Answered step by step

Verified Expert Solution

Question

1 Approved Answer

We can use the debt-equity ratio to calculate the weights of equity and debt. The debt of the company has a weight for long-term

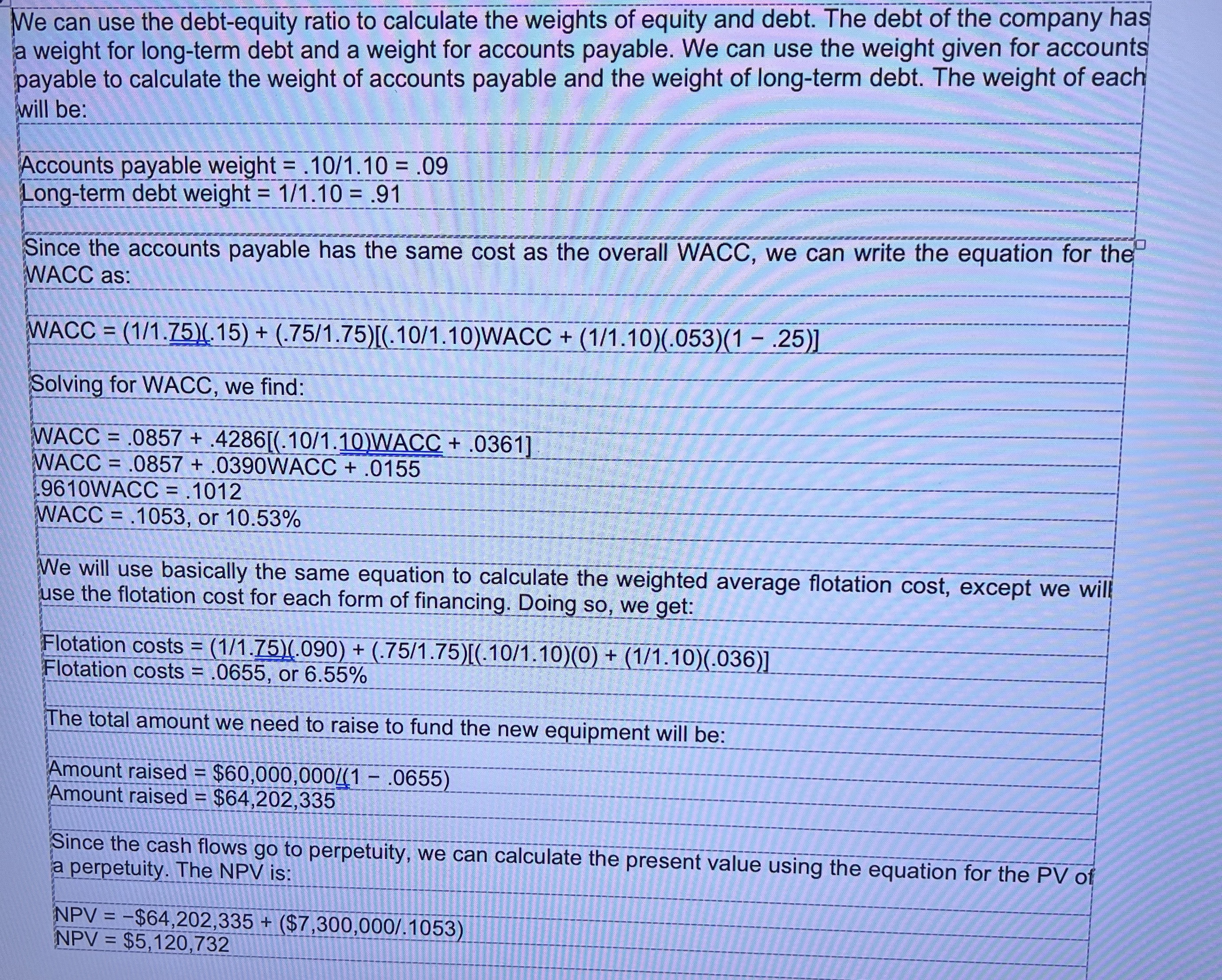

We can use the debt-equity ratio to calculate the weights of equity and debt. The debt of the company has a weight for long-term debt and a weight for accounts payable. We can use the weight given for accounts payable to calculate the weight of accounts payable and the weight of long-term debt. The weight of each will be: Accounts payable weight = .10/1.10 = .09 Long-term debt weight = 1/1.10 = .91 Since the accounts payable has the same cost as the overall WACC, we can write the equation for the WACC as: WACC (1/1.75) (.15) + (.75/1.75)[(.10/1.10)WACC +(1/1.10)(.053)(1 - .25)] = Solving for WACC, we find: WACC = .0857 + .4286[(.10/1.10)WACC + .0361] WACC = .0857+.0390WACC + .0155 9610WACC = .1012 WACC = .1053, or 10.53% We will use basically the same equation to calculate the weighted average flotation cost, except we will use the flotation cost for each form of financing. Doing so, we get: Flotation costs = (1/1.75)(.090) + (.75/1.75)[(.10/1.10)(0) + (1/1.10)(.036)] Flotation costs = .0655, or 6.55% The total amount we need to raise to fund the new equipment will be: Amount raised = $60,000,000/(1 - .0655) Amount raised = $64,202,335 Since the cash flows go to perpetuity, we can calculate the present value using the equation for the PV of a perpetuity. The NPV is: NPV=-$64,202,335 + ($7,300,000/.1053) NPV = $5,120,732

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started