Question

We can write this as P = C/ 1+r+ C /(1+r) 2 + + C+B/ (1+r)n (Equation 1) Where we have defined the following

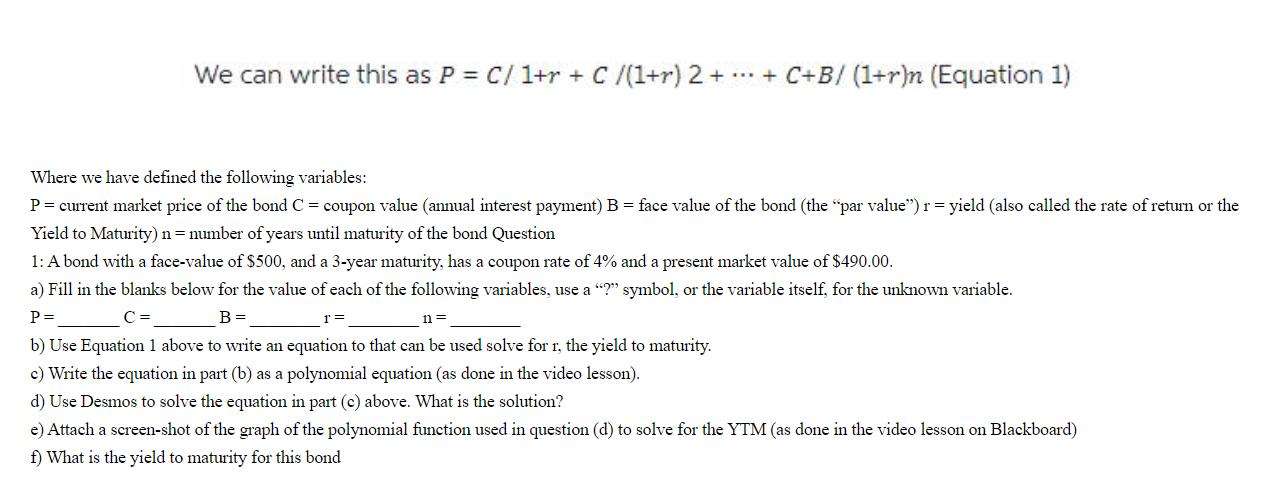

We can write this as P = C/ 1+r+ C /(1+r) 2 + + C+B/ (1+r)n (Equation 1) Where we have defined the following variables: P = current market price of the bond C= coupon value (annual interest payment) B = face value of the bond (the "par value") r = yield (also called the rate of return or the Yield to Maturity) n = number of years until maturity of the bond Question 1: A bond with a face-value of $500, and a 3-year maturity, has a coupon rate of 4% and a present market value of $490.00. a) Fill in the blanks below for the value of each of the following variables, use a "?" symbol, or the variable itself, for the unknown variable. C = P = B = r = 11 = b) Use Equation 1 above to write an equation to that can be used solve for r, the yield to maturity. c) Write the equation in part (b) as a polynomial equation (as done in the video lesson). d) Use Desmos to solve the equation in part (c) above. What is the solution? e) Attach a screen-shot of the graph of the polynomial function used in question (d) to solve for the YTM (as done in the video lesson on Blackboard) f) What is the yield to maturity for this bond

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a P 49000 C 4 500 2000 B 50000 r n 3 b The equation to solve for r the yield to ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started