Question

Waysafe Inc. consists of two grocery stores. The first store is fairly valued at $60M and the second store, valued at $50M, could be torn

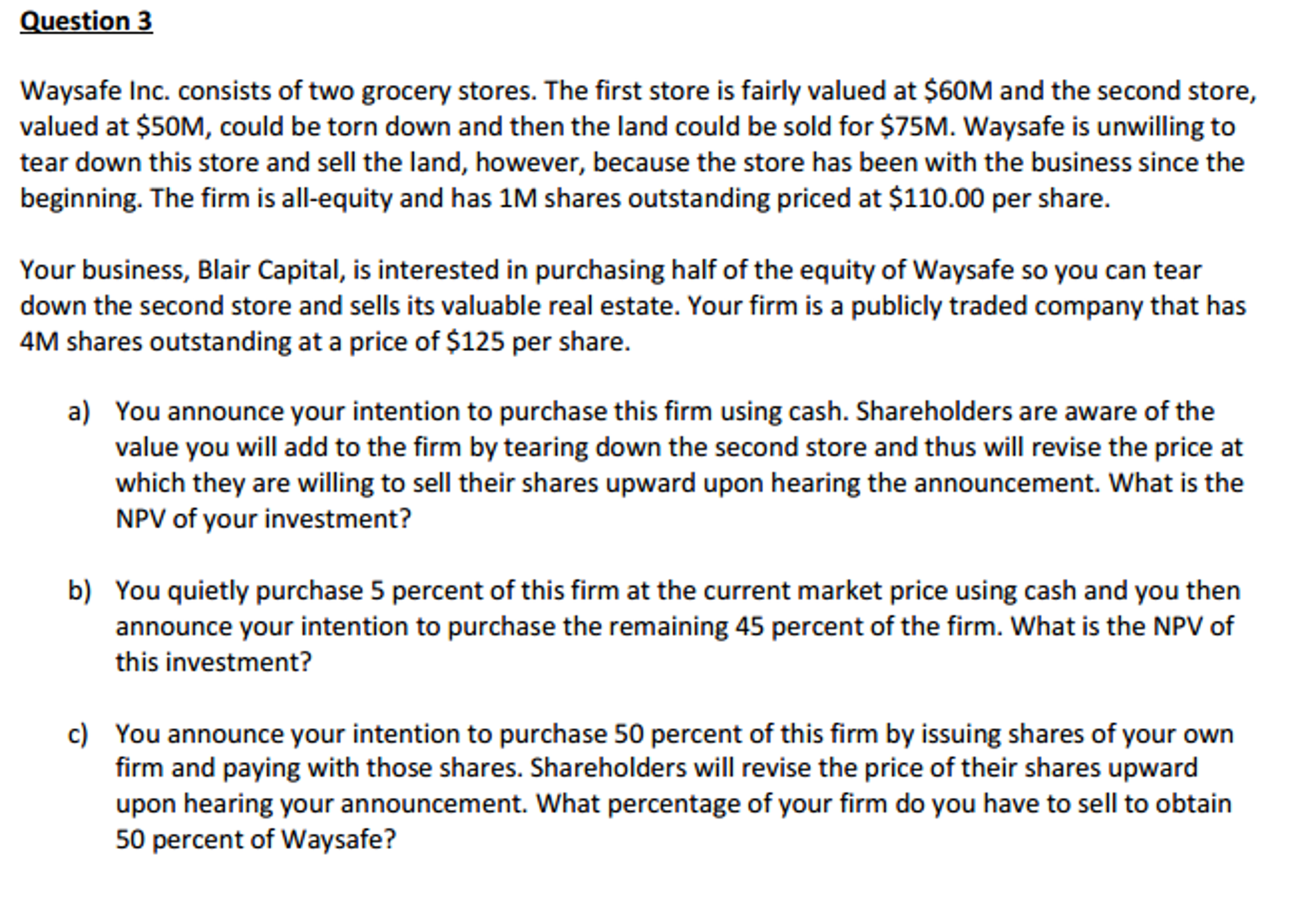

Waysafe Inc. consists of two grocery stores. The first store is fairly valued at $60M and the second store, valued at $50M, could be torn down and then the land could be sold for $75M. Waysafe is unwilling to tear down this store and sell the land, however, because the store has been with the business since the beginning. The firm is all-equity and has 1M shares outstanding priced at $110.00 per share.

Waysafe Inc. consists of two grocery stores. The first store is fairly valued at $60M and the second store, valued at $50M, could be torn down and then the land could be sold for $75M. Waysafe is unwilling to tear down this store and sell the land, however, because the store has been with the business since the beginning. The firm is all-equity and has 1M shares outstanding priced at $110.00 per share.

Your business, Blair Capital, is interested in purchasing half of the equity of Waysafe so you can tear down the second store and sells its valuable real estate. Your firm is a publicly traded company that has 4M shares outstanding at a price of $125 per share.

a) You announce your intention to purchase this firm using cash. Shareholders are aware of the value you will add to the firm by tearing down the second store and thus will revise the price at which they are willing to sell their shares upward upon hearing the announcement. What is the NPV of your investment?

b) You quietly purchase 5 percent of this firm at the current market price using cash and you then announce your intention to purchase the remaining 45 percent of the firm. What is the NPV of this investment?

c) You announce your intention to purchase 50 percent of this firm by issuing shares of your own firm and paying with those shares. Shareholders will revise the price of their shares upward upon hearing your announcement. What percentage of your firm do you have to sell to obtain 50 percent of Waysafe?

Show step by step work no excel please!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started