Wayne Rooney issues $100,000 bonds on January 1, 2013. The bonds mature on December 31, 2015. The stated rate of interest is 8%, and interest payments are made semi-annually (on June 30 and December 31 of each year). Determine the bonds cash flows and put those in a timeline.

Recall that the interest payment is computed as: Face Value x Stated Rate of Interest

1. The market demands a 10% effective yield on these bonds. What will they sell for?

2. Why are these bonds issued at a discount?

3. What is the sum of money that Wayne Rooney is borrowing through this bonds issuance?

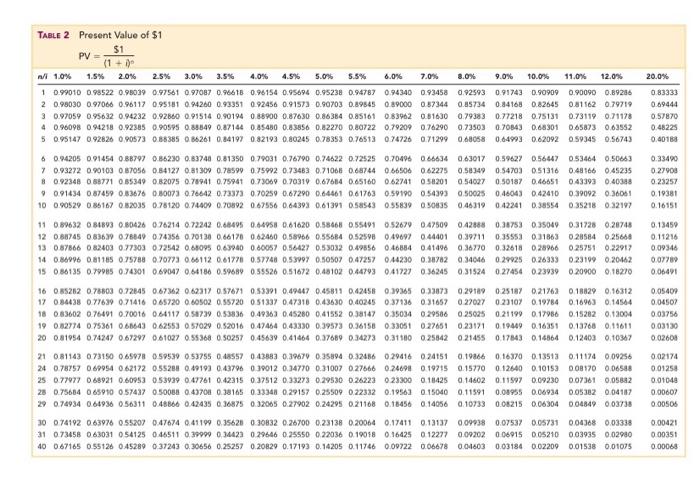

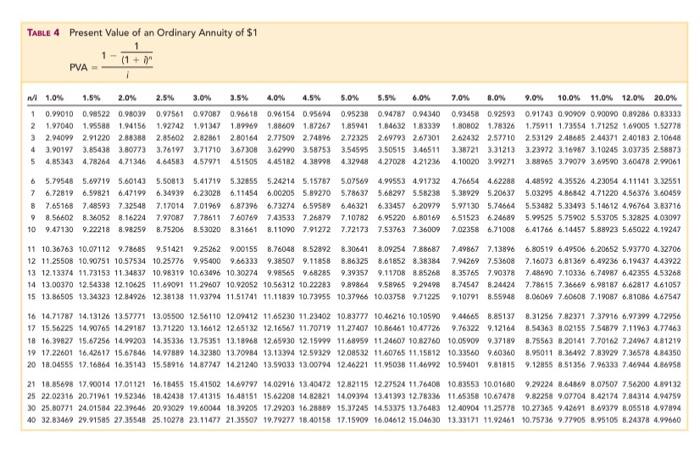

PV TABLE 2 Present Value of $1 $1 (1 + n 1.0% 1.5% 20% 2.5% 3.0% 4.0% 5.0% 5.5% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 10.99010 098522 0.98039 0.97561 0.97087 0.96618 0.96154 0.95694 0.95238 0.94787 0.94340 0.93458 0.92593 091743 0.90909 0.90090 0.89286 2 0.98030 0.97066 0.96117 0.95581 0.94260 0.93351 0.92456 0.91573 0.90703 0.89545 019000 0.37344 0.85734 0.84168 0.82645 0.81162 0.79719 30.97059 0.95632 0.94232 0.92860 0.91514 0.90194 0.88900 0.87630 0.86384 0.85161 0.8392 0.81630 0.79383 0.77218 0.75131 0.73119 0.71178 4 09098 094218 0.92385 0.90595 0.88849 0.87144 0.45480 0.83856 0.82270 0.80722 0.79209 0.74290 0.73503 0.70343 0.68301 0.65873 0.63552 5 0.95147 092826 0905 73 085385 0.36261 0.84197 0.82193 0.80245 0.78353 0.76513 0.74726 0.71299 068068 064993 0.62092 0.59345 0.56743 20.0% 0.83333 0.69444 0.57870 0.46225 0.40183 0.33490 0.27900 0.23257 0.19381 0.16151 6 0.94205 0.91454 0.BB797 0.86290 0.83740 0.81350 0.79031 0.76790 0.74622 0.72525 0.70496 0.66634 0.63017 0.59622 0.56447 0.53464 0.50663 7 0.93272 0.90103 067056 0.54127 0.81309 0.78599 0.75992 0.73483 0.71066 0.68744 066506 0.62275 0.58349 0.54703 0.51316 0.48166 0.45235 8 0.92348 068771 085349 0.82075 0.78941 0.75947 0.73069 0.70319 0.67614 0.65160 0.62741 58201 0.54027 050187 0.46651 0.43393 0.40388 9 0.91434 087459 0.83676 080073 0.76642 0.73373 0.70259 0.67290 064461 061763 0.59190 0.543930.50925 046043 0.42410 0.39092 0.36061 10 0.90529 0.86167 0.52035 0.78120 0.74409 .70892 0.67556 0.64393 0.61391 0.58543 0.35839 0.50835 046319 0.42241 0.38554 0.35218 0.32197 11 0.89632 084B93 0.80426 076214 0.72242 0.68405 0.64958 0.61620 0.58468 0.55491 0.52679 0.47509 042888 0.38753 0.35049 0.31728 0.20748 12 0.88745 0.8369 0.78849 0.74356 0.70130 066170 0.62460 0.58966 0.55684 0.52598 0.49692 0.44401 0.39711 035553 0.31863 0.28584 0.25668 13 0.87866 082403 0.77303 072542 068095 0.63940 060057 0.56427 0.53032 0.49856 0.46884 0.41496 0.36770 0.32618 028966 0.25751 0.22917 14 0.86996 0.81185 0.75788 0.70773 066112 0.61778 0.57748 0.53997 0.50507 0.47257 044230 0.30782 0.34046 0.29925 0.26333 0.23109 0.20462 15 086135 0.79985 0.74301 069047 064186 0.59689 0.55526 0.51672 0.48102 044793 041727 036245 0.31524 0 27454 0.23939 0.20900 0.18270 0.13450 0.11216 0.09346 0.07780 0.06491 16 0.85262 0.76803 0.72845 0.67362 0.62317 0.57671 0.53391 0.49447 0.45811 0.42458 0.19365 0.33873029789025187 0.21762 0.18829 0.16312 17 034438 0.77639 0.71416 065720 0.60502 0.55720 051337 0.47318 0.43630 0.40245 0.37136 0.31657 27027 023107 0.19784 0.16963 0.14564 18 0.63602 0.76401 0.70016 0.64117 058739 0.53836 049363 0.45280 0.41552 038147 0.35034 0.29586 0.25025 0.21190 0.17986 0.15262 0.12004 19 0.82774 0.75361 061643 0.62553 0.57029 0.52016 0.47464 0.43330 0.39573 0.36158 0.33051 0.27651 023171 0.19449 0.16351 0.13768 0.11611 20 081054 0.74247 067297 0.61027 0.55368 0.50257 0.45639 041464 0.37689 0.34273 0.31500 0.25842 0.21455 0.17843 016864 0.12403 0.10367 0.05409 0.04507 0.03756 0.03130 0.02608 21 0.81143 073150 065078 0.59539 0.53755 0.48557 0.43883 0.39679 0.35894 0.32456 029416 0.24151 0.19866 016370 0.13513 0.11174 0.09256 24 0.78757 0.69954 062172 0.55284 0.49193 0.43796 0.30012 0.34770 0.31007 0.27666 0.24691 019715 0.15770 0.12640 0.10153 008170 006588 25 077977 068921 0.60953 0.53939 0.47761 0.42315 0.37512 0.33273 0.29530 0.26223 023300 018425 014602 0.11597 0.09230 0.07361 0.05882 28 0.75664 065910 0.57437 0.500 0.47704 0.38165 0.33348 0.29157 0.25509 0.22332 0.19561 015040 0.11591 0.08955 0.06934 0.05302 0.04187 29 0.74934 064936 056311 0.48866 0.42435 0.36875 0.32065 0.27902 0.24295 0.21168 0.18456 0.14056 0.10733 0.06215 0.06304 0.04849 003738 30 074192 063976 0.55207 0.47674 0.41199 035621 030832 0.26700 0.23138 0.20064 0.17411 0.13137 009938 0.07537 0.05731 0.04368 0.03338 31 073458 063031 054125 0 46511 0.39999 0.34423 0.29646 0.25550 0.22036 0.19018 0.16425 012277 0.09202 006915 0.05210 0.03935 0.02980 40 067165 0.55126 0.45289 037243 0.30656 0.25257 0.20829 0.17193 0.14205 0.11746 0.09722 0.06678 0.01603 0.03184 0.02209 0.01538 0.01075 0.02174 0.01258 0.01040 0.00607 0.00506 0.00421 0.00351 0.00068 TABLE 4 Present Value of an Ordinary Annuity of $1 (1 + PVA W 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 10.99010 0.98522 0.98039 0.07561 0.97087 0.96618 0.96154 0.95694 0.95238 0.94787 0.94340 2 1.97040 1.95588 1.94156 1.92742 1.91347 1.09969 1.88600 1.87267 185941 1.84632 183339 3 2.94099 2.91220 2.88388 2.85602 2.82861 2.80164 2.77509 2.74896 2.72325 2.69793 2.67301 4 3.90197 3.85438 3.80773 3.76197 3.71710 3.67308 3.62990 3.58753 3.54595 3.50515 3.46511 5 4.85343 4.78264 4.71346 4,64583 457971 4.51505 4,45182 4.389984.32948 4.27028 421236 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 20.0% 0.93458 0.92593 0.01743 0.90109 0.00090 0.89286 0.83333 1.80802 1.78326 1.75911 1.73554 171252 1,69005 1.52778 262432 2.57710 2.53129 2.48685 2.44371 2,40183 2.10648 3.38721 3.31213 3.23972 3.16987 3.10245 3.03735 258873 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 2.99061 0 5.79548 5.49719 5.60143 5.50813 5.41719 5.32855 5.242145.15787 5.07569 4.99553 4.91732 7 6.72819 6.59821 6.47199 6.34939 6.23028 0.11454 0.00205 589270 5.78637 5.68297 5.58238 8 7.65168 7.48593 732548 7.17014 7.01969 6.87396 6.73274 6.59569 6,46321 6.33457 620979 98.56602 8.36052 8.162247.970877.78611 760769 7.43533 726879710782 6.95220 680169 10. 9.47130 9.22218 8.98259 8.75206 8.53020 8.31661 8.11090 7.91272 7.721737.53763 736000 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.32551 5.38929 5.20637 5,03295 4.86842 4.71220 4.56376 3.60459 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 3.83716 6.51523 6.24689 5.99525 5.75902 5.53705 5.37825 4.03097 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022 4.19247 11 10.36763 10.07112 9.78685 9.51421 9.25262 9.00155 8.76048 8.52892 8.30641 8.09254 7.88687 12 11.25508 10.90751 10.57534 10.25776 9.95400 9.66333 9.385079.11858 8.86325 8.61852 8.38384 13 12.13374 11.73153 11.34837 10.98319 10.63496 10.30274 9.98565 9.68285 9.39357 9.11708 8.85268 14 13.00370 52.54338 12.10625 11.69091 11,29607 10.92052 10.56312 10 22283 9.89864 9.58965 9.29498 15 13.86505 13.34323 12.84926 12.35138 11.93794 11.51741 11.11839 10.73955 10.37966 10.03758 9.71225 7.49867 7.13896 6.80519 6.49506 620652 5.93770 4.82706 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 4.43922 8.35765 7.90378 7.48690 7.10336 6.74987 6,42355 4.53268 8.74547 8.24424 7.78615 7.36669 6.98187 662817 461057 9.10791 8.55948 8.06069 7.60608 7.19087 6,81086 4.67547 16 14.71787 14.13126 13.57771 13.05500 12.56110 12.09412 11.65230 11.23402 10.83777 10.46216 10.10590 9.44665 8.85137 8.31256 7.82371 7.37916 6.97 399 4.72956 17 15.56225 14.90765 14.29187 13.71220 13.16612 12.65132 12.16567 11.70719 11.27407 1086461 10.47726 9.76322 9.12164 8.54363 8.02155 754879 7.11963 4.77463 18 16.39827 15.67256 14.99203 14,35336 13.75351 13.18968 12.65930 12.15999 1168950 11.24607 10.82760 10.05909 9.37189 8.75563 B.20141 7.70162 7.24967 4.81219 19 17.22601 16,42617 15.67846 14.97889 14.32380 13.70984 13.13394 12.59329 1208532 11.60765 11,15812 10.33560 9.60360 8.95011 8.36492 783929 7.36578 4.84350 20 18.04555 17.16364 16.35143 15.58916 14.87747 14.21240 13.59033 13.00794 12.46221 11.95038 11.46992 10.59401 9.818159.12855 8.51356 7.96333 7.46944 4.86958 21 18.85698 17.90014 17.01121 16.18455 15.41502 14.69797 14.02916 13.40472 12.82115 12.27524 11.76408 10.83553 10.01680 9.29224 8.6439 3.02507 7.56200 4.89132 25 22.02316 20.71961 19.52346 18.42438 17.41315 16.48151 15.62208 14.82821 14.09194 13.41393 12.78336 11.65358 10.67478 2.82258 9.07704 8.42174 7.84314 4.94759 30 25.50771 24.01584 22.39646 20.93029 19.60044 18.39205 17.29203 16.28889 15.37245 14.53375 13.76483 12.40904 11.25778 10.27365 942691 8.69379 8.05518 4.97894 40 32.83469 29.01585 27.35548 25.10278 23.11477 21.35507 10.79272 18.40158 17.15909 16.04612 15.04630 13.38171 11.92461 10.75736 9.77905 8.95105 8.24378 4.99660