Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wazer Enterprise buys a production machine at the price of RM 450,000, three years ago. The company need to pay an additional cost of

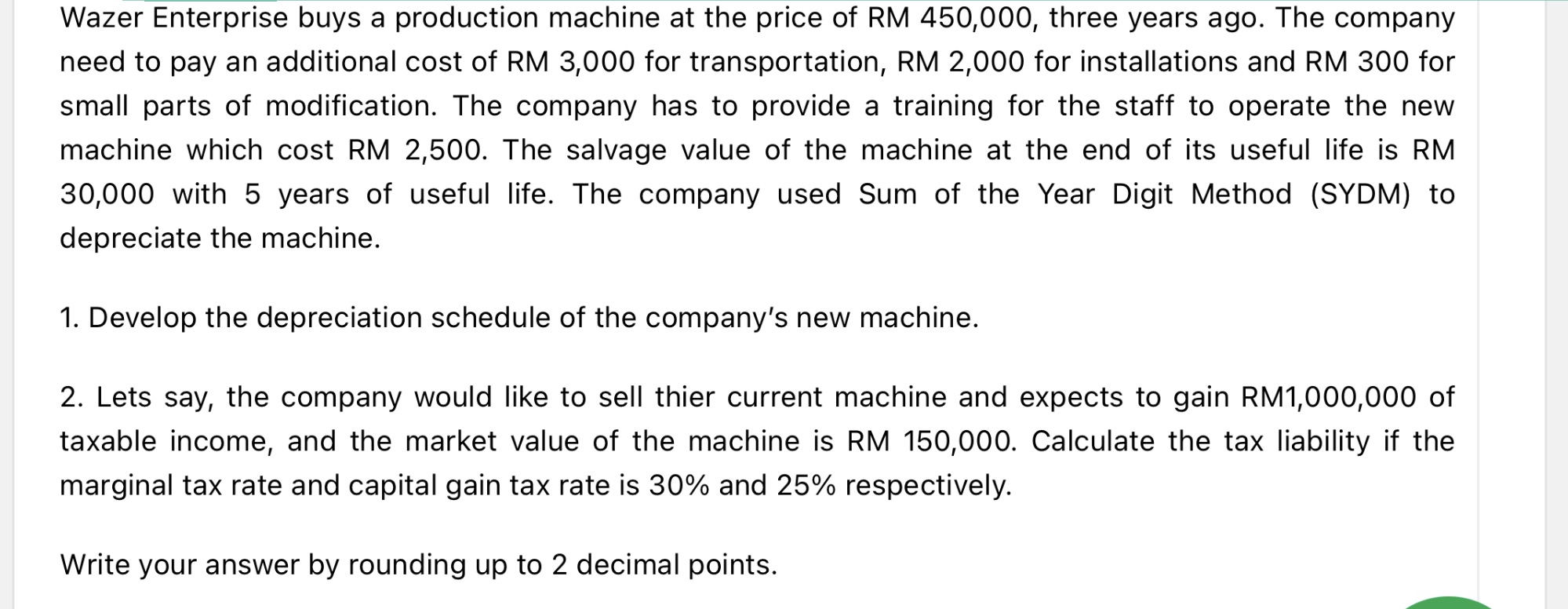

Wazer Enterprise buys a production machine at the price of RM 450,000, three years ago. The company need to pay an additional cost of RM 3,000 for transportation, RM 2,000 for installations and RM 300 for small parts of modification. The company has to provide a training for the staff to operate the new machine which cost RM 2,500. The salvage value of the machine at the end of its useful life is RM 30,000 with 5 years of useful life. The company used Sum of the Year Digit Method (SYDM) to depreciate the machine. 1. Develop the depreciation schedule of the company's new machine. 2. Lets say, the company would like to sell thier current machine and expects to gain RM1,000,000 of taxable income, and the market value of the machine is RM 150,000. Calculate the tax liability if the marginal tax rate and capital gain tax rate is 30% and 25% respectively. Write your answer by rounding up to 2 decimal points.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started