Answered step by step

Verified Expert Solution

Question

1 Approved Answer

We have collected the following information from NFF Corporation: The firm has 650 million in interest-bearing debt on its books, on which it pays

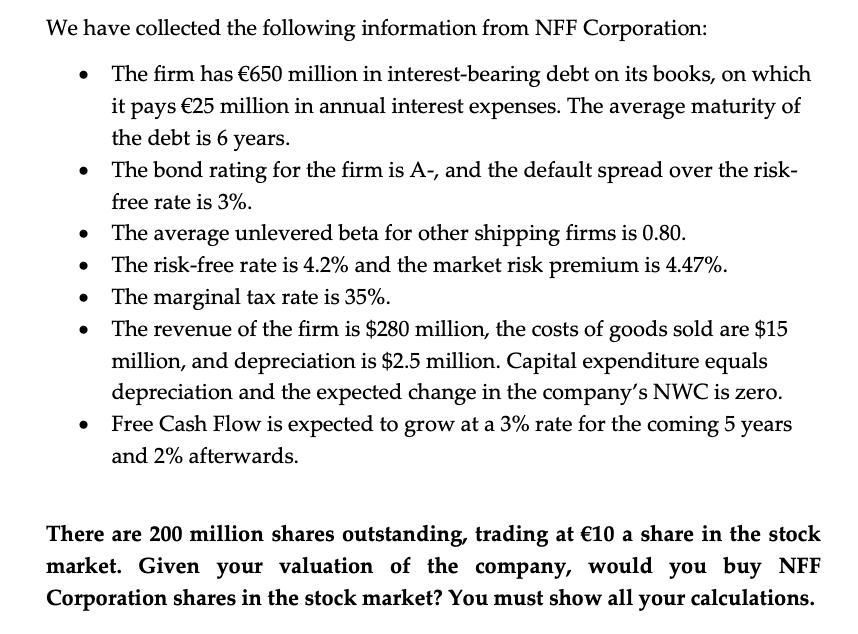

We have collected the following information from NFF Corporation: The firm has 650 million in interest-bearing debt on its books, on which it pays 25 million in annual interest expenses. The average maturity of the debt is 6 years. The bond rating for the firm is A-, and the default spread over the risk- free rate is 3%. The average unlevered beta for other shipping firms is 0.80. The risk-free rate is 4.2% and the market risk premium is 4.47%. The marginal tax rate is 35%. The revenue of the firm is $280 million, the costs of goods sold are $15 million, and depreciation is $2.5 million. Capital expenditure equals depreciation and the expected change in the company's NWC is zero. Free Cash Flow is expected to grow at a 3% rate for the coming 5 years and 2% afterwards. There are 200 million shares outstanding, trading at 10 a share in the stock market. Given your valuation of the company, would you buy NFF Corporation shares in the stock market? You must show all your calculations.

Step by Step Solution

★★★★★

3.56 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether it is advisable to buy shares of NFF Corporation in the stock market we need to perform a valuation analysis We will use the discounted cash flow DCF method to estimate the intrin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started