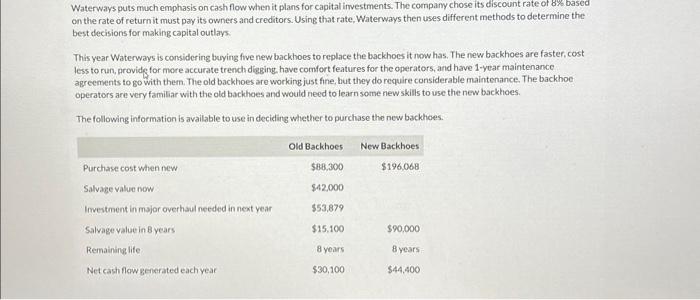

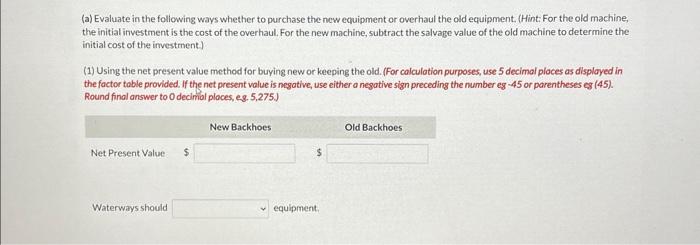

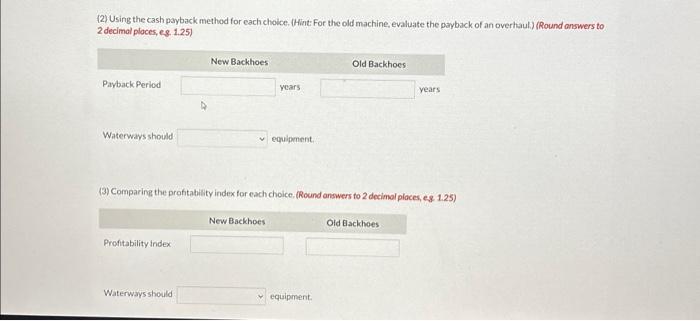

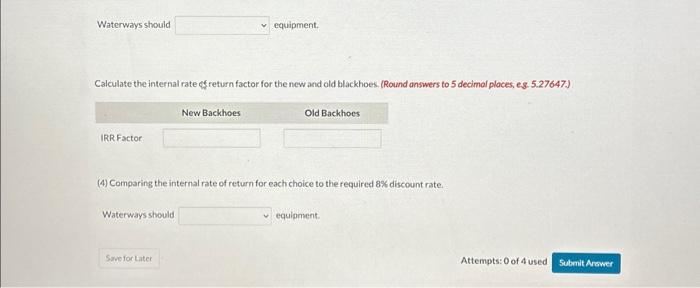

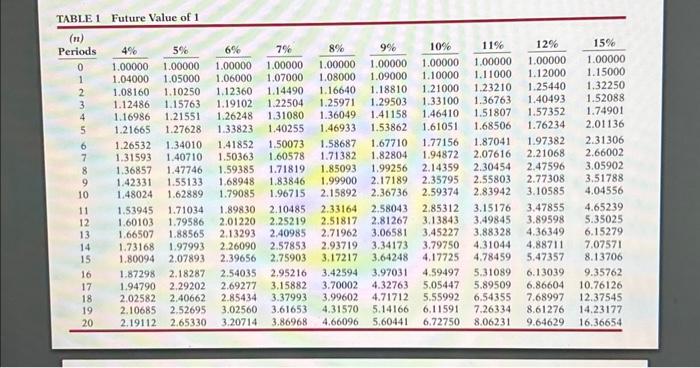

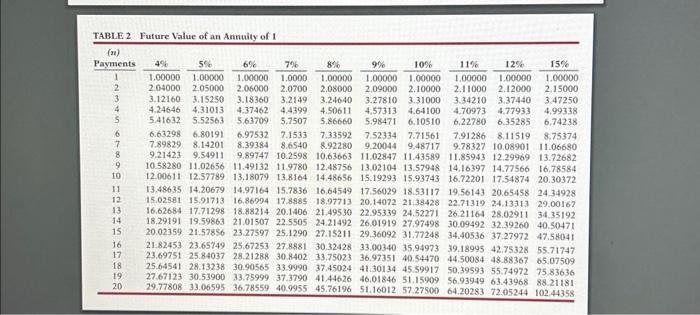

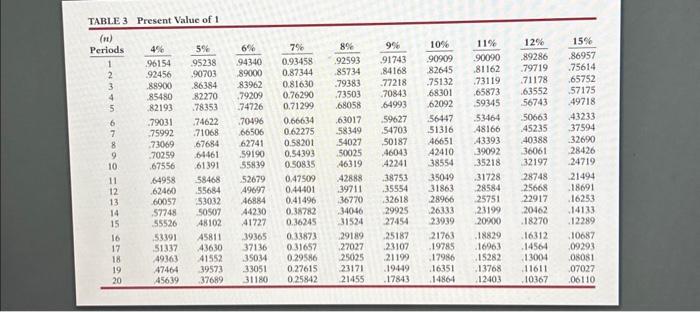

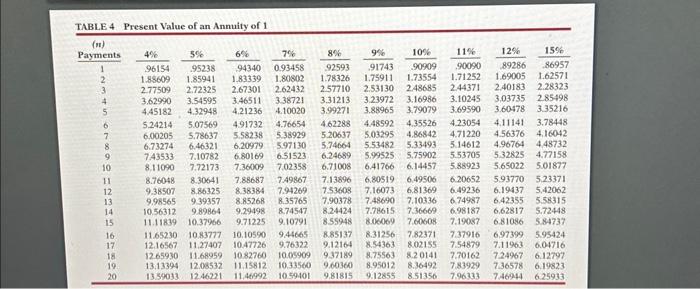

Waterways puts much emphasis on cash flow when it plans for capital investments. The company chose its discount rate of 8 based on the rate of returnit must pay its owners and creditors. Using that rate, Waterways then uses different methods to determine the best decisions for making capital outlays. This year Waterways is considering buying five new backhoes to replace the backhocs it now has. The new backhoes are faster, cost less to run, providg for more accurate trench dieging, have comfort features for the operators, and have 1 -year maintenance agreements to go with them. The old backhoes are working just fne, but they do require considerable maintenance. The backhoe operators are very familiar with the old backhoes and would need to learn some new skills to use the new backhoes. (a) Evaluate in the following ways whether to purchase the new equipment or overhaul the old equipment. (Hint: For the old machine, the initial investment is the cost of the overhaul. For the new machine, subtract the salvage value of the old machine to determine the initial cost of the imvestment.) (1) Using the net present value method for buying new or keeping the old. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses 98 (45). Round final answer to O decimal ploces, es. 5,275. (2) Using the cash payback method for each choice. (Hint: For the old machine, evaluate the payback of an overhaul) (Round onswers to 2 decimal ploces, es. 1.25) Waterways should equlpment. (3) Comparing the proftability index for each choice, (Round answers to 2 decimol places, es 1.25) Waterways should equipment. Calculate the internal rate of return factor for the new and old blackhoes. (Round answers to 5 decimol places, es. 5.27647 ) (4) Comparing the internal rate of return for each choice to the required 8% discount rate. Waterways should equipment. TABLE 1 Future Value of 1 TABLE 2 Future Value of an Annuity of 1 TABLE 3 Present Value of 1 TABLE 4 Present Value of an Annuity of 1