Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Waterways puts much emphasis on cash flow when it plans for capital investments. The company chose its discount rate of 9% based on the rate

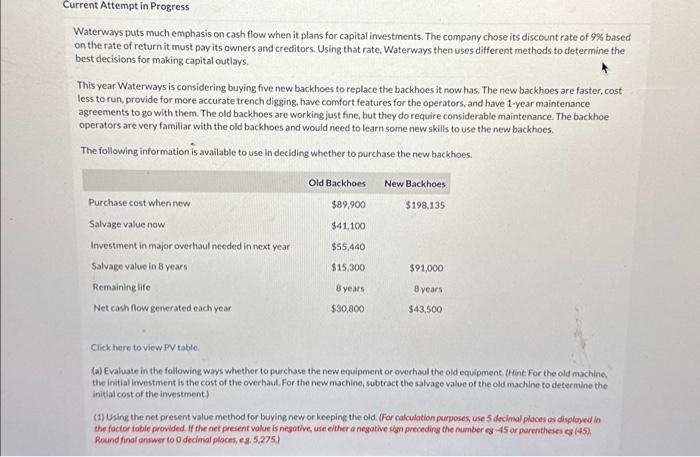

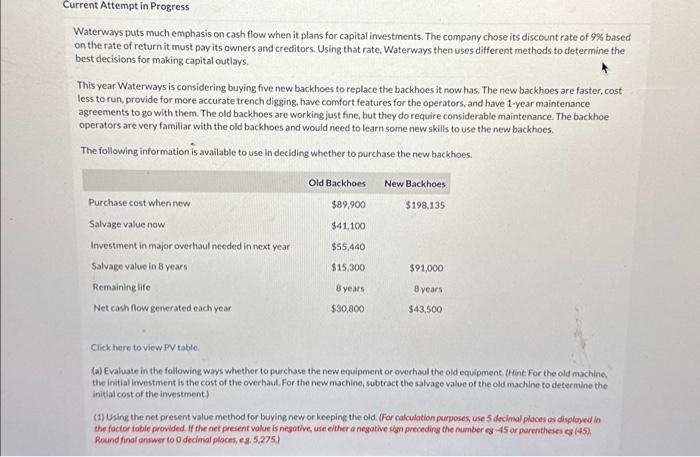

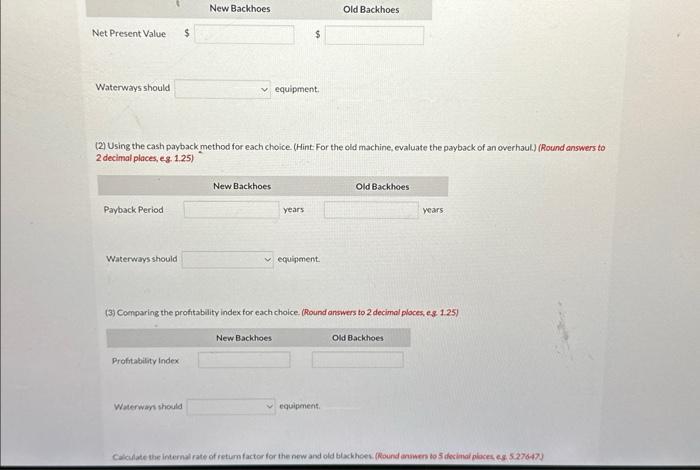

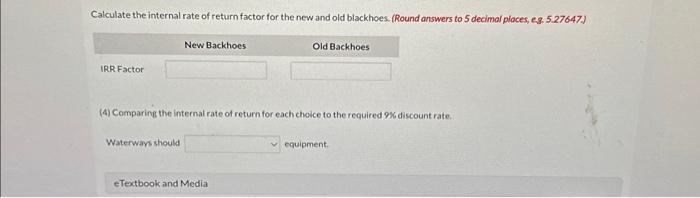

Waterways puts much emphasis on cash flow when it plans for capital investments. The company chose its discount rate of 9% based on the rate of return it must pay its owners and creditors. Using that rate, Waterways then uses different methods to determine the best decisions for making capital outlays. This year Waterways is considering buying five new backhoes to replace the backhoes it now has. The new backhoes are faster, cost less to run, provide for more accurate trench digging, have comfort features for the operators, and have 1-year maintenance agreements to go with them. The old backhoes are working just fine, but they do require considerable maintenance. The backhoe operators are very familiar with the old backhoes and would need to learn some new skills to use the new backhoes. The following information is available to use in deciding whether to purchase the new backhoes. Purchase cost when new Salvage value now Investment in major overhaul needed in next year Salvage value in 8 years Remaining life Net cash flow generated each year Click here to view PV table. Old Backhoes $89,900 $41,100 $55,440 $15,300 8 years $30,800 New Backhoes $198,135 $91,000 8 years $43,500 (a) Evaluate in the following ways whether to purchase the new equipment or overhaul the old equipment. (Hint: For the old machine, the initial investment is the cost of the overhaul. For the new machine, subtract the salvage value of the old machine to determine the initial cost of the investment.) (1) Using the net present value method for buying new or keeping the old. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). Round final answer to 0 decimal places, e.g. 5,275.)

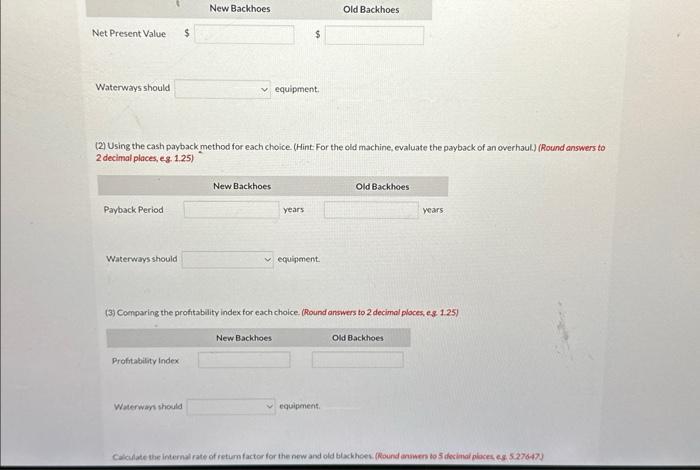

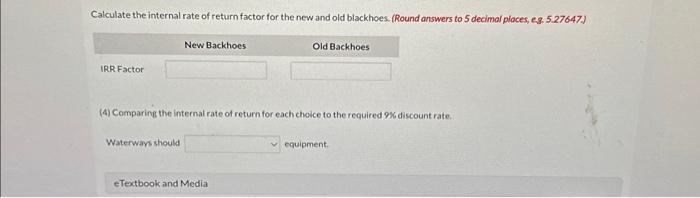

Waterways puts much emphasis on cash flow when it plans for capital investments. The company chose its discount rate of 9% based on the rate of return it must pay its owners and creditors. Using that rate, Waterways then uses different methods to determine the best decisions for making capital outlays. This year Waterways is considering buying five new backhoes to replace the backhoes it now has. The new backhoes are faster, cost less to run, provide for more accurate trench digging, have comfort features for the operators, and have 1 -year maintenance agreements to go with them. The old backhoes are working just fine, but they do require considerable maintenance. The backhoe operators are very familiar with the old backhoes and would need to learn some new skills to use the new backhoes. The following information is available to use in deciding whether to purchase the new backhoes. Click here to view PV table. (a) Evaluate in the following ways whether to purchase the new equipment or owerhaul the old equipment. (Hint for the old machine. the initial investment is the cost of the overhaul. For the new machine, subtract the salvase value of the old machine to determine the Initat cost of the investiment) (1) Using the net present value method for buying new or keeping the old. (For calculation purposes, use 5 decimal places as disployed in the factor table provided, if the net present value is negotlve, use either a negathe sim preceding the number of 45 or parentheses $3 (45) found finat answer to 0 dectmaf places, es, 5,275) (2) Using the cash payback method for each choice. (Hint: For the old machine, evaluate the payback of an overhaul.) (Round answers to 2 decimal places, eg. 1.25) Waterways should equipment. (3) Comparing the profitability index for each choice. (Round arawers to 2 decimal ploces, es, 1.25) Calculate the internal rate of return factor for the new and old blackhoes. (Round answers to 5 decimol places, e.8.5.27647.) (4) Comparing the internal rate of return for each choice to the required 9% discount rate. Waterwars should equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started