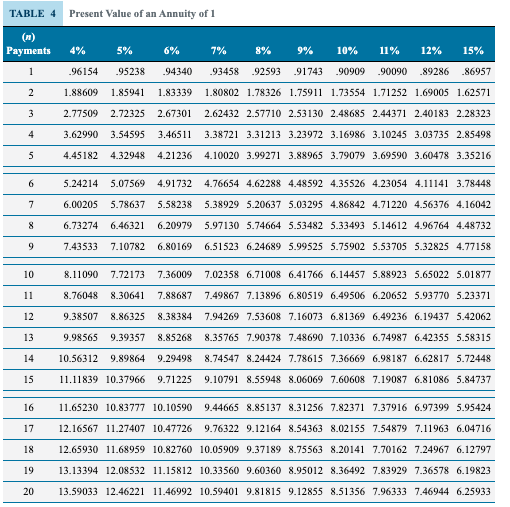

Waterways Continuing Problem 12 a Your answer is partially correct. Try again. Waterways puts much emphasis on cash flow when it plans for capital investments. The company chose its discount rate of 9% based on the rate of return it must pay its owners and creditors. Using that rate, Waterways then uses different methods to determine the best decisions for making capital outlays. This year Waterways is considering buying five new backhoes to replace the backhoes it now has. The new backhoes are faster, cost less to run, provide for more accurate trench digging, have comfort features for the operators, and have 1-year maintenance agreements to go with them. The old backhoes are working just fine, but they do require considerable maintenance. The backhoe operators are very familiar with the old backhoes and would need to learn some new skills to use the new backhoes. The following information is available to use in deciding whether to purchase the new backhoes. Purchase cost when new Salvage value now Investment in major overhaul needed in next year Salvage value in 8 years Remaining life Net cash flow generated each year Old Backhoes New Backhoes $89,900 $198,135 $41,100 $55,440 $15,300 $91,000 8 years 8 years $30,800 $43,500 Click here to view PV table. (a) Evaluate in the following ways whether to purchase the new equipment or overhaul the old equipment. (Hint: For the old machine, the initial investment is the cost of the overhaul. For the new machine, subtract the salvage value of the old machine to determine the initial cost of the investment.) (1) Using the net present value method for buying new or keeping the old. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). Round final answer to O decimal places, e.g. 5,275.) New Backhoes Old Backhoes Net Present Value 85670 127325 Waterways should retain Old Backhoes equipment. (2) Using the payback method for each choice. (Hint: For the old machine, evaluate the payback of an overhaul.) (Round answers to 2 decimal places, e.g. 1.25) Old Backhoes New Backhoes 3.61 Payback Period years 1.8 years retain Old Backhoes equipment. (3) Comparing the profitability index for each choice. (Round answers to 2 decimal places, e.g. 1.25) New Backhoes Old Backhoes Profitability Index 1.53 3.07 Waterways should retain Old Backhoes equipment. Calculate the internal rate of return factor for the new and old blackhoes. (Round answers to 5 decimal places, e.g. 5.27647.) New Backhoes Old Backhoes IRR Factor 1 4.55483 2.91883 (4) Comparing the internal rate of return for each choice to the required 9% discount rate. Waterways should retain Old Backhoes . Click if you would like to Show Work for this question: Open Show Work TABLE 3 Present Value of 1 Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 15% 1 96154 95238 94340 93458 92593 91743 90909 90090 .89286 .86957 2 92456 90703 .89000 87344 .85734 .84168 .82645 81162 79719 .75614 3 88900 .86384 .83962 .81630 .79383.77218 .75132 .73119 71178 65752 4 85480 .82270 .79209.76290 .73503 .70843 .68301 .65873.63552 .57175 5 .82193 .78353 .74726 .71299 .68058 .64993 .62092 59345 56743 49718 6 7 8 9 10 79031 .74622 70496.66634 .63017 59627 56447 53464 50663 .43233 75992 .71068 .66506 .62275 58349 54703 51316 48166 .45235 .37594 73069 .67684 .62741 .58201 54027 50187 .46651 4339340388 32690 70259 .64461 59190 54393 50025 .46043.42410 39092 36061 28426 ,67556,61391 55839 50835 46319.42241 38554 35218 32197 24719 11 12 13 14 15 ,64958 58468 52679 .47509.42888 38753 35049 31728 .28748 .21494 ,62460 55684 ,49697 .44401 39711 35554 31863 .28584 .25668 18691 ,60057.53032.46884 .41496 36770 32618 28966 25751 22917 16253 57748 50507.44230 .38782 34046 29925 26333 23199 20462 14133 .55526 .48102 .41727 .36245 31524 27454 23939 20900 18270 12289 16 17 18 19 20 53391 45811 39365 33873 29189 25187 21763 18829.16312 .10687 51337.43630 37136 31657 27027 23107.19785 16963 .14564 .09293 49363 41552 .35034 29586 25025 21199 17986 .15282 .13004 .08081 .47464 39573 .33051 27615 23171 .19449 .16351 .13768 .11611 .07027 .45639 37689 31180 25842 21455 .17843 .14864 12403 .10367 .06110 TABLE 4 Present Value of an Annuity of 1 Payments 2 3 4 5 4% 96154 1.88609 2.77509 3.62990 4.45182 5% 6% 7% 8% 9% 10% 11% 12% 15% 95238 94340 93458 92593 9174390909 9009089286 86957 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571 2.72325 2.67301 2.62432 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323 3.54595 3.46511 3.38721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 4.32948 4.21236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 6 7 8 9 5.242145.075694.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 6.002055.78637 5.58238 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042 6.73274 6.46321 6.20979 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 4.48732 7.435337.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158 10 11 12 13 14 15 8 9 9 8.11090 7.72173 7.36009 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022 5.01877 .76048 8.306417.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770 5.23371 .38507 8.863258.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 5.42062 .98565 9.39357 8.85268 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5.58315 10.56312 9.898649.294988.74547 8.24424 7.78615 7.36669 6.98187 6.62817 5.72448 11.11839 10.37966 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 16 17 18 19 20 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.37916 6.97399 5.95424 12.16567 11.27407 10.47726 9.76322 9.12164 8.54363 8.02155 7.54879 7.11963 6.04716 12.65930 11.68959 10.82760 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 6.12797 1 3.13394 12.08532 11.15812 10.33560 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 1 3.59033 12.46221 11.46992 10.59401 9.81815 9.12855 8.51356 7.96333 7.46944 6.25933