Question

Wayland Custom Woodworking is a firm that manufactures custom cabinets and woodwork for business and residential customers. Students will have the opportunity to establish payroll

Wayland Custom Woodworking is a firm that manufactures custom cabinets and woodwork for business and residential customers. Students will have the opportunity to establish payroll records and to complete a month of payroll information for Wayland.

Wayland Custom Woodworking is located at 1716 Nichol Street, Logan, Utah, 84321, phone number 435-555-9877. The owner is Mark Wayland. Waylands EIN is 91-7444533 and his Utah Employer Account Number is 999-9290-1. Wayland has determined it will pay their employees on a semimonthly basis.

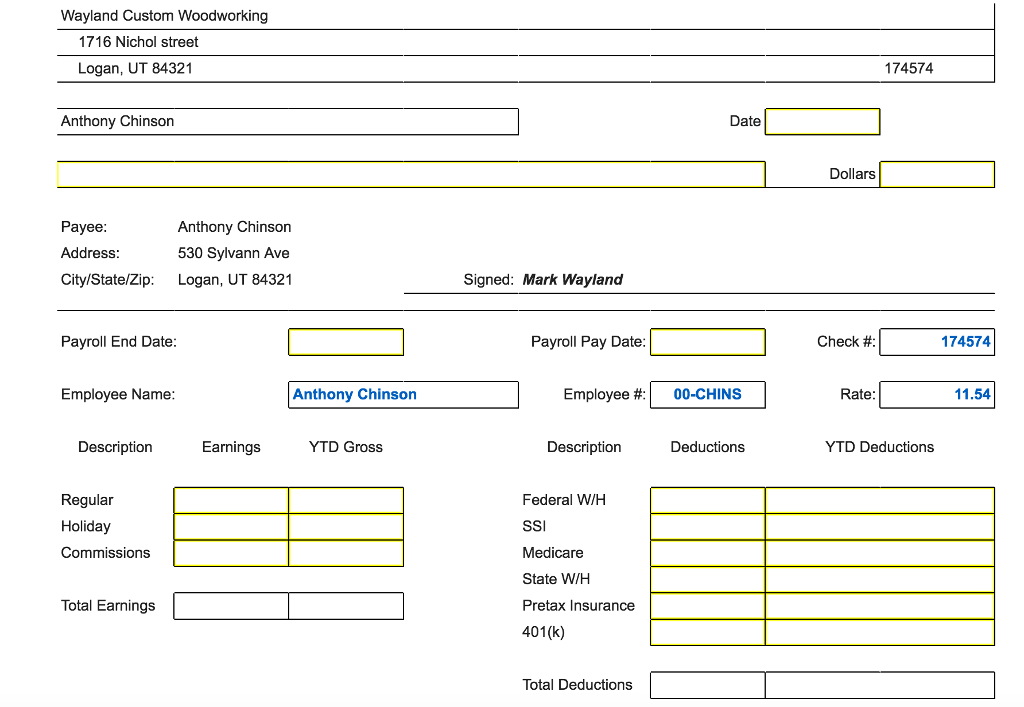

Students will complete the payroll for the final quarter of 2015, and will file fourth quarter and annual tax reports on the appropriate dates. When writing out the dollar amount for each check, spell out all words and the cents are presented over 100, for example 50 cents would be 50/100.

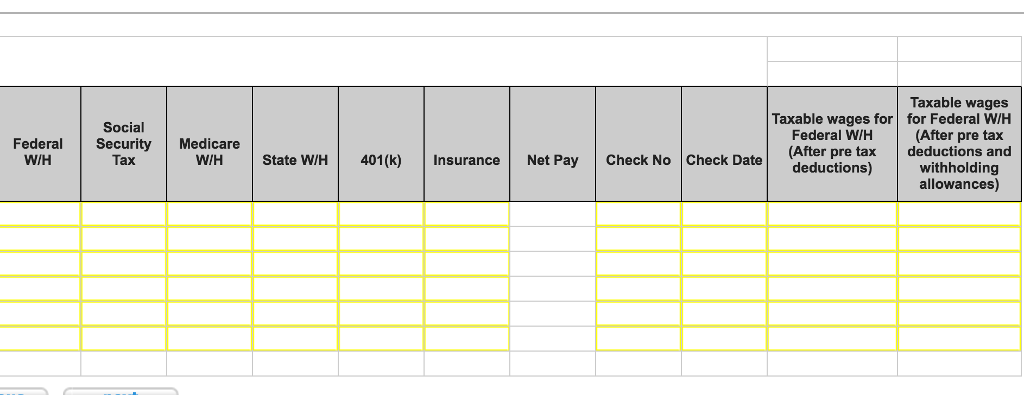

Federal income tax should be computed using the percentage method tables in Appendix C. FUTA information is in the table below. The Utah state income tax rate and the SUTA (UI) rate are in the table below.

Rounding can create a challenge. For these exercises, the rate for the individuals is not rounded. So take their salary and divide by 2,080 (52 weeks at 40 hours per week) for full time, nonexempt employees. For example, Vardens salary is $42,000 and is a nonexempt employee, so the calculation will be $42,000/2,080, which would give you $20.19231 per hour. Exempt employees salaries are divided by 24 (number of payrolls for semimonthly.) For example, Chinsons salary is $24,000 and is a full time employee, so the calculation will be $24,000/24, which would give you $1,000. After this hourly rate is determined, than it can be applied to the number of hours worked. After the gross pay has been calculated, round this number to only two decimal points prior to calculating taxes or other withholdings.

For the completion of this project the following information can be located in Appendix C. Students will use the Percentage method for federal income tax and the tax tables have been provided for Utah. Both 401(k) and insurance are pretax for federal income tax and Utah income tax. Round calculations to get to final tax amounts and 401(k) contributions after calculating gross pay.

| Federal Withholding Allowance (less 401(k), Section 125) | $166.70 per allowance claimed |

| Semimonthly Federal Percentage Method Tax Table | Appendix C, Page 293, Table #3 |

| Federal Unemployment Rate (Federal unemployment rate less Section 125 health insurance) | 0.6% on the first $7,000 of wages |

| State Withholding Rate (less 401(k), Section 125) | See Utah Schedule 3 |

| State Unemployment Rate (less Section 125) | 2.6% on the first $31,300 of wages |

| Wayland Custom Woodworking Balance sheet 9/30/2015 | ||||||

| Assets | Liabilities & Equity | |||||

| Cash | $ | 1,125,000.00 | Accounts Payable | $ | 112,490.00 | |

| Supplies | 27,240.00 | Salaries and Wages Payable | ||||

| Office Equipment | 87,250.00 | Federal Unemployment Tax Payable | ||||

| Inventory | 123,000.00 | Social Security Tax Payable | ||||

| Vehicle | 25,000.00 | Medicare Tax Payable | ||||

| Accumulated Depreciation, Vehicle | State Unemployment Tax Payable | |||||

| Building | 164,000.00 | Employee Federal Income Tax Payable | ||||

| Accumulated Depreciation, Building | Employee State Income Tax Payable | |||||

| Land | 35,750.00 | 401(k) Contributions Payable | ||||

| Employee Medical Premiums Payable | ||||||

| Total Assets | 1,587,240.00 | Notes Payable | 224,750.00 | |||

| Utilities Payable | ||||||

| Total Liabilities | 337,240.00 | |||||

| Owners' Equity | 1,250,000.00 | |||||

| Retained Earnings | - | |||||

| Total Equity | 1,250,000.00 | |||||

| Total Liabilities and Equity | 1,587,240.00 | |||||

October 1:

Wayland Custom Woodworking (WCW) pays its employees according to their job classification. The following employees comprise Waylands staff:

| Employee Number | Name and Address | Payroll information |

| 00-Chins | Anthony Chinson 530 Sylvann Avenue Logan, UT 84321 435-555-1212 Job title: Account Executive | Married, 1 withholding allowance Exempt $24,000/year + commission Start Date: 10/1/2015 SSN: 511-22-3333 |

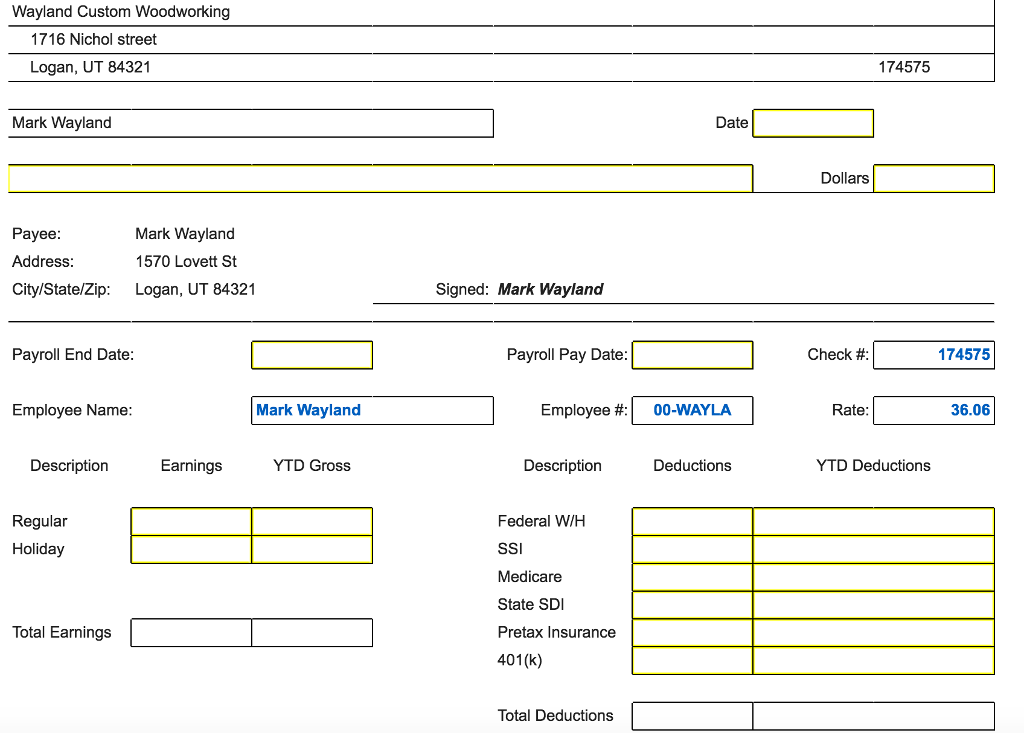

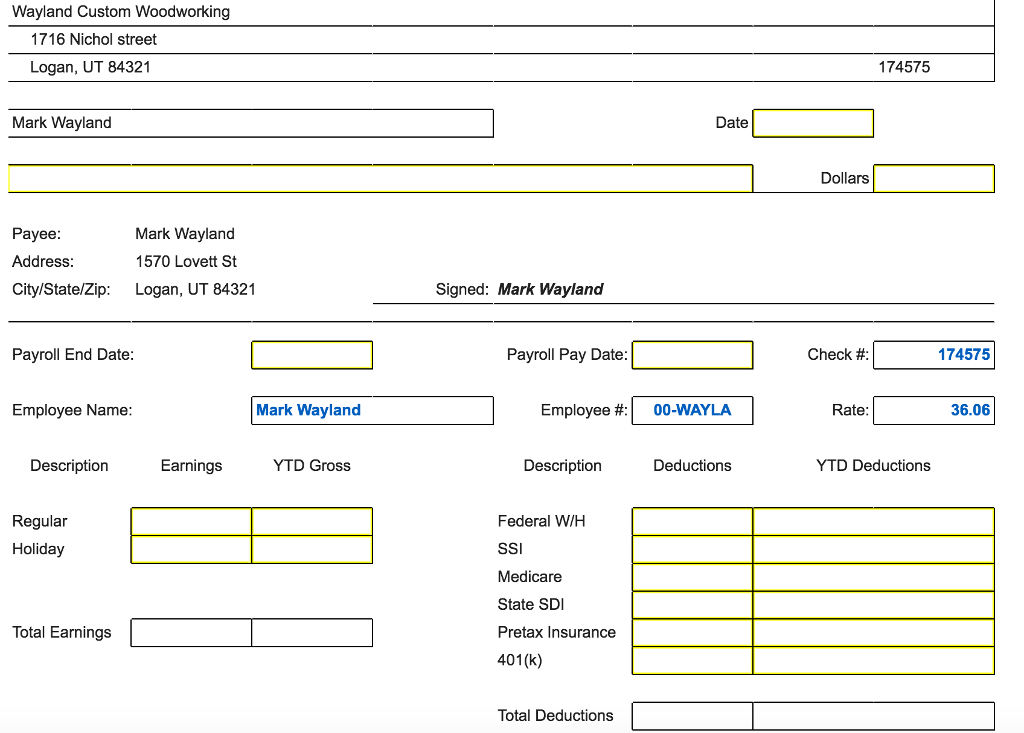

| 00-Wayla | Mark Wayland 1570 Lovett Street Logan, UT 84321 435-555-1110 Job title: President/Owner | Married, 5 withholding allowances Exempt $75,000/year Start Date: 10/1/2015 SSN: 505-33-1775 |

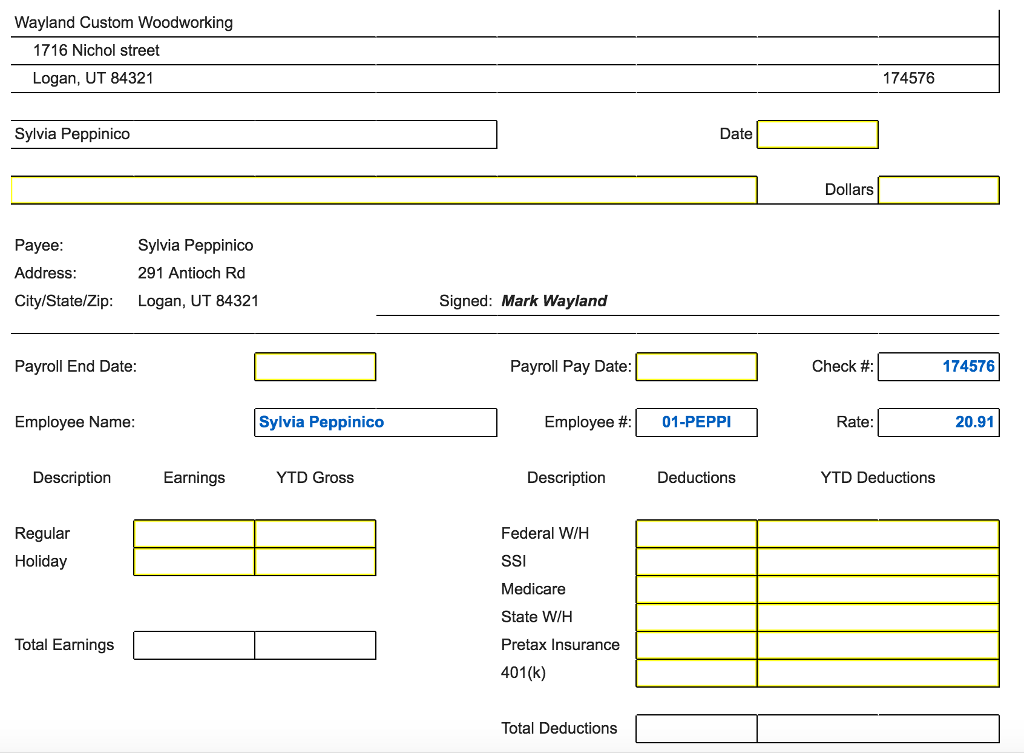

| 01-Peppi | Sylvia Peppinico 291 Antioch Road Logan, UT 84321 435-555-2244 Job title: Craftsman | Married, 7 withholding allowances Exempt $43,500/year Start Date: 10/1/2015 SSN: 047-55-9951 |

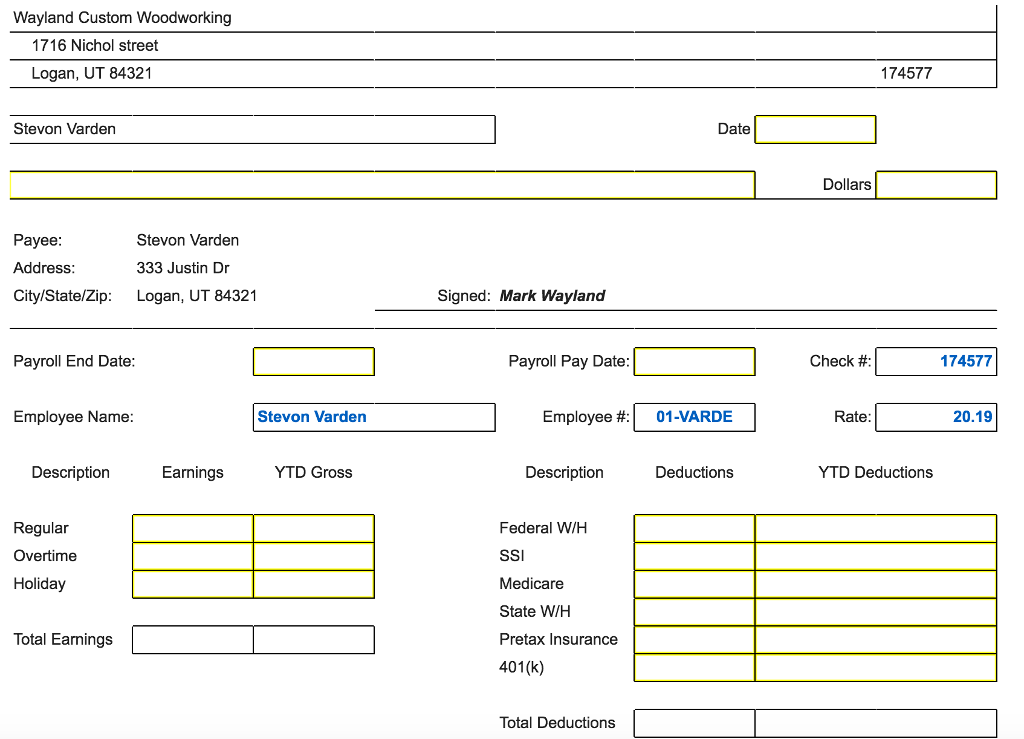

| 01-Varde | Stevon Varden 333 Justin Drive Logan, UT 84321 435-555-9981 Job title: Craftsman | Married, 2 withholding allowances Nonexempt $42,000/year Start Date: 10/1/2015 SSN: 022-66-1131 |

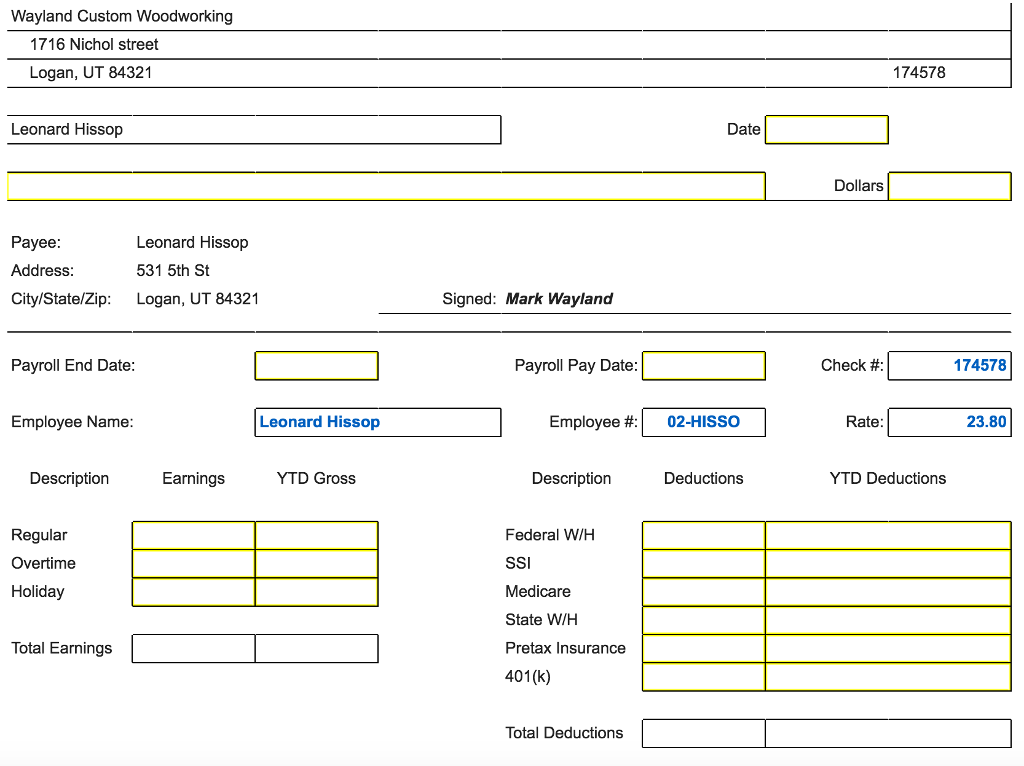

| 02-Hisso | Leonard Hissop 531 5th Street Logan, UT 84321 435-555-5858 Job title: Purchasing/Shipping | Single, 4 withholding allowances Nonexempt $49,500/year Start Date: 10/1/2015 SSN: 311-22-6698 |

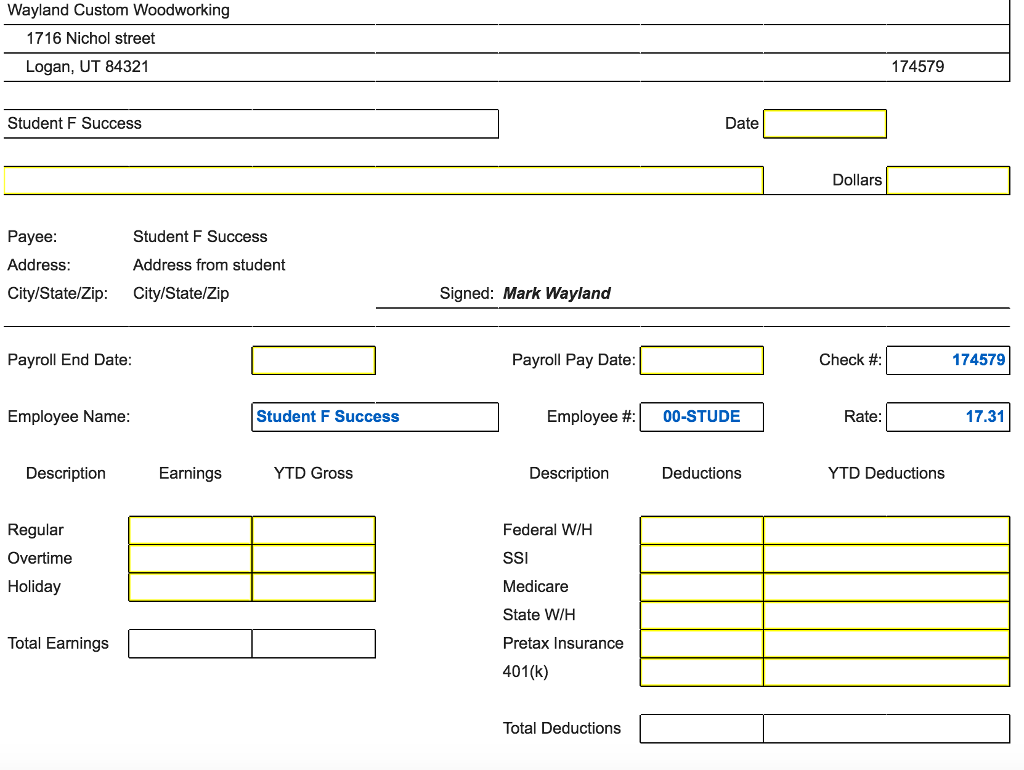

| 00-Stude | Student F Success 480-555-3322 Job title: Accounting Clerk | Single, 1 withholding allowance Nonexempt $36,000/year Start Date: 10/1/2015 SSN: 555-55-5555 |

Voluntary deductions for each employee are as follows:

| Name | Deduction |

| Chinson | Insurance: $50/paycheck |

| 401(k): 3% of gross pay | |

| Wayland | Insurance: $75/paycheck |

| 401(k): 6% of gross pay | |

| Peppinico | Insurance: $75/paycheck |

| 401(k): $50 per paycheck | |

| Varden | Insurance: $50/paycheck |

| 401(k): 4% of gross pay | |

| Hissop | Insurance: $75/paycheck |

| 401(k): 3% of gross pay | |

| Student | Insurance: $50/paycheck |

| 401(k): 3% of gross pay | |

The departments are as follows:

Department 00: Sales and Administration

Department 01: Factory workers

Department 02: Delivery and Customer service

1. You have been hired as of October 1 as the new accounting clerk. Your name is Student F. Success and your employee number is 00-STUDE. Your Utah drivers license is 887743 expiring in 7/2018 and social security number is 555-55-5555, and you are non-exempt and paid at a rate of $36,000 per year. Using the information provided, complete the W-4 and the I-9 to start your employee file. Complete as if Single with 1 withholding, you decide to contribute 3% to 401(k) and health insurance is $50 per pay period.

2. Complete the headers of the Employees' Earnings Records for all company employees. Enter the YTD earnings for each employee.

QQQQQQ*******QQQQQQQ********

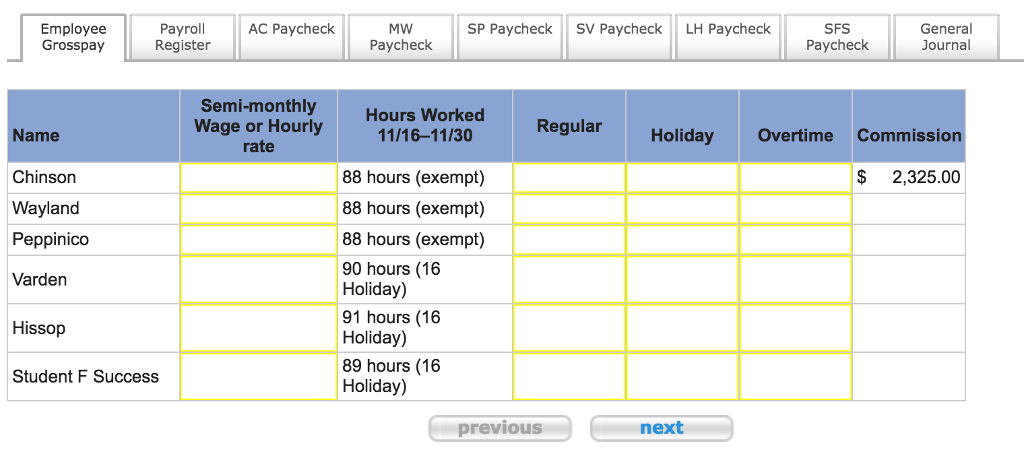

November 30 is the end of the final pay period for the month. Employee pay will be disbursed on December 3, 201X. Any hours exceeding 88 are considered overtime. Compute the employee gross pay.

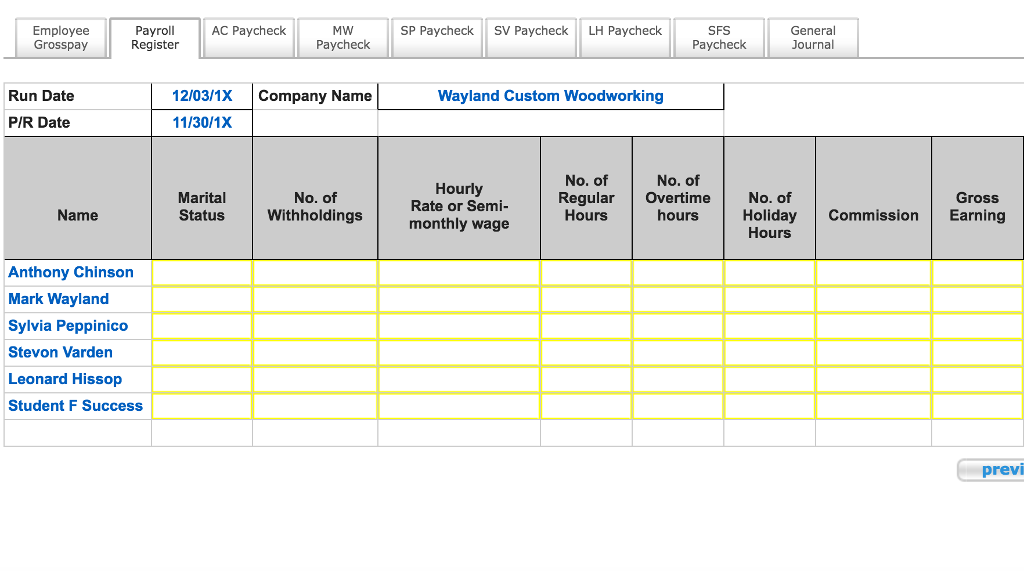

Compute the Net Pay for each employee using the payroll register. Once you have computed the net pay, complete the paycheck for each employee (assume that all the employees are paid by check). Date the checks 12/3/1X (current year).

The company is closed and pays for the Friday following Thanksgiving. The employees will receive holiday pay for Thanksgiving and the Friday following. For this period, any hours in excess of 88 hours is considered overtime.

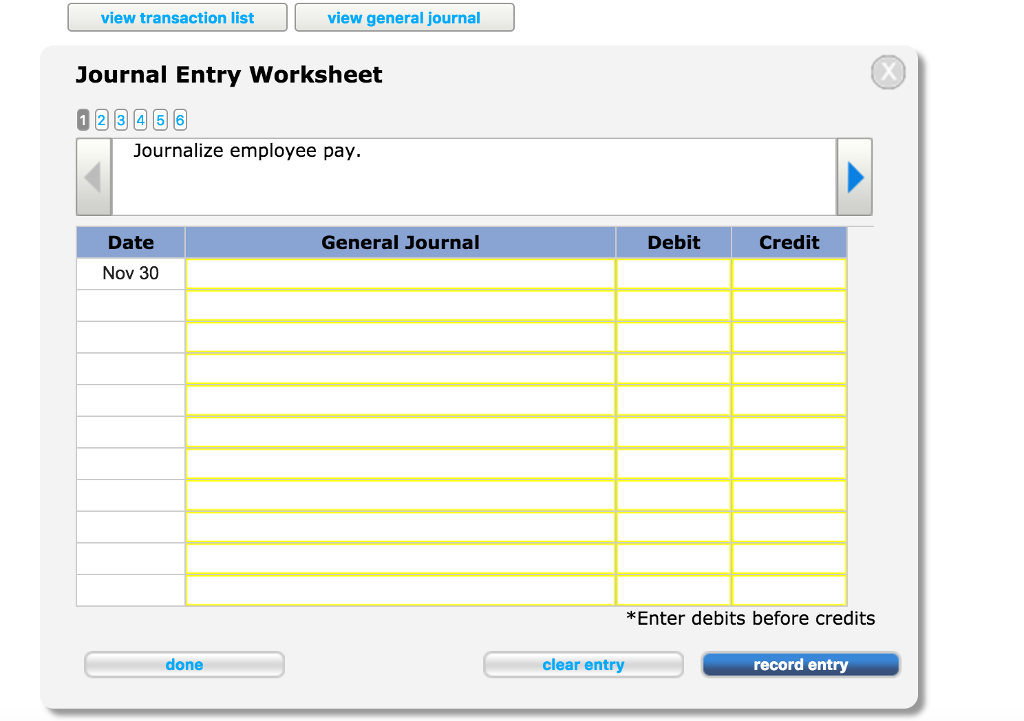

Complete the General Journal entries as follows:

30-Nov Journalize employee pay for the period. 30-Nov Journalize employer payroll tax for the November 30 pay date 03-Dec Journalize payment of payroll to employees (use one entry for all checks). 03-Dec Journalize remittance of 401(k) and health insurance premiums deducted 03-Dec Journalize remittance of monthly payroll taxes

Update the Employees' Earnings Records for the periods pay and update the YTD amount.

-NOTE 1: Do not round intermediate calculations and round hourly rate to 5 decimal places & remaining answers to 2 decimal places. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

-NOTE 2: When writing out the net amount of an employee's check, be sure to write it in the correct format (e.g. Three Hundred Ninety-nine and 75/100). Be sure to capitalize the letters as shown. Enter all dates in mm/dd/yy format where year is entered as 1X.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started