Answered step by step

Verified Expert Solution

Question

1 Approved Answer

We are entering in a Long contract Ch. 3 H.W. - Search es Help Mailings Review View Aav Ao E A.EE ARBbccdd AaBbcend AaBbc Aabbcc

We are entering in a Long contract

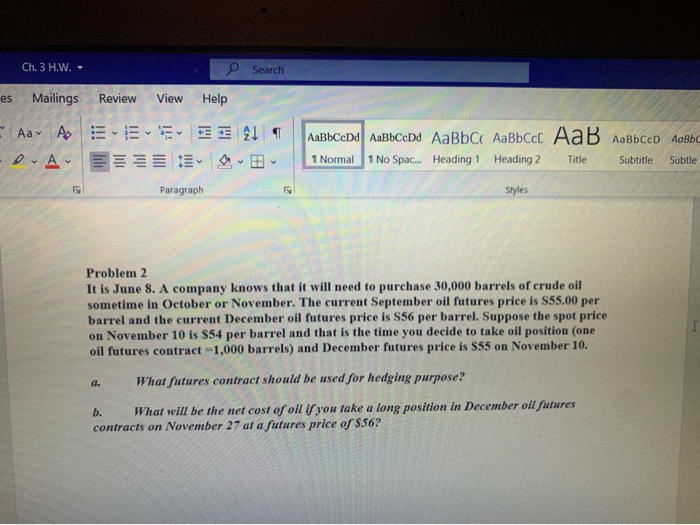

Ch. 3 H.W. - Search es Help Mailings Review View Aav Ao E A.EE ARBbccdd AaBbcend AaBbc Aabbcc AaB Aabbccd AoBbc 1 Normal 1 No Spac... Heading 1 Heading 2 Title Subtitle Subtle Paragraph Styles Problem 2 It is June 8. A company knows that it will need to purchase 30,000 barrels of crude oil sometime in October or November. The current September oil futures price is $55.00 per barrel and the current December oil futures price is S56 per barrel. Suppose the spot price on November 10 is S54 per barrel and that is the time you decide to take oil position (one oil futures contract 1,000 barrels) and December futures price is $55 on November 10. a. What futures contract should be used for hedging purpose? b. What will be the nel cost of oil il you take a long position in December oil futures contracts on November 27 at a futures price of $56 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started