Question

We can divide the various differences into two broad categories: Competitive Effectiveness and Operational Efficiency. Competitive effectiveness can be measured by 4 variances: Temperature, Market

We can divide the various differences into two broad categories: Competitive Effectiveness and Operational Efficiency. Competitive effectiveness can be measured by 4 variances: Temperature, Market Share (excluding transfers), Sales Mix, and Product Price. For both the French region and the Italian region (we will look at Spain later), calculate the following:

A. What is the standard contribution per liter of product? (Standard contribution is the budgeted contribution margin divided by the budgeted volume in liters.)

B. How much additional product was sold due to the change in average temperature? What affect did this have on profitability?

C. Market share variance is measured by the change in total volume of product sold, times the standard contribution. What affect did this have on profitability?

D. The budget plan called for 10% of revenue to come from specialty products. What was the actual % of revenue that came from Specialty Products? This calculation is challenging, so I will give you the net effect. For the Italian region, this increased profits by 2,000 Euro. For the French region, this decreased profits by 59,000 Euro. Explain why the shift in product mix between ice creams and specialty products would cause the profit to change.

E. How much of the change in profit came about due to the product price being different? Measure this by looking at the actual sales revenue compared to the expected revenue based on planned prices and actual volumes.

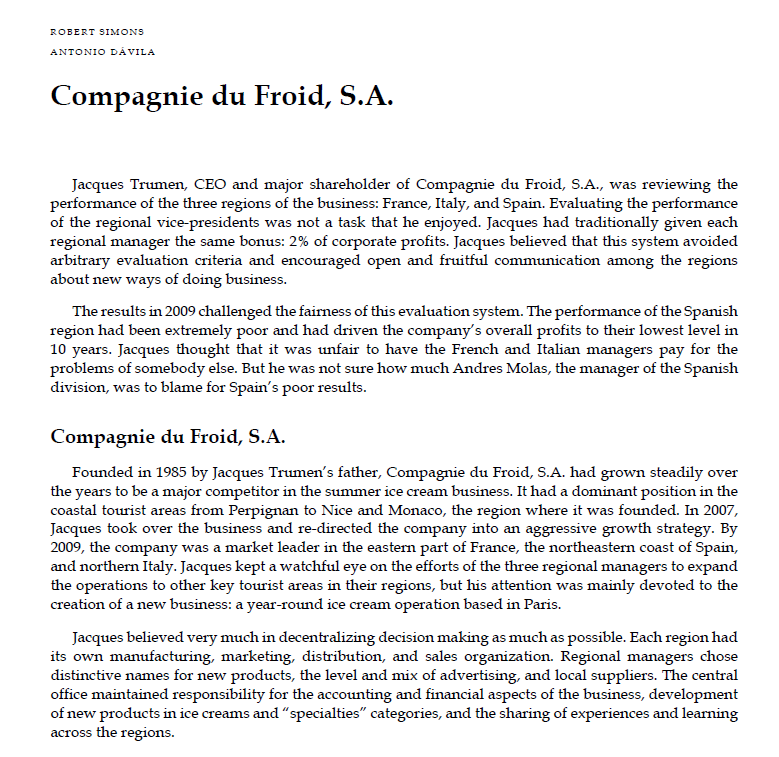

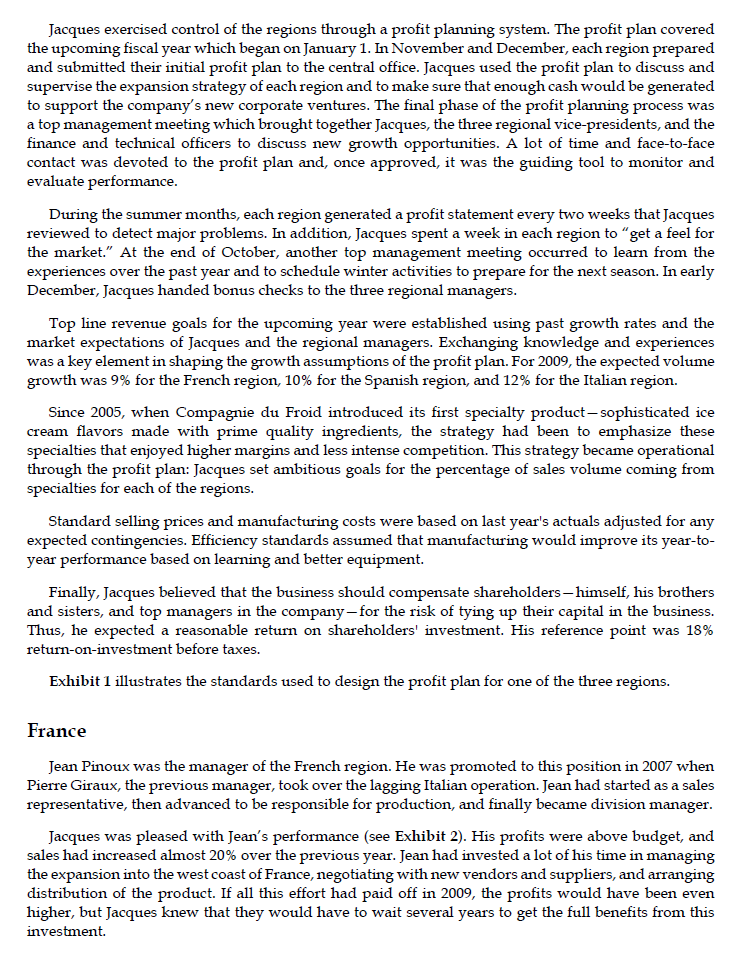

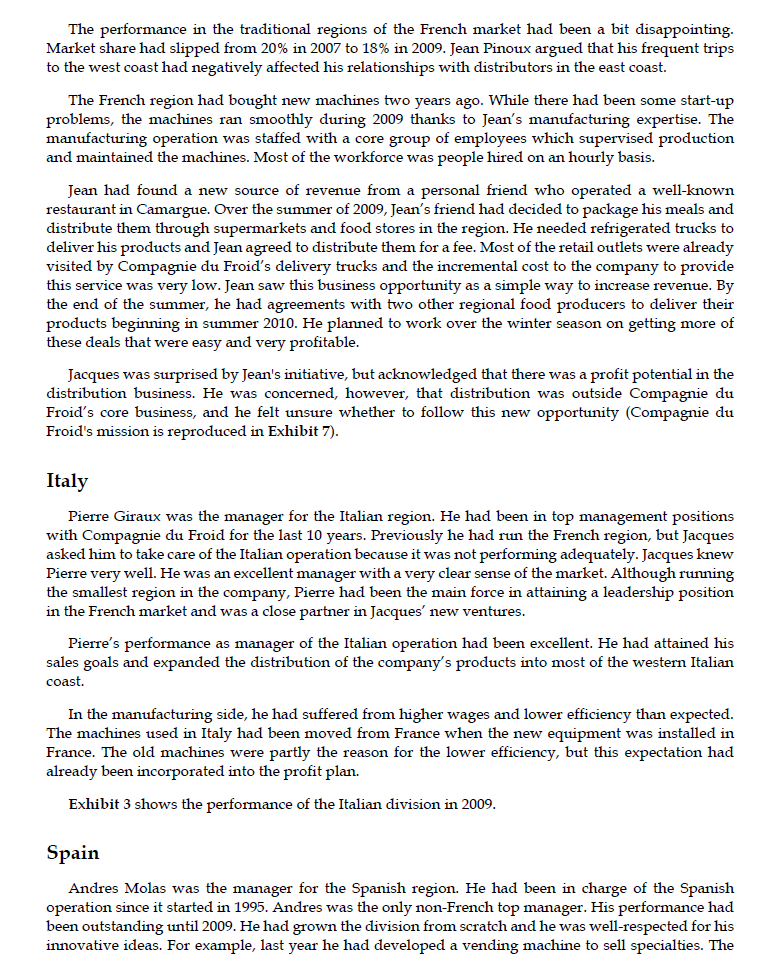

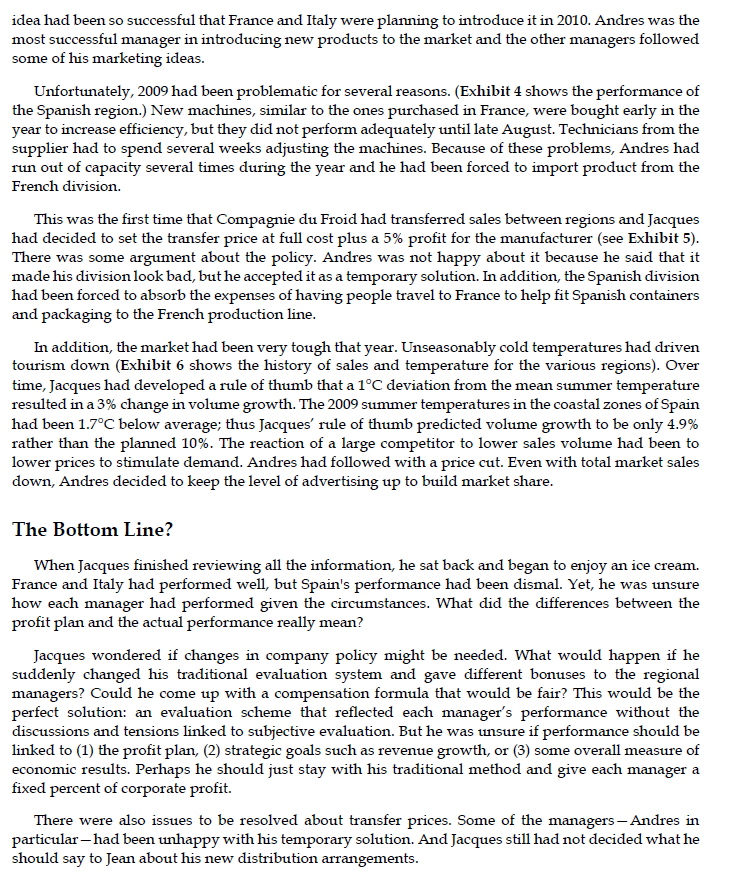

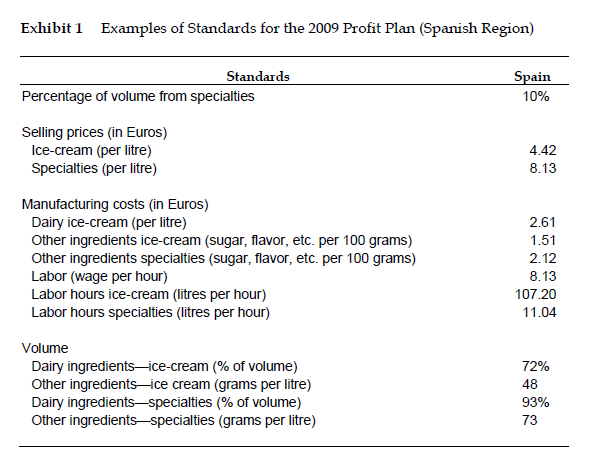

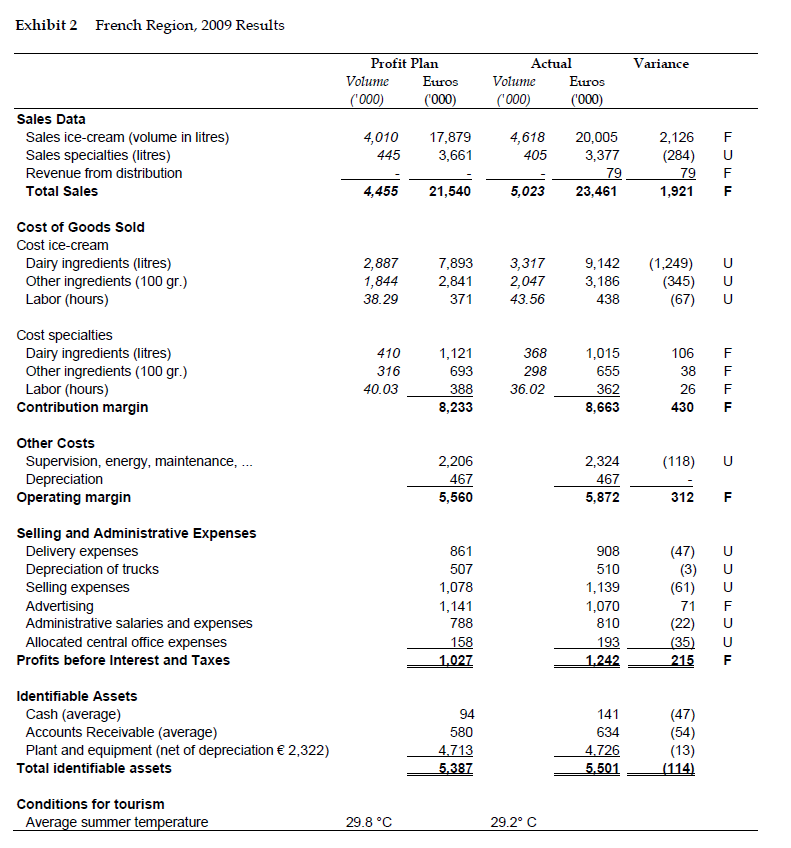

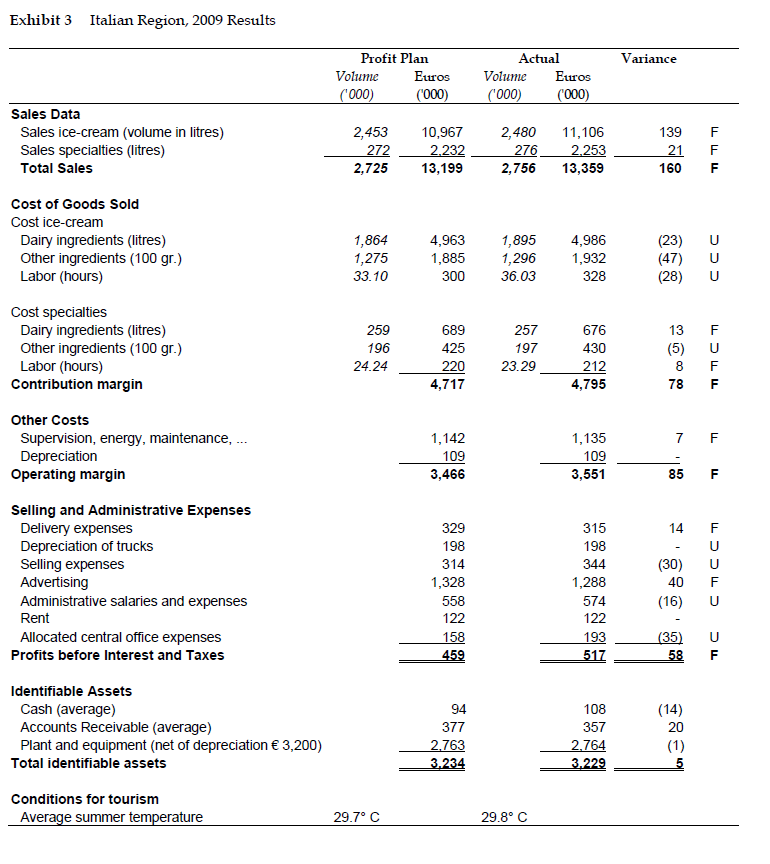

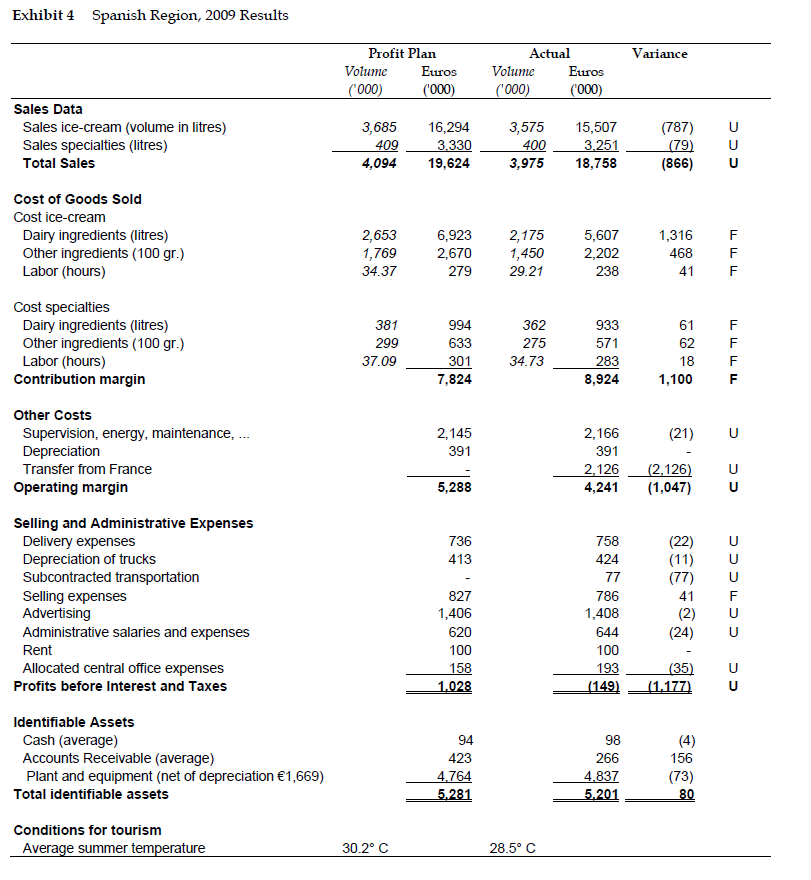

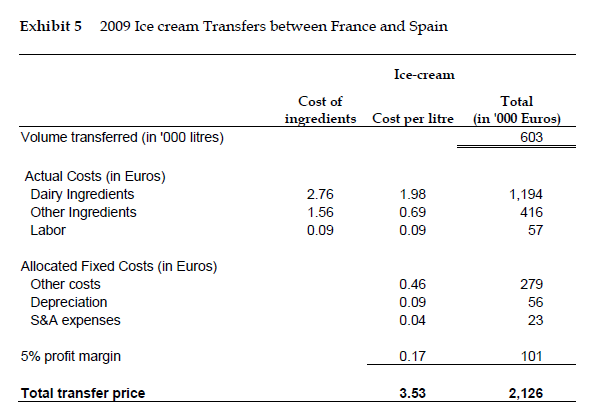

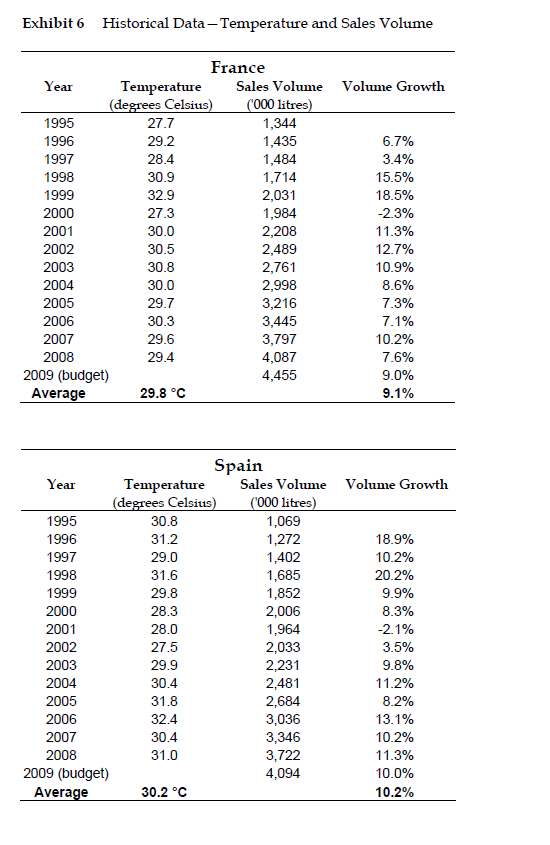

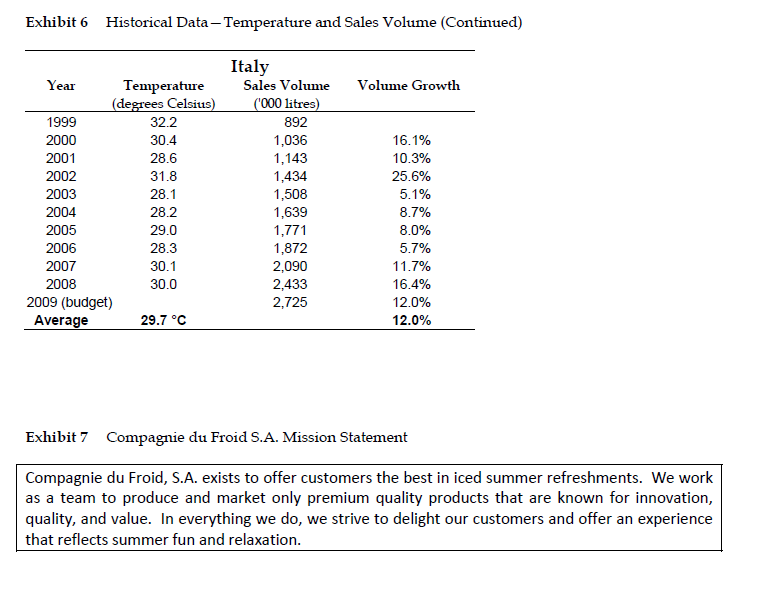

ROBERT SIMONS ANTONIO DVILA Compagnie du Froid, S.A. Jacques Trumen, CEO and major shareholder of Compagnie du Froid, S.A., was reviewing the performance of the three regions of the business: France, Italy, and Spain. Evaluating the performance of the regional vice-presidents was not a task that he enjoyed. Jacques had traditionally given each regional manager the same bonus: 2% of corporate profits. Jacques believed that this system avoided arbitrary evaluation criteria and encouraged open and fruitful communication among the regions about new ways of doing business. The results in 2009 challenged the fairness of this evaluation system. The performance of the Spanish region had been extremely poor and had driven the company's overall profits to their lowest level in 10 years. Jacques thought that it was unfair to have the French and Italian managers pay for the problems of somebody else. But he was not sure how much Andres Molas, the manager of the Spanish division, was to blame for Spain's poor results. Compagnie du Froid, S.A. Founded in 1985 by Jacques Trumen's father, Compagnie du Froid, S.A. had grown steadily over the years to be a major competitor in the summer ice cream business. It had a dominant position in the coastal tourist areas from Perpignan to Nice and Monaco, the region where it was founded. In 2007, Jacques took over the business and re-directed the company into an aggressive growth strategy. By 2009, the company was a market leader in the eastern part of France, the northeastern coast of Spain, and northern Italy. Jacques kept a watchful eye on the efforts of the three regional managers to expand the operations to other key tourist areas in their regions, but his attention was mainly devoted to the creation of a new business: a year-round ice cream operation based in Paris. Jacques believed very much in decentralizing decision making as much as possible. Each region had its own manufacturing, marketing, distribution, and sales organization. Regional managers chose distinctive names for new products, the level and mix of advertising, and local suppliers. The central office maintained responsibility for the accounting and financial aspects of the business, development of new products in ice creams and "specialties" categories, and the sharing of experiences and learning across the regions. Jacques exercised control of the regions through a profit planning system. The profit plan covered the upcoming fiscal year which began on January 1. In November and December, each region prepared and submitted their initial profit plan to the central office. Jacques used the profit plan to discuss and supervise the expansion strategy of each region and to make sure that enough cash would be generated to support the company's new corporate ventures. The final phase of the profit planning process was a top management meeting which brought together Jacques, the three regional vice-presidents, and the finance and technical officers to discuss new growth opportunities. A lot of time and face-to-face contact was devoted to the profit plan and, once approved, it was the guiding tool to monitor and evaluate performance. During the summer months, each region generated a profit statement every two weeks that Jacques reviewed to detect major problems. In addition, Jacques spent a week in each region to "get a feel for the market." At the end of October, another top management meeting occurred to learn from the experiences over the past year and to schedule winter activities to prepare for the next season. In early December, Jacques handed bonus checks to the three regional managers. Top line revenue goals for the upcoming year were established using past growth rates and the market expectations of Jacques and the regional managers. Exchanging knowledge and experiences was a key element in shaping the growth assumptions of the profit plan. For 2009, the expected volume growth was 9% for the French region, 10% for the Spanish region, and 12% for the Italian region. Since 2005, when Compagnie du Froid introduced its first specialty product-sophisticated ice cream flavors made with prime quality ingredients, the strategy had been to emphasize these specialties that enjoyed higher margins and less intense competition. This strategy became operational through the profit plan: Jacques set ambitious goals for the percentage of sales volume coming from specialties for each of the regions. Standard selling prices and manufacturing costs were based on last year's actuals adjusted for any expected contingencies. Efficiency standards assumed that manufacturing would improve its year-to- year performance based on learning and better equipment. Finally, Jacques believed that the business should compensate shareholders-himself, his brothers and sisters, and top managers in the company-for the risk of tying up their capital in the business. Thus, he expected a reasonable return on shareholders' investment. His reference point was 18% return-on-investment before taxes. Exhibit 1 illustrates the standards used to design the profit plan for one of the three regions. France Jean Pinoux was the manager of the French region. He was promoted to this position in 2007 when Pierre Giraux, the previous manager, took over the lagging Italian operation. Jean had started as a sales representative, then advanced to be responsible for production, and finally became division manager. Jacques was pleased with Jean's performance (see Exhibit 2). His profits were above budget, and sales had increased almost 20% over the previous year. Jean had invested a lot of his time in managing the expansion into the west coast of France, negotiating with new vendors and suppliers, and arranging distribution of the product. If all this effort had paid off in 2009, the profits would have been even higher, but Jacques knew that they would have to wait several years to get the full benefits from this investment. The performance in the traditional regions of the French market had been a bit disappointing. Market share had slipped from 20% in 2007 to 18% in 2009. Jean Pinoux argued that his frequent trips to the west coast had negatively affected his relationships with distributors in the east coast. The French region had bought new machines two years ago. While there had been some start-up problems, the machines ran smoothly during 2009 thanks to Jean's manufacturing expertise. The manufacturing operation was staffed with a core group of employees which supervised production and maintained the machines. Most of the workforce was people hired on an hourly basis. Jean had found a new source of revenue from a personal friend who operated a well-known restaurant in Camargue. Over the summer of 2009, Jean's friend had decided to package his meals and distribute them through supermarkets and food stores in the region. He needed refrigerated trucks to deliver his products and Jean agreed to distribute them for a fee. Most of the retail outlets were already visited by Compagnie du Froid's delivery trucks and the incremental cost to the company to provide this service was very low. Jean saw this business opportunity as a simple way to increase revenue. By the end of the summer, he had agreements with two other regional food producers to deliver their products beginning in summer 2010. He planned to work over the winter season on getting more of these deals that were easy and very profitable. Jacques was surprised by Jean's initiative, but acknowledged that there was a profit potential in the distribution business. He was concerned, however, that distribution was outside Compagnie du Froid's core business, and he felt unsure whether to follow this new opportunity (Compagnie du Froid's mission is reproduced in Exhibit 7). Italy Pierre Giraux was the manager for the Italian region. He had been in top management positions with Compagnie du Froid for the last 10 years. Previously he had run the French region, but Jacques asked him to take care of the Italian operation because it was not performing adequately. Jacques knew Pierre very well. He was an excellent manager with a very clear sense of the market. Although running the smallest region in the company, Pierre had been the main force in attaining a leadership position in the French market and was a close partner in Jacques' new ventures. Pierre's performance as manager of the Italian operation had been excellent. He had attained his sales goals and expanded the distribution of the company's products into most of the western Italian coast. In the manufacturing side, he had suffered from higher wages and lower efficiency than expected. The machines used in Italy had been moved from France when the new equipment was installed in France. The old machines were partly the reason for the lower efficiency, but this expectation had already been incorporated into the profit plan. Exhibit 3 shows the performance of the Italian division in 2009. Spain Andres Molas was the manager for the Spanish region. He had been in charge of the Spanish operation since it started in 1995. Andres was the only non-French top manager. His performance had been outstanding until 2009. He had grown the division from scratch and he was well-respected for his innovative ideas. For example, last year he had developed a vending machine to sell specialties. The idea had been so successful that France and Italy were planning to introduce it in 2010. Andres was the most successful manager in introducing new products to the market and the other managers followed some of his marketing ideas. Unfortunately, 2009 had been problematic for several reasons. (Exhibit 4 shows the performance of the Spanish region.) New machines, similar to the ones purchased in France, were bought early in the year to increase efficiency, but they did not perform adequately until late August. Technicians from the supplier had to spend several weeks adjusting the machines. Because of these problems, Andres had run out of capacity several times during the year and he had been forced to import product from the French division. This was the first time that Compagnie du Froid had transferred sales between regions and Jacques had decided to set the transfer price at full cost plus a 5% profit for the manufacturer (see Exhibit 5). There was some argument about the policy. Andres was not happy about it because he said that it made his division look bad, but he accepted it as a temporary solution. In addition, the Spanish division had been forced to absorb the expenses of having people travel to France to help fit Spanish containers and packaging to the French production line. In addition, the market had been very tough that year. Unseasonably cold temperatures had driven tourism down (Exhibit 6 shows the history of sales and temperature for the various regions). Over time, Jacques had developed a rule of thumb that a 1C deviation from the mean summer temperature resulted in a 3% change in volume growth. The 2009 summer temperatures in the coastal zones of Spain had been 1.7C below average; thus Jacques' rule of thumb predicted volume growth to be only 4.9% rather than the planned 10%. The reaction of a large competitor to lower sales volume had been to lower prices to stimulate demand. Andres had followed with a price cut. Even with total market sales down, Andres decided to keep the level of advertising up to build market share. The Bottom Line? When Jacques finished reviewing all the information, he sat back and began to enjoy an ice cream. France and Italy had performed well, but Spain's performance had been dismal. Yet, he was unsure how each manager had performed given the circumstances. What did the differences between the profit plan and the actual performance really mean? Jacques wondered if changes in company policy might be needed. What would happen if he suddenly changed his traditional evaluation system and gave different bonuses to the regional managers? Could he come up with a compensation formula that would be fair? This would be the perfect solution: an evaluation scheme that reflected each manager's performance without the discussions and tensions linked to subjective evaluation. But he was unsure if performance should be linked to (1) the profit plan, (2) strategic goals such as revenue growth, or (3) some overall measure of economic results. Perhaps he should just stay with his traditional method and give each manager a fixed percent of corporate profit. There were also issues to be resolved about transfer prices. Some of the managers - Andres in particular - had been unhappy with his temporary solution. And Jacques still had not decided what he should say to Jean about his new distribution arrangements. Exhibit 1 Examples of Standards for the 2009 Profit Plan (Spanish Region) Standards Percentage of volume from specialties Spain 10% Selling prices in Euros) Ice-cream (per litre) Specialties (per litre) 4.42 8.13 Manufacturing costs (in Euros) Dairy ice-cream (per litre) Other ingredients ice-cream (sugar, flavor, etc. per 100 grams) Other ingredients specialties (sugar, flavor, etc. per 100 grams) Labor (wage per hour) Labor hours ice-cream (litres per hour) Labor hours specialties (litres per hour) 2.61 1.51 2.12 8.13 107.20 11.04 72% Volume Dairy ingredients-ice-cream (% of volume) Other ingredients ice cream (grams per litre) Dairy ingredientsspecialties (% of volume) Other ingredientsspecialties (grams per litre) 48 93% 73 Exhibit 2 French Region, 2009 Results Variance Profit Plan Volume Euros ('000) (000) Actual Volume Euros ('000) ('000) Sales Data Sales ice-cream (volume in litres) Sales specialties (litres) Revenue from distribution Total Sales 4,010 17,879 4453,661 4,455 21,540 4,618 405 5.023 20,005 3,377 79 2,126 F (284) U 79F 1,921 F Cost of Goods Sold Cost ice-cream Dairy ingredients (litres) Other ingredients (100 gr.) Labor (hours) 3,317 2,887 1,844 38.29 7,893 2,841 371 2,047 43.56 9,142 3,186 438 (1,249) (345) (67) 368 Cost specialties Dairy ingredients (litres) Other ingredients (100 gr.) Labor (hours) Contribution margin 106 410 316 40.03 298 1,121 693 388 8,233 36.02 1,015 655 362 8,663 38 26 430 (118) Other Costs Supervision, energy, maintenance, ... Depreciation Operating margin 2,206 467 2,324 467 5,872 5,560 (47) (3) (61) Selling and Administrative Expenses Delivery expenses Depreciation of trucks Selling expenses Advertising Administrative salaries and expenses Allocated central office expenses Profits before Interest and Taxes 861 507 1,078 1,141 788 158 1.027 908 510 1,139 1,070 810 193 1.242 71 (35) 215 94 Identifiable Assets Cash (average) Accounts Receivable (average) Plant and equipment (net of depreciation 2,322) Total identifiable assets 580 4,713 5.387 141 634 4.726 5.501 (47) (54) (13) (114 Conditions for tourism Average summer temperature 29.8C 29.8 C 29.2C 29.2C Exhibit 3 Italian Region, 2009 Results Variance Profit Plan Volume Euros ('000) (000) Actual Volume Euros (000) (000) Sales Data Sales ice-cream (volume in litres) Sales specialties (litres) Total Sales 2,453 272 2,725 10,967 2.232 13,199 2,480 276_ 2,756 11,106 2.253 13,359 139F 21 F 160 F Cost of Goods Sold Cost ice-cream Dairy ingredients (litres) Other ingredients (100 gr.) Labor (hours) 1,864 1,275 33.10 4,963 1,885 300 1,895 1,296 36.03 4,986 1,932 328 (23) (47) (28) U U U 257 Cost specialties Dairy ingredients (litres) Other ingredients (100 gr.) Labor (hours) Contribution margin 259 196 24.24 689 425 220 4,717 197 23.29 676 430 212 4,795 T TC T T Other Costs Supervision, energy, maintenance, ... Depreciation Operating margin 1,142 109 3,466 1,135 109 3,551 T Selling and Administrative Expenses Delivery expenses Depreciation of trucks Selling expenses Advertising Administrative salaries and expenses Rent Allocated central office expenses Profits before Interest and Taxes 329 198 314 1,328 558 122 158 459 315 198 344 1,288 574 122 TC c TCC T 193 517 Identifiable Assets Cash (average) Accounts Receivable (average) Plant and equipment (net of depreciation 3,200) Total identifiable assets 94 377 2.763 108 357 2,764 3.234 3.229 lo Conditions for tourism Average summer temperature 29.7C 29.8 C Exhibit 4 Spanish Region, 2009 Results Varia ance Profit Plan Volume Euros ('000) ('000) Actual Volume Euros ('000) (000) Sales Data Sales ice-cream (volume in litres) Sales specialties (litres) Total Sales 3,685 409 4,094 16,294 3.330 19,624 3,575 400 3,975 15,507 3.251 18,758 (787) (79) (866) ccc Cost of Goods Sold Cost ice-cream Dairy ingredients (litres) Other ingredients (100 gr.) Labor (hours) 5,607 2,653 1,769 34.37 6,923 2,670 279 2,175 1,450 29.21 1,316 468 2,202 238 41 362 933 Cost specialties Dairy ingredients (litres) Other ingredients (100 gr.) Labor (hours) Contribution margin 381 299 37.09 994 633 275 61 62 571 T T T. 301 34.73 283 18 1,100 7,824 8,924 (21) c Other Costs Supervision, energy, maintenance, ... Depreciation Transfer from France Operating margin 2,145 391 2,166 391 2,126 4,241 (2,126) (1,047) cc 5,288 736 413 Selling and Administrative Expenses Delivery expenses Depreciation of trucks Subcontracted transportation Selling expenses Advertising Administrative salaries and expenses Rent Allocated central office expenses Profits before Interest and Taxes (22) (11) (77) 41 (2) (24) 827 758 424 77 786 1,408 644 100 193 (149) 1,406 620 100 158 1.028 - CC CCCCC (35) _(1.177) 94 98 Identifiable Assets Cash (average) Accounts Receivable (average) Plant and equipment (net of depreciation 1,669) Total identifiable assets (4) 156 423 4,764 5.281 266 4,837 5.201 (73) Conditions for tourism Average summer temperature 30.2C 28.5C Exhibit 5 2009 Ice cream Transfers between France and Spain Ice-cream Cost of ingredients Cost per litre Total (in '000 Euros) 603 Volume transferred (in '000 litres) Actual Costs (in Euros) Dairy Ingredients Other Ingredients Labor 2.76 1.56 1.98 0.69 0.09 1,194 416 0.09 57 Allocated Fixed Costs (in Euros) Other costs Depreciation S&A expenses 0.46 0.09 0.04 5% profit margin 0.17 Total transfer price 3.53 2,126 Exhibit 6 Historical Data - Temperature and Sales Volume Year 27.7 France Temperature Sales Volume Volume Growth (degrees Celsius) (000 litres) 1995 1,344 1996 29.2 1,435 6.7% 1997 1,484 3.4% 1998 1,714 15.5% 1999 2,031 18.5% 2000 1,984 -2.3% 2001 2,208 11.3% 2002 2,489 12.7% 2003 2,761 10.9% 2004 2,998 8.6% 2005 29.7 3,216 7.3% 2006 30.3 3,445 7.1% 2007 29.6 3,797 10.2% 2008 29.4 4,087 7.6% 2009 (budget) 4,455 9.0% Average 29.8 C 9.1% ooooooo 29.8 28.3 Spain Year Temperature Sales Volume Volume Growth (degrees Celsius) ('000 litres) 1995 30.8 1,069 1996 31.2 1,272 18.9% 1997 29.0 1,402 10.2% 1998 31.6 1,685 20.2% 1999 1,852 9.9% 2000 2,006 8.3% 2001 1,964 -2.1% 2002 2,033 3.5% 2003 29.9 2,231 9.8% 2004 30.4 2,481 11.2% 2005 2,684 8.2% 2006 32.4 3,036 13.1% 2007 30.4 3,346 10.2% 2008 31.0 3,722 11.3% 2009 (budget) 4,094 10.0% Average 30.2 C 10.2% 31.8 Exhibit 6 Historical Data- Temperature and Sales Volume (Continued) Volume Growth Year Temperature (degrees Celsius) 1999 32.2 2000 30.4 2001 28.6 2002 31.8 2003 28.1 2004 28.2 2005 29.0 2006 28.3 2007 30.1 2008 30.0 2009 (budget) Average 29.7 C Italy Sales Volume ('000 litres) 892 1,036 1,143 1,434 1,508 1,639 1,771 1,872 2,090 2,433 2,725 16.1% 10.3% 25.6% 5.1% 8.7% 8.0% 5.7% 11.7% 16.4% 12.0% 12.0% Exhibit 7 Compagnie du Froid S.A. Mission Statement Compagnie du Froid, S.A. exists to offer customers the best in iced summer refreshments. We work as a team to produce and market only premium quality products that are known for innovation, quality, and value. In everything we do, we strive to delight our customers and offer an experience that reflects summer fun and relaxation. ROBERT SIMONS ANTONIO DVILA Compagnie du Froid, S.A. Jacques Trumen, CEO and major shareholder of Compagnie du Froid, S.A., was reviewing the performance of the three regions of the business: France, Italy, and Spain. Evaluating the performance of the regional vice-presidents was not a task that he enjoyed. Jacques had traditionally given each regional manager the same bonus: 2% of corporate profits. Jacques believed that this system avoided arbitrary evaluation criteria and encouraged open and fruitful communication among the regions about new ways of doing business. The results in 2009 challenged the fairness of this evaluation system. The performance of the Spanish region had been extremely poor and had driven the company's overall profits to their lowest level in 10 years. Jacques thought that it was unfair to have the French and Italian managers pay for the problems of somebody else. But he was not sure how much Andres Molas, the manager of the Spanish division, was to blame for Spain's poor results. Compagnie du Froid, S.A. Founded in 1985 by Jacques Trumen's father, Compagnie du Froid, S.A. had grown steadily over the years to be a major competitor in the summer ice cream business. It had a dominant position in the coastal tourist areas from Perpignan to Nice and Monaco, the region where it was founded. In 2007, Jacques took over the business and re-directed the company into an aggressive growth strategy. By 2009, the company was a market leader in the eastern part of France, the northeastern coast of Spain, and northern Italy. Jacques kept a watchful eye on the efforts of the three regional managers to expand the operations to other key tourist areas in their regions, but his attention was mainly devoted to the creation of a new business: a year-round ice cream operation based in Paris. Jacques believed very much in decentralizing decision making as much as possible. Each region had its own manufacturing, marketing, distribution, and sales organization. Regional managers chose distinctive names for new products, the level and mix of advertising, and local suppliers. The central office maintained responsibility for the accounting and financial aspects of the business, development of new products in ice creams and "specialties" categories, and the sharing of experiences and learning across the regions. Jacques exercised control of the regions through a profit planning system. The profit plan covered the upcoming fiscal year which began on January 1. In November and December, each region prepared and submitted their initial profit plan to the central office. Jacques used the profit plan to discuss and supervise the expansion strategy of each region and to make sure that enough cash would be generated to support the company's new corporate ventures. The final phase of the profit planning process was a top management meeting which brought together Jacques, the three regional vice-presidents, and the finance and technical officers to discuss new growth opportunities. A lot of time and face-to-face contact was devoted to the profit plan and, once approved, it was the guiding tool to monitor and evaluate performance. During the summer months, each region generated a profit statement every two weeks that Jacques reviewed to detect major problems. In addition, Jacques spent a week in each region to "get a feel for the market." At the end of October, another top management meeting occurred to learn from the experiences over the past year and to schedule winter activities to prepare for the next season. In early December, Jacques handed bonus checks to the three regional managers. Top line revenue goals for the upcoming year were established using past growth rates and the market expectations of Jacques and the regional managers. Exchanging knowledge and experiences was a key element in shaping the growth assumptions of the profit plan. For 2009, the expected volume growth was 9% for the French region, 10% for the Spanish region, and 12% for the Italian region. Since 2005, when Compagnie du Froid introduced its first specialty product-sophisticated ice cream flavors made with prime quality ingredients, the strategy had been to emphasize these specialties that enjoyed higher margins and less intense competition. This strategy became operational through the profit plan: Jacques set ambitious goals for the percentage of sales volume coming from specialties for each of the regions. Standard selling prices and manufacturing costs were based on last year's actuals adjusted for any expected contingencies. Efficiency standards assumed that manufacturing would improve its year-to- year performance based on learning and better equipment. Finally, Jacques believed that the business should compensate shareholders-himself, his brothers and sisters, and top managers in the company-for the risk of tying up their capital in the business. Thus, he expected a reasonable return on shareholders' investment. His reference point was 18% return-on-investment before taxes. Exhibit 1 illustrates the standards used to design the profit plan for one of the three regions. France Jean Pinoux was the manager of the French region. He was promoted to this position in 2007 when Pierre Giraux, the previous manager, took over the lagging Italian operation. Jean had started as a sales representative, then advanced to be responsible for production, and finally became division manager. Jacques was pleased with Jean's performance (see Exhibit 2). His profits were above budget, and sales had increased almost 20% over the previous year. Jean had invested a lot of his time in managing the expansion into the west coast of France, negotiating with new vendors and suppliers, and arranging distribution of the product. If all this effort had paid off in 2009, the profits would have been even higher, but Jacques knew that they would have to wait several years to get the full benefits from this investment. The performance in the traditional regions of the French market had been a bit disappointing. Market share had slipped from 20% in 2007 to 18% in 2009. Jean Pinoux argued that his frequent trips to the west coast had negatively affected his relationships with distributors in the east coast. The French region had bought new machines two years ago. While there had been some start-up problems, the machines ran smoothly during 2009 thanks to Jean's manufacturing expertise. The manufacturing operation was staffed with a core group of employees which supervised production and maintained the machines. Most of the workforce was people hired on an hourly basis. Jean had found a new source of revenue from a personal friend who operated a well-known restaurant in Camargue. Over the summer of 2009, Jean's friend had decided to package his meals and distribute them through supermarkets and food stores in the region. He needed refrigerated trucks to deliver his products and Jean agreed to distribute them for a fee. Most of the retail outlets were already visited by Compagnie du Froid's delivery trucks and the incremental cost to the company to provide this service was very low. Jean saw this business opportunity as a simple way to increase revenue. By the end of the summer, he had agreements with two other regional food producers to deliver their products beginning in summer 2010. He planned to work over the winter season on getting more of these deals that were easy and very profitable. Jacques was surprised by Jean's initiative, but acknowledged that there was a profit potential in the distribution business. He was concerned, however, that distribution was outside Compagnie du Froid's core business, and he felt unsure whether to follow this new opportunity (Compagnie du Froid's mission is reproduced in Exhibit 7). Italy Pierre Giraux was the manager for the Italian region. He had been in top management positions with Compagnie du Froid for the last 10 years. Previously he had run the French region, but Jacques asked him to take care of the Italian operation because it was not performing adequately. Jacques knew Pierre very well. He was an excellent manager with a very clear sense of the market. Although running the smallest region in the company, Pierre had been the main force in attaining a leadership position in the French market and was a close partner in Jacques' new ventures. Pierre's performance as manager of the Italian operation had been excellent. He had attained his sales goals and expanded the distribution of the company's products into most of the western Italian coast. In the manufacturing side, he had suffered from higher wages and lower efficiency than expected. The machines used in Italy had been moved from France when the new equipment was installed in France. The old machines were partly the reason for the lower efficiency, but this expectation had already been incorporated into the profit plan. Exhibit 3 shows the performance of the Italian division in 2009. Spain Andres Molas was the manager for the Spanish region. He had been in charge of the Spanish operation since it started in 1995. Andres was the only non-French top manager. His performance had been outstanding until 2009. He had grown the division from scratch and he was well-respected for his innovative ideas. For example, last year he had developed a vending machine to sell specialties. The idea had been so successful that France and Italy were planning to introduce it in 2010. Andres was the most successful manager in introducing new products to the market and the other managers followed some of his marketing ideas. Unfortunately, 2009 had been problematic for several reasons. (Exhibit 4 shows the performance of the Spanish region.) New machines, similar to the ones purchased in France, were bought early in the year to increase efficiency, but they did not perform adequately until late August. Technicians from the supplier had to spend several weeks adjusting the machines. Because of these problems, Andres had run out of capacity several times during the year and he had been forced to import product from the French division. This was the first time that Compagnie du Froid had transferred sales between regions and Jacques had decided to set the transfer price at full cost plus a 5% profit for the manufacturer (see Exhibit 5). There was some argument about the policy. Andres was not happy about it because he said that it made his division look bad, but he accepted it as a temporary solution. In addition, the Spanish division had been forced to absorb the expenses of having people travel to France to help fit Spanish containers and packaging to the French production line. In addition, the market had been very tough that year. Unseasonably cold temperatures had driven tourism down (Exhibit 6 shows the history of sales and temperature for the various regions). Over time, Jacques had developed a rule of thumb that a 1C deviation from the mean summer temperature resulted in a 3% change in volume growth. The 2009 summer temperatures in the coastal zones of Spain had been 1.7C below average; thus Jacques' rule of thumb predicted volume growth to be only 4.9% rather than the planned 10%. The reaction of a large competitor to lower sales volume had been to lower prices to stimulate demand. Andres had followed with a price cut. Even with total market sales down, Andres decided to keep the level of advertising up to build market share. The Bottom Line? When Jacques finished reviewing all the information, he sat back and began to enjoy an ice cream. France and Italy had performed well, but Spain's performance had been dismal. Yet, he was unsure how each manager had performed given the circumstances. What did the differences between the profit plan and the actual performance really mean? Jacques wondered if changes in company policy might be needed. What would happen if he suddenly changed his traditional evaluation system and gave different bonuses to the regional managers? Could he come up with a compensation formula that would be fair? This would be the perfect solution: an evaluation scheme that reflected each manager's performance without the discussions and tensions linked to subjective evaluation. But he was unsure if performance should be linked to (1) the profit plan, (2) strategic goals such as revenue growth, or (3) some overall measure of economic results. Perhaps he should just stay with his traditional method and give each manager a fixed percent of corporate profit. There were also issues to be resolved about transfer prices. Some of the managers - Andres in particular - had been unhappy with his temporary solution. And Jacques still had not decided what he should say to Jean about his new distribution arrangements. Exhibit 1 Examples of Standards for the 2009 Profit Plan (Spanish Region) Standards Percentage of volume from specialties Spain 10% Selling prices in Euros) Ice-cream (per litre) Specialties (per litre) 4.42 8.13 Manufacturing costs (in Euros) Dairy ice-cream (per litre) Other ingredients ice-cream (sugar, flavor, etc. per 100 grams) Other ingredients specialties (sugar, flavor, etc. per 100 grams) Labor (wage per hour) Labor hours ice-cream (litres per hour) Labor hours specialties (litres per hour) 2.61 1.51 2.12 8.13 107.20 11.04 72% Volume Dairy ingredients-ice-cream (% of volume) Other ingredients ice cream (grams per litre) Dairy ingredientsspecialties (% of volume) Other ingredientsspecialties (grams per litre) 48 93% 73 Exhibit 2 French Region, 2009 Results Variance Profit Plan Volume Euros ('000) (000) Actual Volume Euros ('000) ('000) Sales Data Sales ice-cream (volume in litres) Sales specialties (litres) Revenue from distribution Total Sales 4,010 17,879 4453,661 4,455 21,540 4,618 405 5.023 20,005 3,377 79 2,126 F (284) U 79F 1,921 F Cost of Goods Sold Cost ice-cream Dairy ingredients (litres) Other ingredients (100 gr.) Labor (hours) 3,317 2,887 1,844 38.29 7,893 2,841 371 2,047 43.56 9,142 3,186 438 (1,249) (345) (67) 368 Cost specialties Dairy ingredients (litres) Other ingredients (100 gr.) Labor (hours) Contribution margin 106 410 316 40.03 298 1,121 693 388 8,233 36.02 1,015 655 362 8,663 38 26 430 (118) Other Costs Supervision, energy, maintenance, ... Depreciation Operating margin 2,206 467 2,324 467 5,872 5,560 (47) (3) (61) Selling and Administrative Expenses Delivery expenses Depreciation of trucks Selling expenses Advertising Administrative salaries and expenses Allocated central office expenses Profits before Interest and Taxes 861 507 1,078 1,141 788 158 1.027 908 510 1,139 1,070 810 193 1.242 71 (35) 215 94 Identifiable Assets Cash (average) Accounts Receivable (average) Plant and equipment (net of depreciation 2,322) Total identifiable assets 580 4,713 5.387 141 634 4.726 5.501 (47) (54) (13) (114 Conditions for tourism Average summer temperature 29.8C 29.8 C 29.2C 29.2C Exhibit 3 Italian Region, 2009 Results Variance Profit Plan Volume Euros ('000) (000) Actual Volume Euros (000) (000) Sales Data Sales ice-cream (volume in litres) Sales specialties (litres) Total Sales 2,453 272 2,725 10,967 2.232 13,199 2,480 276_ 2,756 11,106 2.253 13,359 139F 21 F 160 F Cost of Goods Sold Cost ice-cream Dairy ingredients (litres) Other ingredients (100 gr.) Labor (hours) 1,864 1,275 33.10 4,963 1,885 300 1,895 1,296 36.03 4,986 1,932 328 (23) (47) (28) U U U 257 Cost specialties Dairy ingredients (litres) Other ingredients (100 gr.) Labor (hours) Contribution margin 259 196 24.24 689 425 220 4,717 197 23.29 676 430 212 4,795 T TC T T Other Costs Supervision, energy, maintenance, ... Depreciation Operating margin 1,142 109 3,466 1,135 109 3,551 T Selling and Administrative Expenses Delivery expenses Depreciation of trucks Selling expenses Advertising Administrative salaries and expenses Rent Allocated central office expenses Profits before Interest and Taxes 329 198 314 1,328 558 122 158 459 315 198 344 1,288 574 122 TC c TCC T 193 517 Identifiable Assets Cash (average) Accounts Receivable (average) Plant and equipment (net of depreciation 3,200) Total identifiable assets 94 377 2.763 108 357 2,764 3.234 3.229 lo Conditions for tourism Average summer temperature 29.7C 29.8 C Exhibit 4 Spanish Region, 2009 Results Varia ance Profit Plan Volume Euros ('000) ('000) Actual Volume Euros ('000) (000) Sales Data Sales ice-cream (volume in litres) Sales specialties (litres) Total Sales 3,685 409 4,094 16,294 3.330 19,624 3,575 400 3,975 15,507 3.251 18,758 (787) (79) (866) ccc Cost of Goods Sold Cost ice-cream Dairy ingredients (litres) Other ingredients (100 gr.) Labor (hours) 5,607 2,653 1,769 34.37 6,923 2,670 279 2,175 1,450 29.21 1,316 468 2,202 238 41 362 933 Cost specialties Dairy ingredients (litres) Other ingredients (100 gr.) Labor (hours) Contribution margin 381 299 37.09 994 633 275 61 62 571 T T T. 301 34.73 283 18 1,100 7,824 8,924 (21) c Other Costs Supervision, energy, maintenance, ... Depreciation Transfer from France Operating margin 2,145 391 2,166 391 2,126 4,241 (2,126) (1,047) cc 5,288 736 413 Selling and Administrative Expenses Delivery expenses Depreciation of trucks Subcontracted transportation Selling expenses Advertising Administrative salaries and expenses Rent Allocated central office expenses Profits before Interest and Taxes (22) (11) (77) 41 (2) (24) 827 758 424 77 786 1,408 644 100 193 (149) 1,406 620 100 158 1.028 - CC CCCCC (35) _(1.177) 94 98 Identifiable Assets Cash (average) Accounts Receivable (average) Plant and equipment (net of depreciation 1,669) Total identifiable assets (4) 156 423 4,764 5.281 266 4,837 5.201 (73) Conditions for tourism Average summer temperature 30.2C 28.5C Exhibit 5 2009 Ice cream Transfers between France and Spain Ice-cream Cost of ingredients Cost per litre Total (in '000 Euros) 603 Volume transferred (in '000 litres) Actual Costs (in Euros) Dairy Ingredients Other Ingredients Labor 2.76 1.56 1.98 0.69 0.09 1,194 416 0.09 57 Allocated Fixed Costs (in Euros) Other costs Depreciation S&A expenses 0.46 0.09 0.04 5% profit margin 0.17 Total transfer price 3.53 2,126 Exhibit 6 Historical Data - Temperature and Sales Volume Year 27.7 France Temperature Sales Volume Volume Growth (degrees Celsius) (000 litres) 1995 1,344 1996 29.2 1,435 6.7% 1997 1,484 3.4% 1998 1,714 15.5% 1999 2,031 18.5% 2000 1,984 -2.3% 2001 2,208 11.3% 2002 2,489 12.7% 2003 2,761 10.9% 2004 2,998 8.6% 2005 29.7 3,216 7.3% 2006 30.3 3,445 7.1% 2007 29.6 3,797 10.2% 2008 29.4 4,087 7.6% 2009 (budget) 4,455 9.0% Average 29.8 C 9.1% ooooooo 29.8 28.3 Spain Year Temperature Sales Volume Volume Growth (degrees Celsius) ('000 litres) 1995 30.8 1,069 1996 31.2 1,272 18.9% 1997 29.0 1,402 10.2% 1998 31.6 1,685 20.2% 1999 1,852 9.9% 2000 2,006 8.3% 2001 1,964 -2.1% 2002 2,033 3.5% 2003 29.9 2,231 9.8% 2004 30.4 2,481 11.2% 2005 2,684 8.2% 2006 32.4 3,036 13.1% 2007 30.4 3,346 10.2% 2008 31.0 3,722 11.3% 2009 (budget) 4,094 10.0% Average 30.2 C 10.2% 31.8 Exhibit 6 Historical Data- Temperature and Sales Volume (Continued) Volume Growth Year Temperature (degrees Celsius) 1999 32.2 2000 30.4 2001 28.6 2002 31.8 2003 28.1 2004 28.2 2005 29.0 2006 28.3 2007 30.1 2008 30.0 2009 (budget) Average 29.7 C Italy Sales Volume ('000 litres) 892 1,036 1,143 1,434 1,508 1,639 1,771 1,872 2,090 2,433 2,725 16.1% 10.3% 25.6% 5.1% 8.7% 8.0% 5.7% 11.7% 16.4% 12.0% 12.0% Exhibit 7 Compagnie du Froid S.A. Mission Statement Compagnie du Froid, S.A. exists to offer customers the best in iced summer refreshments. We work as a team to produce and market only premium quality products that are known for innovation, quality, and value. In everything we do, we strive to delight our customers and offer an experience that reflects summer fun and relaxationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started