Question

Wayne Automotive produces four lines of auto accessories for the major Detroit automobile manufacturers. The lines are known by the code letters A, B, C,

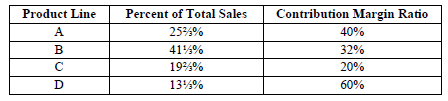

Wayne Automotive produces four lines of auto accessories for the major Detroit automobile manufacturers. The lines are known by the code letters A, B, C, and D. The current sales mix for Wayne and the contribution margin ratio (unit contribution margin divided by unit sales price) for these product lines are as follows:

Total sales for next year are forecast to be $150,000. Total fixed costs will be $35,000. a.Prepare a table showing (1) sales, (2) total variable costs, and (3) the total contribution marginassociated with each product line. b.What is the aggregate contribution margin ratio indicative of this sales mix? c.At this sales mix, what is the break-even point in dollars?

Total sales for next year are forecast to be $150,000. Total fixed costs will be $35,000. a.Prepare a table showing (1) sales, (2) total variable costs, and (3) the total contribution marginassociated with each product line. b.What is the aggregate contribution margin ratio indicative of this sales mix? c.At this sales mix, what is the break-even point in dollars?

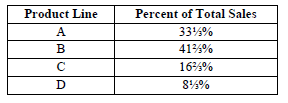

Because of production constraints, Wayne Automotive (see Question 4.) may have to adhere to a different sales mix for next year. The alternative plan is outlined as follows:  a.Assuming all other facts in Question 4. remain the same, what effect will this different salesmix have on Waynes break-even point in dollars? b.Which sales mix will Waynes management prefer?

a.Assuming all other facts in Question 4. remain the same, what effect will this different salesmix have on Waynes break-even point in dollars? b.Which sales mix will Waynes management prefer?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started