Question: We are looking for answers for both 3A and B. Any help would be appreciated, thank you! Assume that GSK (U.K.) sells generic (non-branded) pharmaceutical

We are looking for answers for both 3A and B. Any help would be appreciated, thank you!

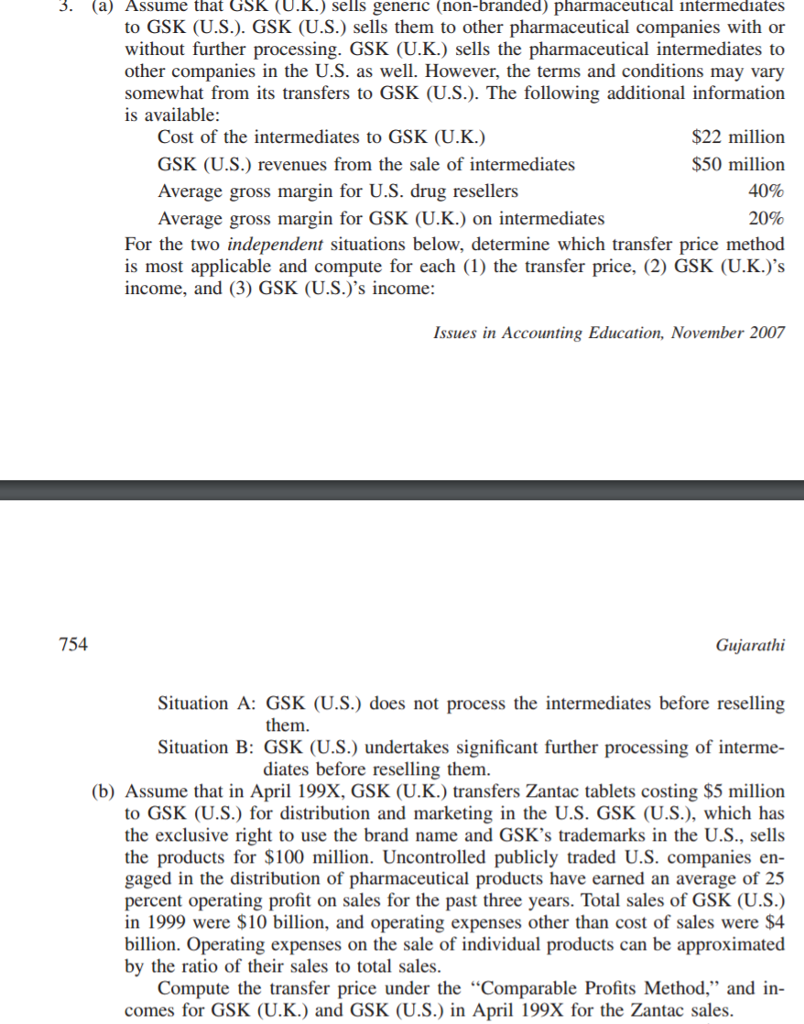

Assume that GSK (U.K.) sells generic (non-branded) pharmaceutical intermediates to GSK (U.S.). GSK (U.S.) sells them to other pharmaceutical companies with or without further processing. GSK (U.K.) sells the pharmaceutical intermediates to other companies in the U.S. as well. However, the terms and conditions may vary somewhat from its transfers to GSK (U.S.). The following additional information is available: For the two independent situations below, determine which transfer price method is most applicable and compute for each (1) the transfer price, (2) GSK (U.K.)'s income, and (3) GSK (U.S.)'s income: GSK (U.S.) does not process the intermediates before reselling them. GSK (U.S.) undertakes significant further processing of intermediates before reselling them. Assume that in April 199X, GSK (U.K.) transfers Zantac tablets costing $5 million to GSK (U.S.) for distribution and marketing in the U.S. GSK (U.S.), which has the exclusive right to use the brand name and GSK's trademarks in the U.S., sells the products for $100 million. Uncontrolled publicly traded U.S. companies engaged in the distribution of pharmaceutical products have earned an average of 25 percent operating profit on sales for the past three years. Total sales of GSK (U.S.) in 1999 were $10 billion, and operating expenses other than cost of sales were $4 billion. Operating expenses on the sale of individual products can be approximated by the ratio of their sales to total sales. Compute the transfer price under the "Comparable Profits Method, " and incomes for GSK (U.K.) and GSK (U.S.) in April 199X for the Zantac sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts