Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wayne Marine Equipment Ltd . ( WMEL ) has decided to proceed with the manufacture and distribution of the high pressure marine cleaning device (

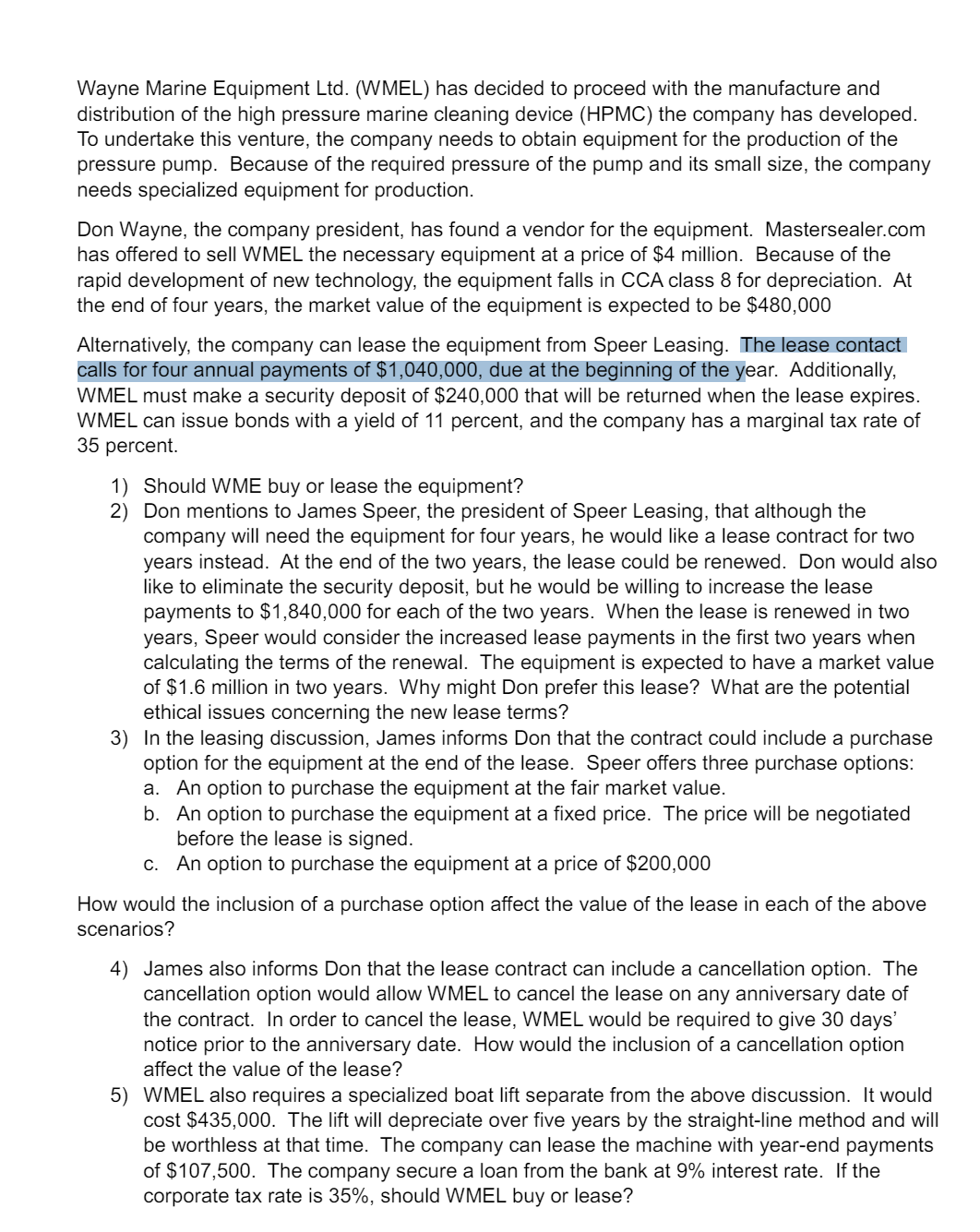

Wayne Marine Equipment LtdWMEL has decided to proceed with the manufacture and

distribution of the high pressure marine cleaning device HPMC the company has developed.

To undertake this venture, the company needs to obtain equipment for the production of the

pressure pump. Because of the required pressure of the pump and its small size, the company

needs specialized equipment for production.

Don Wayne, the company president, has found a vendor for the equipment.

Mastersealer.com

has offered to sell WMEL the necessary equipment at a price of $ million. Because of the

rapid development of new technology, the equipment falls in CCA class for depreciation. At

the end of four years, the market value of the equipment is expected to be $

Alternatively, the company can lease the equipment from Speer Leasing. The lease contact

calls for four annual payments of $ due at the beginning of the year. Additionally,

WMEL must make a security deposit of $ that will be returned when the lease expires.

WMEL can issue bonds with a yield of percent, and the company has a marginal tax rate of

percent.

Should WME buy or lease the equipment?

Don mentions to James Speer, the president of Speer Leasing, that although the

company will need the equipment for four years, he would like a lease contract for two

years instead. At the end of the two years, the lease could be renewed. Don would also

like to eliminate the security deposit, but he would be willing to increase the lease

payments to $ for each of the two years. When the lease is renewed in two

years, Speer would consider the increased lease payments in the first two years when

calculating the terms of the renewal. The equipment is expected to have a market value

of $ million in two years. Why might Don prefer this lease? What are the potential

ethical issues concerning the new lease terms?

In the leasing discussion, James informs Don that the contract could include a purchase

option for the equipment at the end of the lease. Speer offers three purchase options:

a An option to purchase the equipment at the fair market value.

b An option to purchase the equipment at a fixed price. The price will be negotiated

before the lease is signed.

c An option to purchase the equipment at a price of $

How would the inclusion of a purchase option affect the value of the lease in each of the above

scenarios?

James also informs Don that the lease contract can include a cancellation option. The

cancellation option would allow WMEL to cancel the lease on any anniversary date of

the contract. In order to cancel the lease, WMEL would be required to give days'

notice prior to the anniversary date. How would the inclusion of a cancellation option

affect the value of the lease?

WMEL also requires a specialized boat lift separate from the above discussion. It would

cost $ The lift will depreciate over five years by the straightline method and will

be worthless at that time. The company can lease the machine with yearend payments

of $ The company secure a loan from the bank at interest rate. If the

corporate tax rate is should WMEL buy or lease?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started