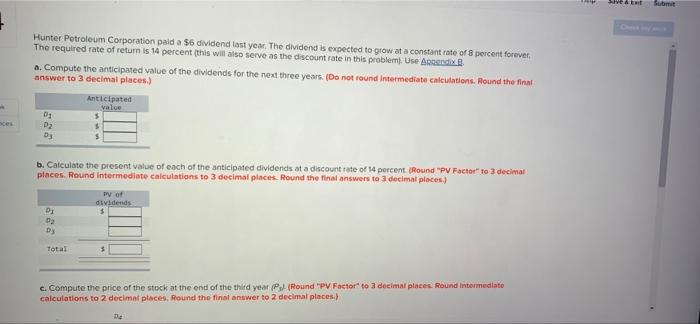

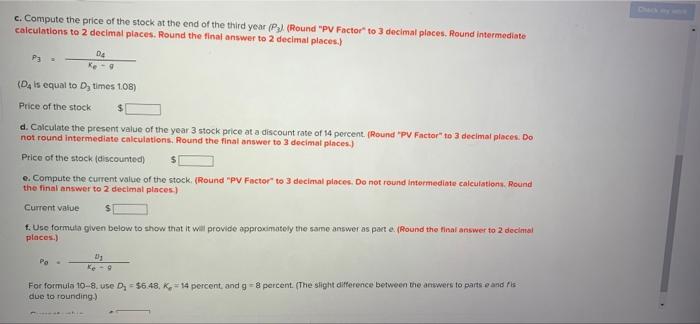

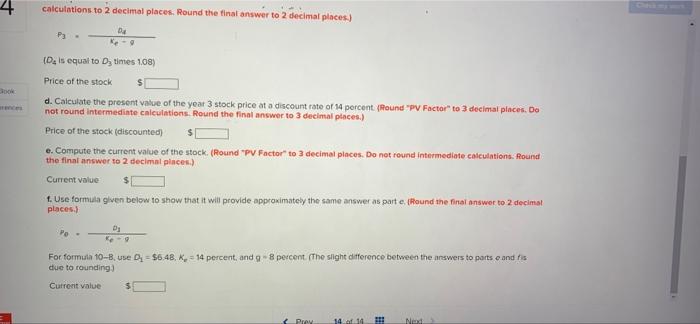

we atat Submit Hunter Petroleum Corporation paid a $6 dividend last year. The dividend is expected to grow at a constant rate of 8 percent forever The required rate of return is 14 percent this will also serve as the discount rate in this problem. Use Arend a. Compute the anticipated value of the dividends for the next three years. (Do not round Intermediate calculations. Round the final answer to 3 decimal places.) Anticipated value D D2 03 b. Calculate the present value of each of the anticipated dividends at a discount rate of 14 percent (Round "PU Factor" to 3 decimat places. Round Intermediate calculations to 3 decimal places. Round the final answers to 3 decimal places) Po dividends $ Di 02 Dy Total c. Compute the price of the stock at the end of the third year (Pl (Round "PV Factor to 3 decimal places. Round Intermediate calculations to 2 decimal places. Round the final answer to 2 decimal places) c. Compute the price of the stock at the end of the third year (P) (Round "PU Factor" to 3 decimai pinces. Round intermediate calculations to 2 decimal places. Round the final answer to 2 decimal places) D4 (D4 is equal to D, times 1.08) Price of the stock d. Calculate the present value of the year 3 stock price at a discount rate of 14 percent. (Round "PV Factor" to 3 decimal places. Do not round intermediate calculations. Round the final answer to 3 decimat places) Price of the stock (discounted) e. Compute the current value of the stock. (Round "PV Factor" to 3 decimal places. Do not round Intermediate calculations. Round the final answer to 2 decimal places) Current value t. Use formuta given below to show that it will provide approximately the same answer as parte. (Round the final answer to 2 decimal places.) Po Ke-9 For formula 10-8. use D = $6.48, K = 14 percent and g = 8 percent. (The slight difference between the answers to parts and is due to rounding) 4 calculations to 2 decimal places. Round the final answer to 2 decimal places) Du Ke- De is equal to D, times 108) 300 Price of the stock $ d. Calculate the present value of the year 3 stock price at a discount rate of 14 percent. (Round "PU Factor" to 3 decimal places. Do not round Intermediate calculations. Round the final answer to 3 decimal places.) Price of the stock (discounted) e. Compute the current value of the stock. (Round "PU Factor" to 3 decimal places. Do not round intermediate calculations. Round the final answer to 2 decimal places.) Current value $ 1. Use formula given below to show that it will provide approximately the same answer as part e. (Hound the final answer to 2 decimal places.) seo For formula 10-Buse Di = $6.48, K. = 14 percent, and a 8 percent (The slight difference between the answers to parts and is due to rounding) Current value Pre 14:10 BI! Ned