Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Waverley Pty Ltd manufactures and sells a new line of cheap laptops for the primary school students' market. The end of financial year is

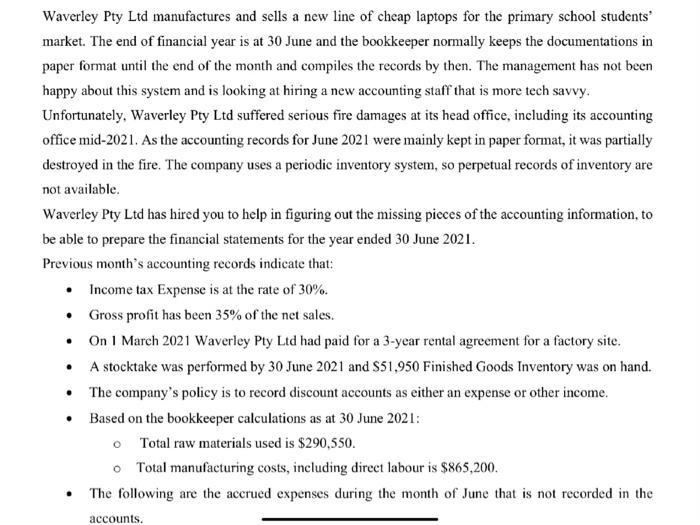

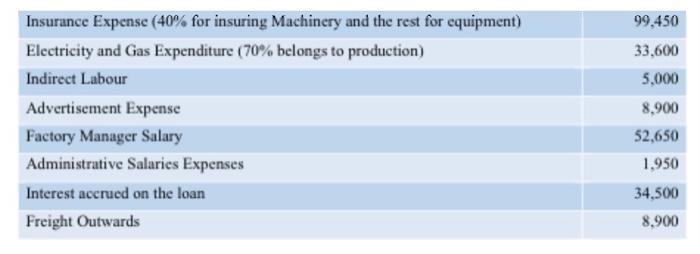

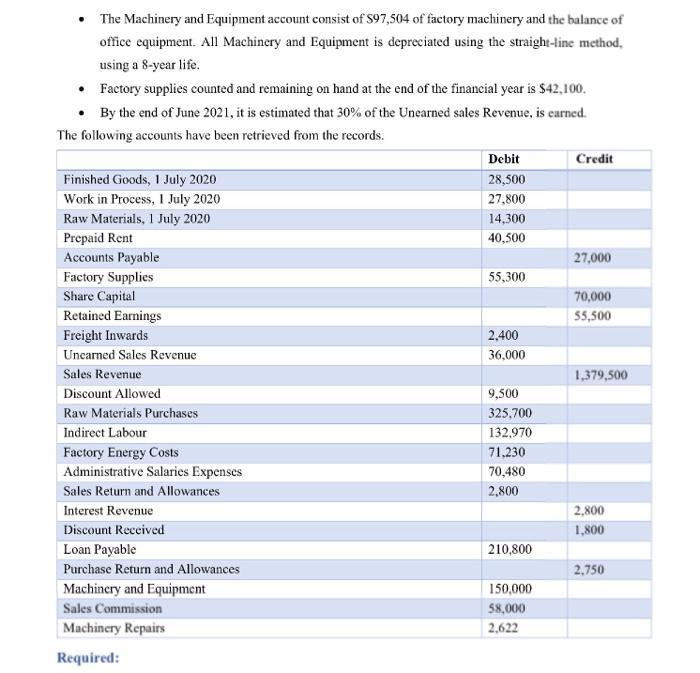

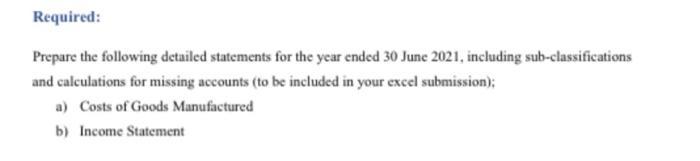

Waverley Pty Ltd manufactures and sells a new line of cheap laptops for the primary school students' market. The end of financial year is at 30 June and the bookkeeper normally keeps the documentations in paper format until the end of the month and compiles the records by then. The management has not been happy about this system and is looking at hiring a new accounting staff that is more tech savvy. Unfortunately, Waverley Pty Ltd suffered serious fire damages at its head office, including its accounting office mid-2021. As the accounting records for June 2021 were mainly kept in paper format, it was partially destroyed in the fire. The company uses a periodic inventory system, so perpetual records of inventory are not available. Waverley Pty Ltd has hired you to help in figuring out the missing pieces of the accounting information, to be able to prepare the financial statements for the year ended 30 June 2021. Previous month's accounting records indicate that: Income tax Expense is at the rate of 30%. Gross profit has been 35% of the net sales. On I March 2021 Waverley Pty Ltd had paid for a 3-year rental agreement for a factory site. A stocktake was performed by 30 June 2021 and S51,950 Finished Goods Inventory was on hand. The company's policy is to record discount accounts as either an expense or other income. Based on the bookkeeper calculations as at 30 June 2021: o Total raw materials used is $290,550. o Total manufacturing costs, including direet labour is $865,200. The following are the accrued expenses during the month of June that is not recorded in the accounts. Insurance Expense (40% for insuring Machinery and the rest for equipment) 99,450 Electricity and Gas Expenditure (70% belongs to production) 33,600 Indirect Labour 5,000 Advertisement Expense 8,900 Factory Manager Salary 52,650 Administrative Salaries Expenses 1,950 Interest accrued on the loan 34,500 Freight Outwards 8,900 The Machinery and Equipment account consist of S97,504 of factory machinery and the balance of office equipment. All Machinery and Equipment is depreciated using the straight-line method, using a 8-year life. Factory supplies counted and remaining on hand at the end of the financial year is $42,100. By the end of June 2021, it is estimated that 30% of the Unearned sales Revenue, is carned. The following accounts have been retrieved from the records. Debit Credit 28,500 Finished Goods, 1 July 2020 Work in Process, I July 2020 27,800 Raw Materials, 1 July 2020 14,300 Prepaid Rent 40,500 Accounts Payable 27,000 Factory Supplies 55,300 Share Capital 70,000 Retained Earnings Freight Inwards 55,500 2,400 Unearned Sales Revenue 36,000 Sales Revenue 1,379,500 Discount Allowed 9,500 Raw Materials Purchases 325,700 Indirect Labour 132,970 Factory Energy Costs Administrative Salaries Expenses 71,230 70,480 Sales Return and Allowances 2,800 Interest Revenue 2,800 Discount Received 1,800 Loan Payable 210,800 Purchase Return and Allowances 2,750 Machinery and Equipment 150,000 Sales Commission 58,000 Machinery Repairs 2,622 Required: Required: Prepare the following detailed statements for the year ended 30 June 2021, including sub-classifications and calculations for missing accounts (to be included in your excel submission); a) Costs of Goods Manufactured b) Income Statement

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Waverly Pty Ldt Cost of Goods Manufactured For the month of June 30 2021 1430000 32570000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started