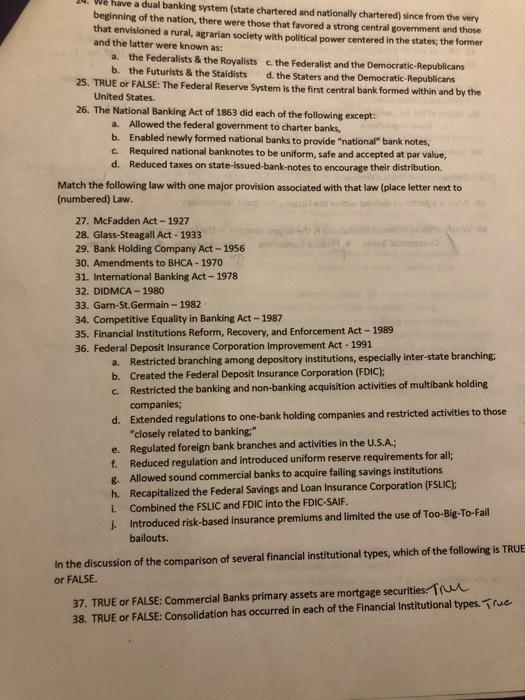

We have a dual banking system (state chartered and nationally chartered) since from the very beginning of the nation, there were those that favored a strong central government and those that envisioned a rural, agrarian society with political power centered in the states, the former and the latter were known as: a. the Federalists & the Royalists c. the Federalist and the Democratic Republicans b. the Futurists & the Staidists d. the Staters and the Democratic Republicans 25. TRUE or FALSE: The Federal Reserve System is the first central bank formed within and by the United States. 26. The National Banking Act of 1863 did each of the following except: a. Allowed the federal government to charter banks, b. Enabled newly formed national banks to provide "national bank notes, c. Required national banknotes to be uniform, safe and accepted at par value, d. Reduced taxes on state-issued-bank-notes to encourage their distribution Match the following law with one major provision associated with that law (place letter next to (numbered) Law. 27. McFadden Act - 1927 28. Glass-Steagall Act. 1933 29. Bank Holding Company Act - 1956 30. Amendments to BHCA - 1970 31. International Banking Act-1978 32. DIDMCA - 1980 33. Garn-St.Germain - 1982 34. Competitive Equality in Banking Act - 1987 35. Financial Institutions Reform, Recovery, and Enforcement Act - 1989 36. Federal Deposit Insurance Corporation Improvement Act - 1991 a. Restricted branching among depository institutions, especially inter-state branching: b. Created the Federal Deposit Insurance Corporation (FDIC); c. Restricted the banking and non-banking acquisition activities of multibank holding companies; d. Extended regulations to one-bank holding companies and restricted activities to those "closely related to banking." e. Regulated foreign bank branches and activities in the U.S.A.; f. Reduced regulation and introduced uniform reserve requirements for all & Allowed sound commercial banks to acquire failing savings institutions h. Recapitalized the Federal Savings and Loan Insurance Corporation (FSLIC); L Combined the FSLIC and FDIC into the FDIC-SAIF. Introduced risk-based insurance premiums and limited the use of Too-Big-To-Fail bailouts. In the discussion of the comparison of several financial institutional types, which of the following is TRUE or FALSE 37. TRUE or FALSE: Commercial Banks primary assets are mortgage securities: 38. TRUE or FALSE: Consolidation has occurred in each of the Financial Institutional types. True We have a dual banking system (state chartered and nationally chartered) since from the very beginning of the nation, there were those that favored a strong central government and those that envisioned a rural, agrarian society with political power centered in the states, the former and the latter were known as: a. the Federalists & the Royalists c. the Federalist and the Democratic Republicans b. the Futurists & the Staidists d. the Staters and the Democratic Republicans 25. TRUE or FALSE: The Federal Reserve System is the first central bank formed within and by the United States. 26. The National Banking Act of 1863 did each of the following except: a. Allowed the federal government to charter banks, b. Enabled newly formed national banks to provide "national bank notes, c. Required national banknotes to be uniform, safe and accepted at par value, d. Reduced taxes on state-issued-bank-notes to encourage their distribution Match the following law with one major provision associated with that law (place letter next to (numbered) Law. 27. McFadden Act - 1927 28. Glass-Steagall Act. 1933 29. Bank Holding Company Act - 1956 30. Amendments to BHCA - 1970 31. International Banking Act-1978 32. DIDMCA - 1980 33. Garn-St.Germain - 1982 34. Competitive Equality in Banking Act - 1987 35. Financial Institutions Reform, Recovery, and Enforcement Act - 1989 36. Federal Deposit Insurance Corporation Improvement Act - 1991 a. Restricted branching among depository institutions, especially inter-state branching: b. Created the Federal Deposit Insurance Corporation (FDIC); c. Restricted the banking and non-banking acquisition activities of multibank holding companies; d. Extended regulations to one-bank holding companies and restricted activities to those "closely related to banking." e. Regulated foreign bank branches and activities in the U.S.A.; f. Reduced regulation and introduced uniform reserve requirements for all & Allowed sound commercial banks to acquire failing savings institutions h. Recapitalized the Federal Savings and Loan Insurance Corporation (FSLIC); L Combined the FSLIC and FDIC into the FDIC-SAIF. Introduced risk-based insurance premiums and limited the use of Too-Big-To-Fail bailouts. In the discussion of the comparison of several financial institutional types, which of the following is TRUE or FALSE 37. TRUE or FALSE: Commercial Banks primary assets are mortgage securities: 38. TRUE or FALSE: Consolidation has occurred in each of the Financial Institutional types. True