Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wayne, Inc., wishes to expand its facilities. The company currently has 7 million shares outstanding and no debt. The stock sells for $40 per share,

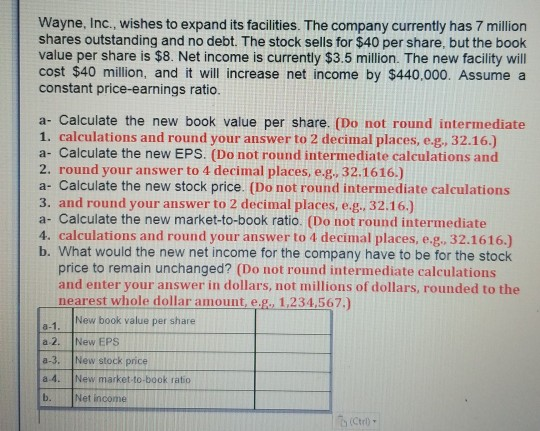

Wayne, Inc., wishes to expand its facilities. The company currently has 7 million shares outstanding and no debt. The stock sells for $40 per share, but the book value per share is $8. Net income is currently $3.5 million. The new facility will cost $40 million, and it will increase net income by $440,000. Assume a constant price-earnings ratio. a- Calculate the new book value per share. (Do not round intermediate 1. calculations and round your answer to 2 decimal places, eg, 32.16.) a- Calculate the new EPS. (Do not round intermediate calculations and 2. round your answer to 4 decimal places, e.g., 32.1616.) ew stock price. (Do not round intermediate calculations 3. and round your answer to 2 decimal places, e.g. 32.16.) a- Calculate the new market-to-book ratio. (Do not round intermediate 4. calculations and round your answer to 4 decimal places, e.g. 32.1616.) b. What would the new net income for the company have to be for the stock price to remain unchanged? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole dollar amount, e... 1,234,567.) New book value per share New EPS New stock price New market-to-book ratio Net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started