Question

Waterways Continuing Problem-10 (Part Level Submission) Waterways Corporation has recently acquired a small manufacturing operation in British Columbia that produces one of its more

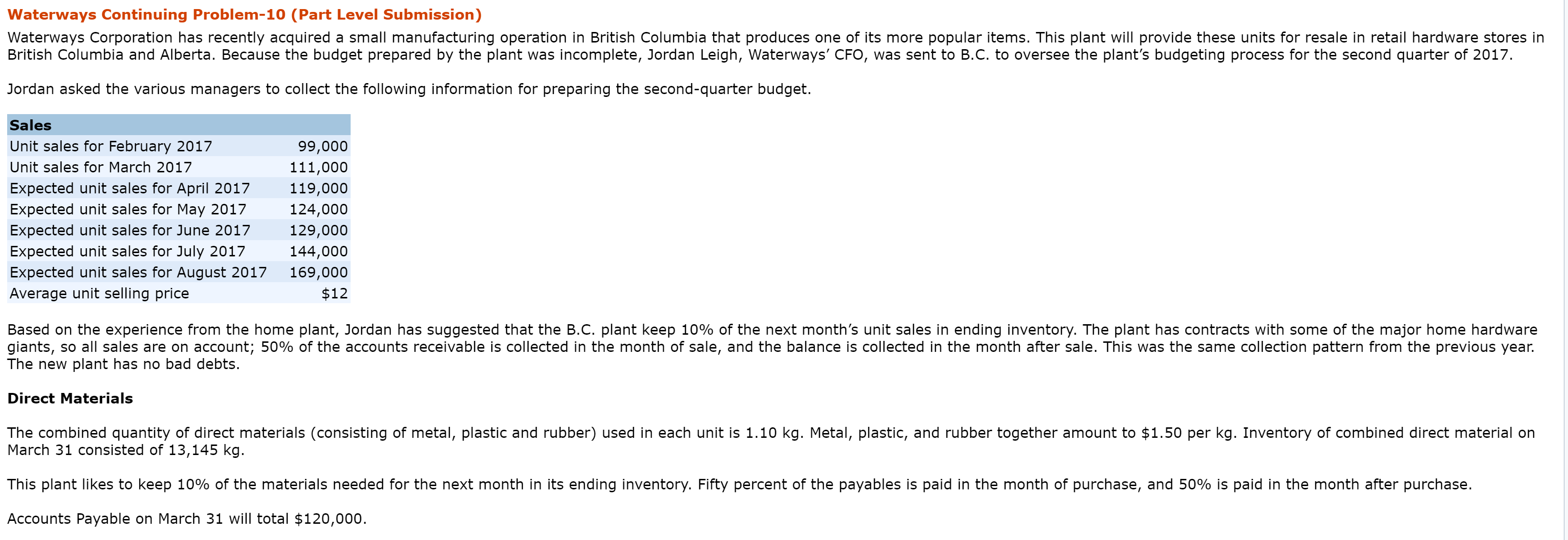

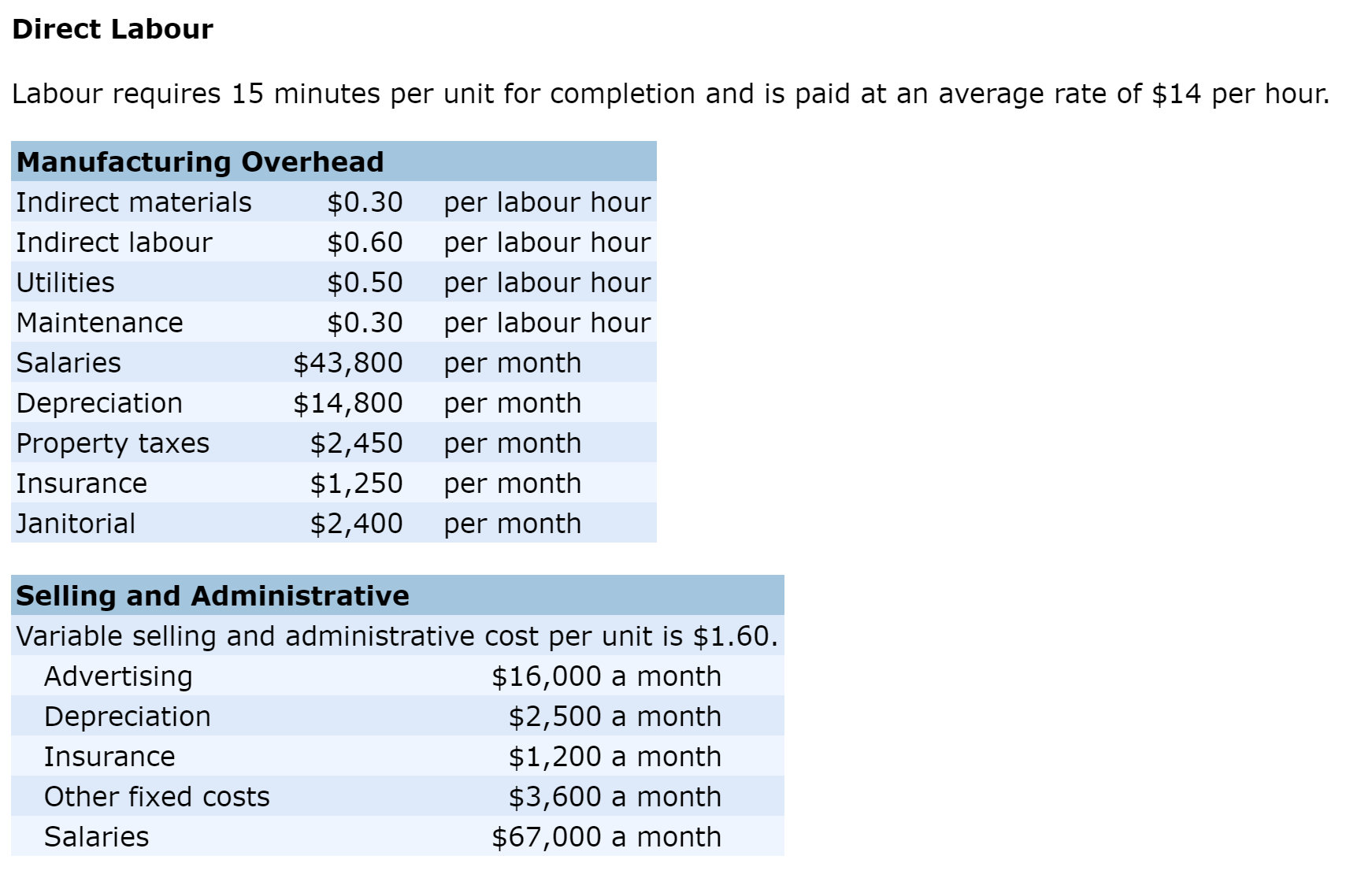

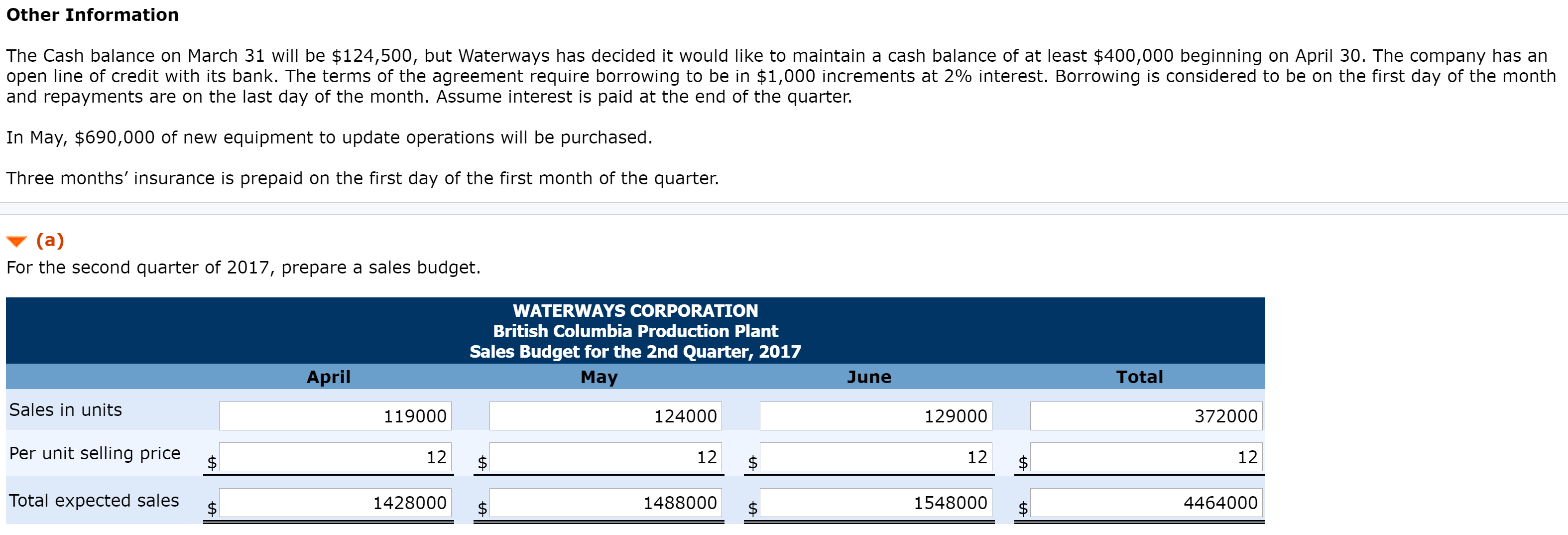

Waterways Continuing Problem-10 (Part Level Submission) Waterways Corporation has recently acquired a small manufacturing operation in British Columbia that produces one of its more popular items. This plant will provide these units for resale in retail hardware stores in British Columbia and Alberta. Because the budget prepared by the plant was incomplete, Jordan Leigh, Waterways' CFO, was sent to B.C. to oversee the plant's budgeting process for the second quarter of 2017. Jordan asked the various managers to collect the following information for preparing the second-quarter budget. Sales Unit sales for February 2017 Unit sales for March 2017 99,000 111,000 Expected unit sales for April 2017 119,000 Expected unit sales for May 2017 124,000 Expected unit sales for June 2017 Expected unit sales for July 2017 Expected unit sales for August 2017 Average unit selling price 129,000 144,000 169,000 $12 Based on the experience from the home plant, Jordan has suggested that the B.C. plant keep 10% of the next month's unit sales in ending inventory. The plant has contracts with some of the major home hardware giants, so all sales are on account; 50% of the accounts receivable is collected in the month of sale, and the balance is collected in the month after sale. This was the same collection pattern from the previous year. The new plant has no bad debts. Direct Materials The combined quantity of direct materials (consisting of metal, plastic and rubber) used in each unit is 1.10 kg. Metal, plastic, and rubber together amount to $1.50 per kg. Inventory of combined direct material on March 31 consisted of 13,145 kg. This plant likes to keep 10% of the materials needed for the next month in its ending inventory. Fifty percent of the payables is paid in the month of purchase, and 50% is paid in the month after purchase. Accounts Payable on March 31 will total $120,000. Direct Labour Labour requires 15 minutes per unit for completion and is paid at an average rate of $14 per hour. Manufacturing Overhead Indirect materials $0.30 per labour hour Indirect labour $0.60 per labour hour Utilities $0.50 per labour hour Maintenance $0.30 per labour hour Salaries $43,800 per month Depreciation $14,800 per month Property taxes $2,450 per month Insurance $1,250 per month Janitorial $2,400 per month Selling and Administrative Variable selling and administrative cost per unit is $1.60. Advertising $16,000 a month Depreciation $2,500 a month Insurance $1,200 a month Other fixed costs $3,600 a month Salaries $67,000 a month Other Information The Cash balance on March 31 will be $124,500, but Waterways has decided it would like to maintain a cash balance of at least $400,000 beginning on April 30. The company has an open line of credit with its bank. The terms of the agreement require borrowing to be in $1,000 increments at 2% interest. Borrowing is considered to be on the first day of the month and repayments are on the last day of the month. Assume interest is paid at the end of the quarter. In May, $690,000 of new equipment to update operations will be purchased. Three months' insurance is prepaid on the first day of the first month of the quarter. (a) For the second quarter of 2017, prepare a sales budget. April Sales in units 119000 Per unit selling price 12 Total expected sales 1428000 WATERWAYS CORPORATION British Columbia Production Plant Sales Budget for the 2nd Quarter, 2017 May 124000 12 1488000 June 129000 12 1548000 Total 372000 12 4464000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started