Question

Wave Exteriors Inc. has an unlevered cost of equity is 12% and a pre-tax cost of debt of 6%. Both the book and the

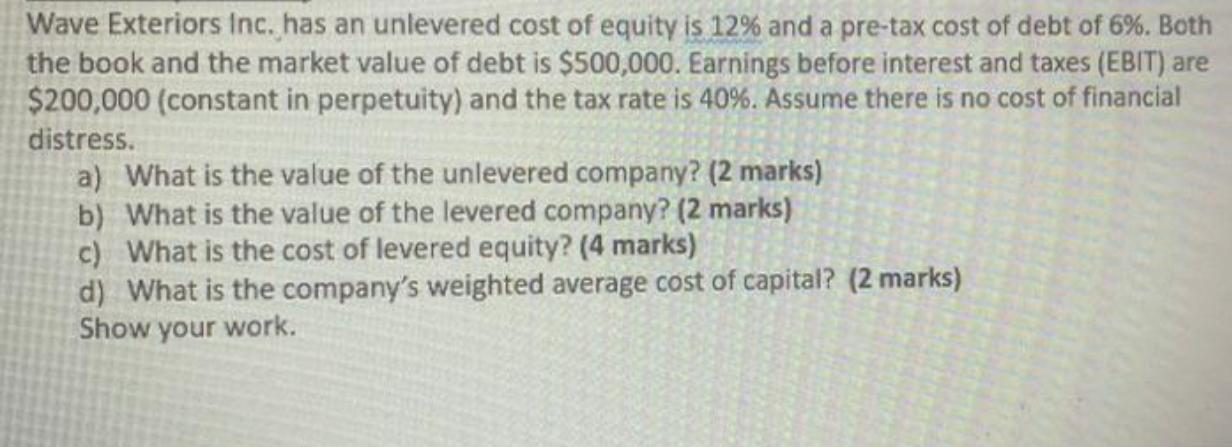

Wave Exteriors Inc. has an unlevered cost of equity is 12% and a pre-tax cost of debt of 6%. Both the book and the market value of debt is $500,000. Earnings before interest and taxes (EBIT) are $200,000 (constant in perpetuity) and the tax rate is 40%. Assume there is no cost of financial distress. a) What is the value of the unlevered company? (2 marks) b) What is the value of the levered company? (2 marks) c) What is the cost of levered equity? (4 marks) d) What is the company's weighted average cost of capital? (2 marks) Show your work.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Wave Exteriors Inc Capital Structure Analysis a Value of the Unlevered Company We know the unlevered ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Valuation The Art and Science of Corporate Investment Decisions

Authors: Sheridan Titman, John D. Martin

3rd edition

133479528, 978-0133479522

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App